Question

ChemX, Inc. is a manufacturer of chemical products with locations in the United States. Its manufacturing plant in Harrisburg, PA is considering the purchase of

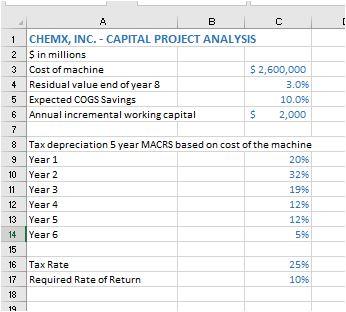

ChemX, Inc. is a manufacturer of chemical products with locations in the United States. Its manufacturing plant in Harrisburg, PA is considering the purchase of a new mixing machine. The cost of goods sold will be $6,850,000 in year 1, and will increase by $200,000 each year.

The cost of the machine is $2,600,000 and it is expected to result in cost savings of 10.0% of that location's cost of goods sold over the life of the mixing machine which is 8 years.

Over the 8 years an annual investment in working capital will be required of $2,000 (needs to be input at the beginning of year). At the end of its life it can be sold for 3% of the original cost. Five year MACRS depreciation will be used for tax purposes, which has the depreciation rate of 20%, 32%, 19%, 12%, 12% and 5% for the first five years. The company's marginal tax rate is 25%.

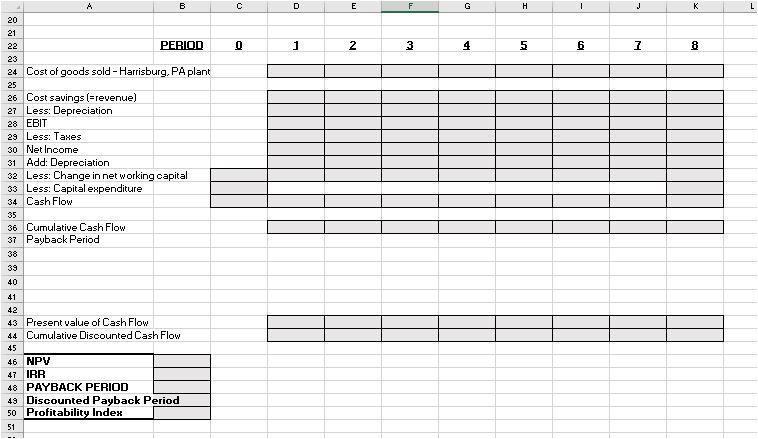

Prepare an analysis to determine if this project will generate an attractive level of economic benefits. Specifically determine the net present value and internal rate of return, payback period, discounted payback period, profitability index of the project.

ACCEPT OR REJECT THE PROJECT AND WHY?

(Your answer here)

[ 2 3 4 1 2 3 4 5 6 7 8 A B CHEMX, INC. - CAPITAL PROJECT ANALYSIS Sin millions Cost of machine $ 2,600,000 Residual value end of year 8 3.096 Expected COGS Savings 10.096 Annual incremental working capital 2,000 $ 6 7 9 mm Tax depreciation 5 year MACRS based on cost of the machine Year 1 20% Year 2 3296 Year 3 1996 Year 4 1295 Year 5 1296 Year 6 596 12 13 5 14 15 16 17 18 Tax Rate Required Rate of Return 2596 1096 19 A B c E F G H 1 J L K 20 D 1 0 N 3 4 6 7 8 21 22 PERIOD 23 24 Cost of goods sold - Harrisburg, PA plant 25 26 Cost savings (=revenue) 27 Less: Depreciation 28 EBIT 29 Less: Taxes 30 Net Income 31 Add: Depreciation 32 Less: Change in net working capital 33 Less: Capital expenditure 34 Cash Flow 35 36 Cumulative Cash Flow 37 Payback Period 38 39 40 41 42 43 Present value of Cash Flow 44 Cumulative Discounted Cash Flow 45 46 NPV 47 IRR 48 PAYBACK PERIOD 49 Discounted Payback Period 50 Profitability Index 51Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started