Answered step by step

Verified Expert Solution

Question

1 Approved Answer

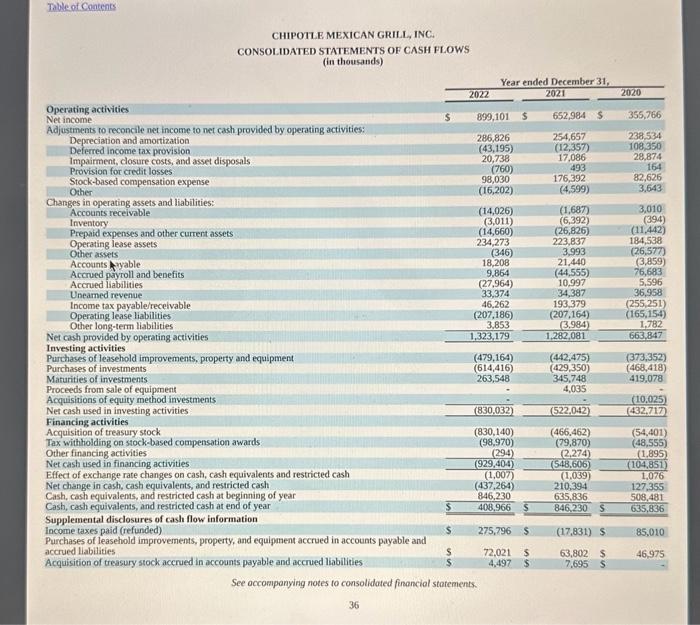

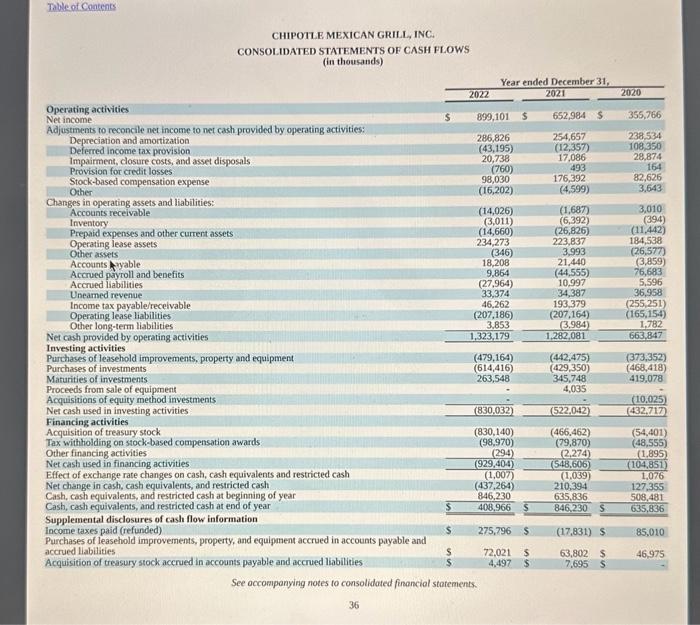

chipotles net income percentage for 2022 was________ while it was______ for 2021. Fill in the blank. CHIPOTLE MEXICAN GRILL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS

chipotles net income percentage for 2022 was________ while it was______ for 2021. Fill in the blank.

