Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chill Out ( Pty ) Ltd is a student restaurant registered as a Small Business Corporation ( SBC ) that generates an income of R

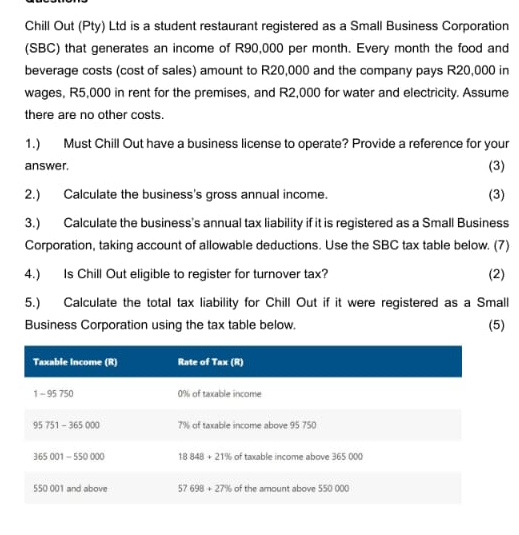

Chill Out Pty Ltd is a student restaurant registered as a Small Business Corporation SBC that generates an income of R per month. Every month the food and beverage costs cost of sales amount to R and the company pays R in wages, R in rent for the premises, and R for water and electricity. Assume there are no other costs.

Must Chill Out have a business license to operate? Provide a reference for your answer.

Calculate the business's gross annual income.

Calculate the business's annual tax liability if it is registered as a Small Business Corporation, taking account of allowable deductions. Use the SBC tax table below.

Is Chill Out eligible to register for turnover tax?

Calculate the total tax liability for Chill Out if it were registered as a Small Business Corporation using the tax table below.

tableTaxable Income RRite of Tax R of taxable income of taxable income above of taxable income above and above, of the amount above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started