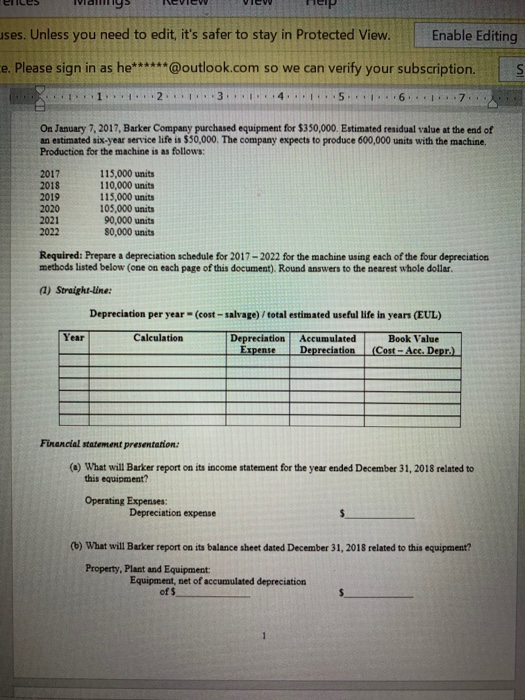

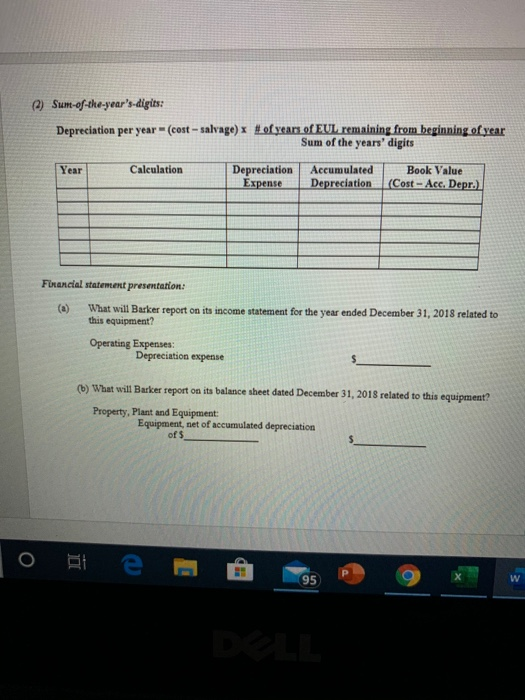

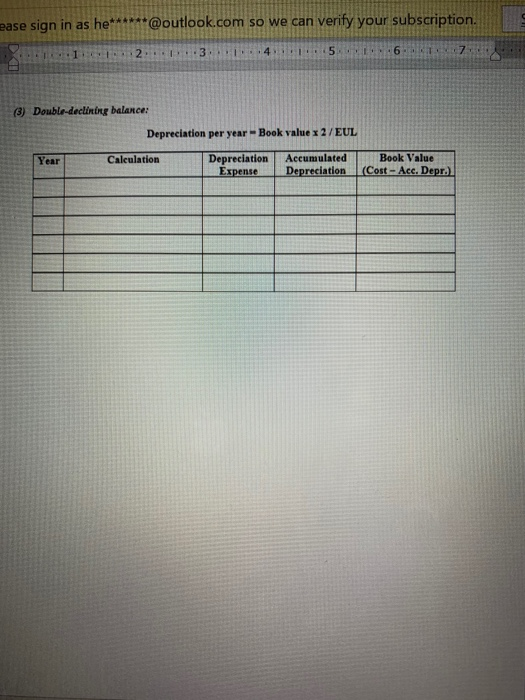

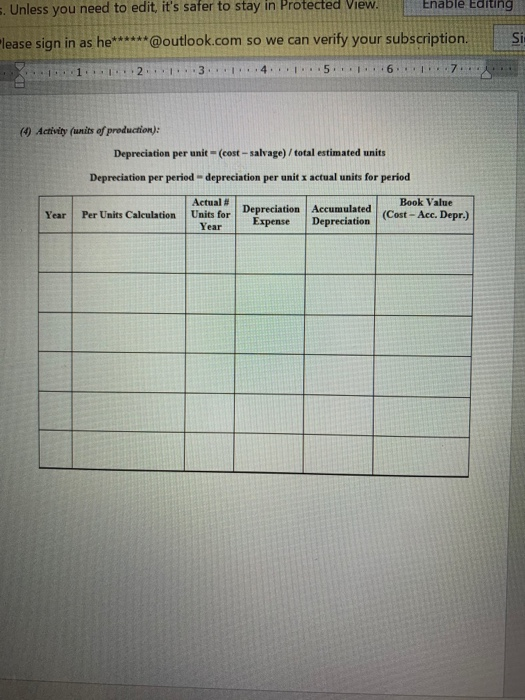

CHILE Vammy- CVIC ViewH elp uses. Unless you need to edit, it's safer to stay in Protected View Enable Editing e. Please sign in as he******@outlook.com so we can verify your subscription 1 . .2. .3 ..4.. ..5 .6 .7. On January 7, 2017, Barker Company purchased equipment for $350,000. Estimated residual value at the end of an estimated six-year service life is 550,000. The company expects to produce 600,000 units with the machine Production for the machine is as follows: 2017 2018 2019 2020 2021 2022 115,000 units 110,000 units 115,000 units 105,000 units 90,000 units 80,000 units Required: Prepare a depreciation schedule for 2017 - 2022 for the machine using each of the four depreciation methods listed below (one on each page of this document). Round answers to the nearest whole dollar. A) Straight-line: Depreciation per year - (cost-salvage) / total estimated useful life in years (EUL) Year Calculation Depreciation Depreciation Expense Accumulated Depreciation Book Value (Cost - Ace. Depr.) Financial statement presentation: (6) What will Barker report on its income statement for the year ended December 31, 2018 related to this equipment? Operating Expenses Depreciation expense (6) What will Barker report on its balance sheet dated December 31, 2018 related to this equipment? Property, Plant and Equipment: Equipment, net of accumulated depreciation ofs () Sum-of-the-year's digits: Depreciation per year (cost-salvage) of years of EUL remaining from beginning of year Sum of the years' digits Year Calculation Depreciation Expense Accumulated Depreciation Book Value Cost - Ace, Depr.) Financial statement presentation: What will Barker report on its income statement for the year ended December 31, 2018 related to this equipment? Operating Expenses Depreciation expense (1) What will Barker report on its balance sheet dated December 31, 2018 related to this equipment? Property, Plant and Equipment: Equipment, net of accumulated depreciation of ease sign in as he*****@outlook.com so we can verify your subscription. 2 . ..3 56 (3) Double-declining balance: Depreciation per year - Book value x 2 /EUL Year Calculation Depreciation Expense Accumulated Depreciation Book Value Cost - Acc. Depr. 5. Unless you need to edit, it's safer to stay in Protected View Enable Editing Please sign in as he******@outlook.com so we can verify your subscription .... ....... ..... ........5.. ..6 .7. (9) Activity (units of production): Depreciation per unit (cost-salvage) / total estimated units Depreciation per period depreciation per unit x actual units for period Year Per Units Calculation Actual Units for Year Depreciation Expense Accumulated Depreciation Book Value (Cost-Acc. Depr.)