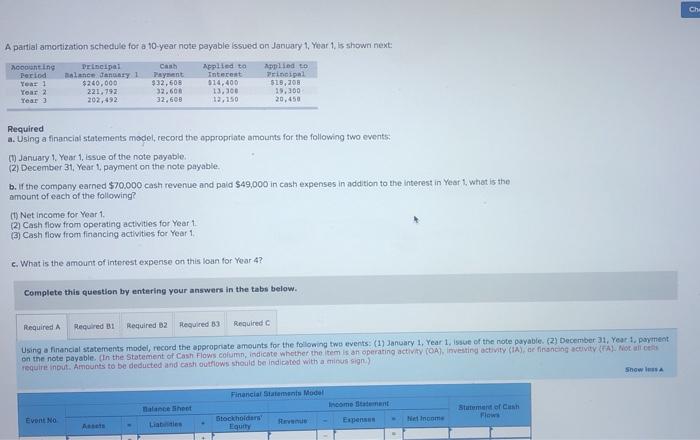

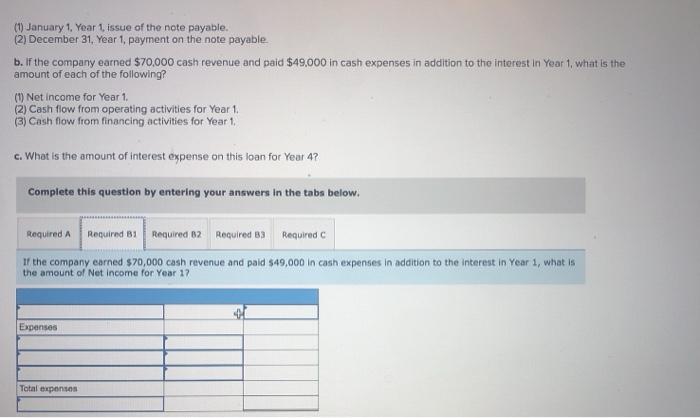

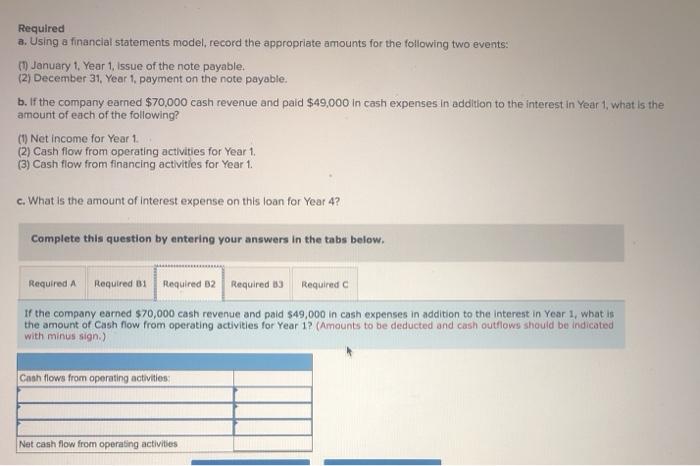

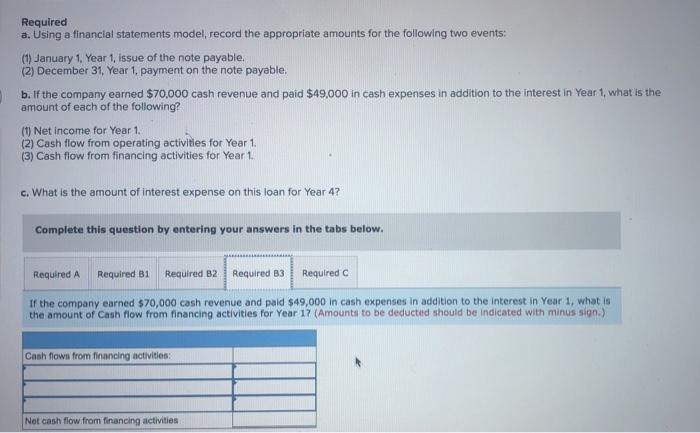

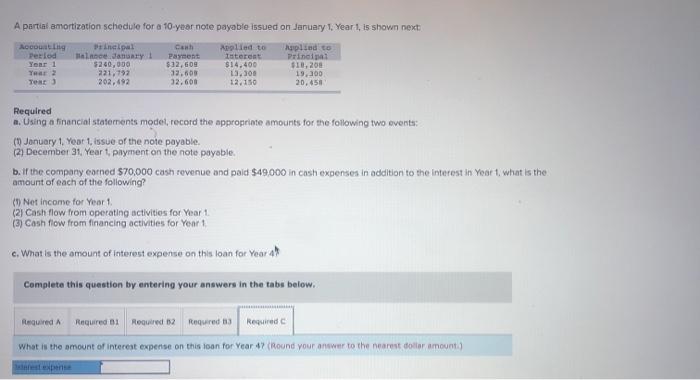

Chi A partial amortization schedule for a 10 year note payable issued on January 1, Year 1. is shown next: counting Period Year Year 2 Year) Principal balance any 1 $240,000 221.792 202, 492 Cash Payment $32,508 32.600 32.600 Applied to Interest 014,400 13,300 12.150 Applied to Principal $19,00 19.300 20,450 Required a. Using a financial statements madel, record the appropriate amounts for the following two events: I January 1 Year 1, Issue of the note payable (2) December 31, Year 1, payment on the note payable. b. If the company earned $70.000 cash revenue and paid $49,000 in cash expenses in addition to the Interest in Year 1, what is the amount of each of the following? (t) Net Income for Year 1 (2) Cash flow from operating activities for Year 1. (3) Cash flow from financing activities for Year 1 c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Required A Required B1 Required 2 Required 3 Required Using a financial statements model, record the appropriate amounts for the following two events: (1) January 1 Year 1 issue of the note payable (2) December 31, Year 1. payment on the note payable. (In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), Investing activity (IA), e financing activity (r. Not alles require input. Amounts to be deducted and cash outflows should be indicated with a mission) Show Financial Statement Model alance Sheet Liabile Income Gent Expenses Stutement of Cash Flow Event No Stockholm Eout Net Income A (1) January 1, Year 1 issue of the note payable. (2) December 31, Year 1, payment on the note payable b. If the company earned 570,000 cash revenue and paid $49,000 in cash expenses in addition to the interest in Yeart, what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1. (3) Cash flow from financing activities for Year 1, c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Required A Required 31 Required B2 Required 3 Required If the company earned $70,000 cash revenue and paid 549,000 in cash expenses In addition to the interest in Year 1, what is the amount of Net Income for Year 12 Expenses Total expenses Required a. Using a financial statements model, record the appropriate amounts for the following two events: in January 1, Year 1, Issue of the note payable. (2) December 31, Year 1. payment on the note payable, b. If the company earned $70,000 cash revenue and paid $49,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1, (3) Cash flow from financing activities for Year 1. c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Required A Required 1 Required B2 Required 13 Required If the company earned $70,000 cash revenue and paid $49,000 in cash expenses in addition to the interest in Year 1, what is the amount of Cash flow from operating activities for Year 1? (Amounts to be deducted and cash outflows should be indicated with minus sign.) Cash flows from operating activities Net cash flow from operating activities Required a. Using a financial statements model record the appropriate amounts for the following two events: (1) January 1, Year 1, Issue of the note payable. (2) December 31, Year 1. payment on the note payable. b. If the company earned $70,000 cash revenue and paid $49,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following? (1) Net income for Year 1. (2) Cash flow from operating activities for Year 1. (3) Cash flow from financing activities for Year 1. c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required 63 Required If the company earned $70,000 cash revenue and paid $49,000 in cash expenses in addition to the interest in Year 1, what is the amount of Cash flow from financing activities for Year 17 (Amounts to be deducted should be indicated with minus sign.) Cash flows from financing activities: Not cash flow from financing activities A partial amortization schedule for a 10-year note payable issued on January 1 Year 1, is shown next Account in pat Applied to plied to Period Balance January Payment steret Principal Year 1 $200,000 $12, 609 $14.400 $10,200 YA 2 221,792 32.600 13.300 19,300 Yest 202.492 32.600 12.150 20.450 Required m. Using a financial statements model, record the appropriate amounts for the following two events: (1) January 1, Year 1, Issue of the note payable. (2) December 31. Yeart, payment on the note payable. b. If the company corned $70.000 cash revenue and paid $49.000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the amount of interest expense on this loan for Year 4% Complete this question by entering your answers in the tabs below. Required Required 1 Required 12 Required 63 Required What is the amount of interest expense on this loan for Year 47 (Round your answer to the nearest dollar amount