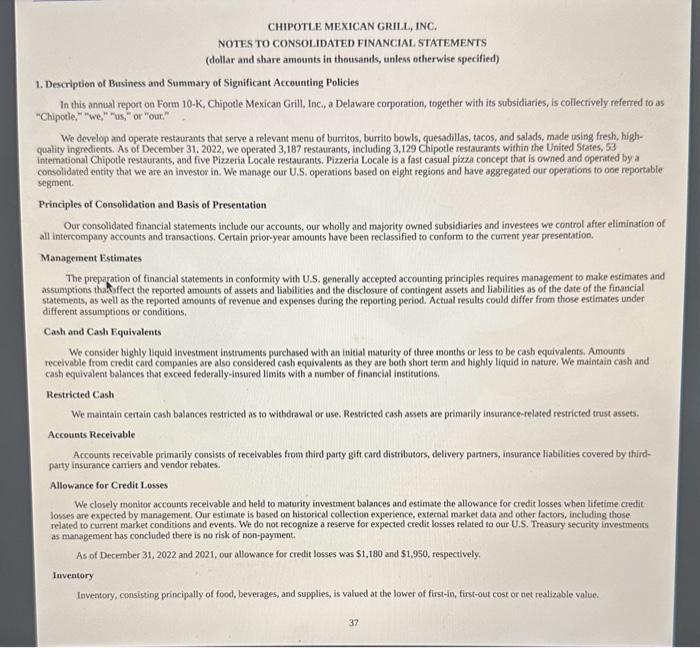

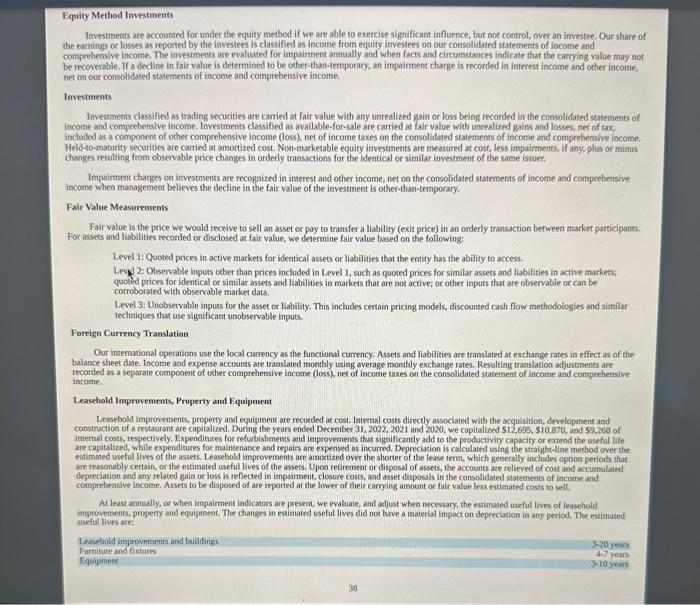

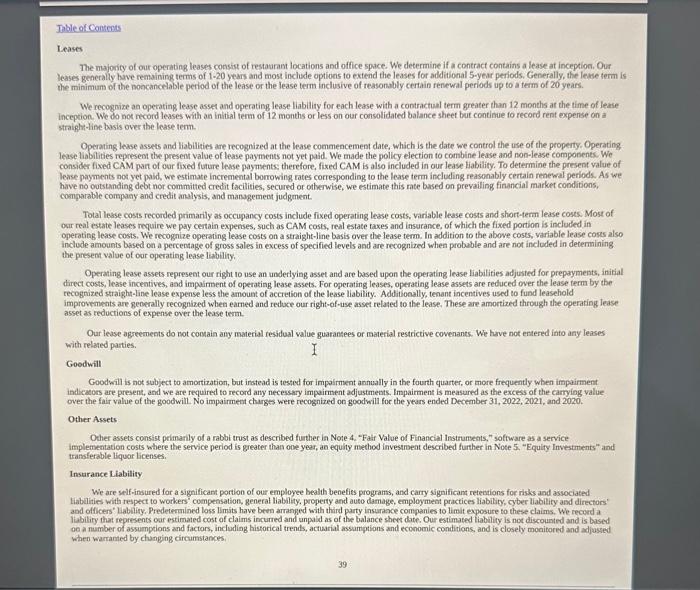

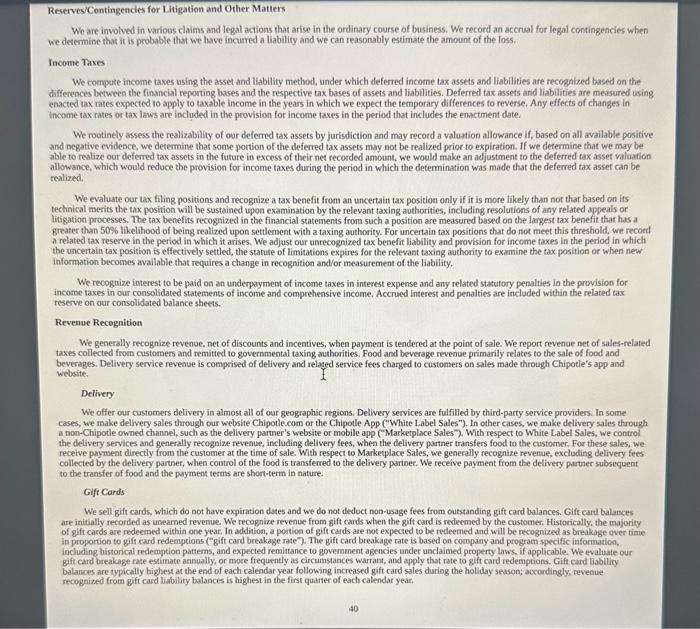

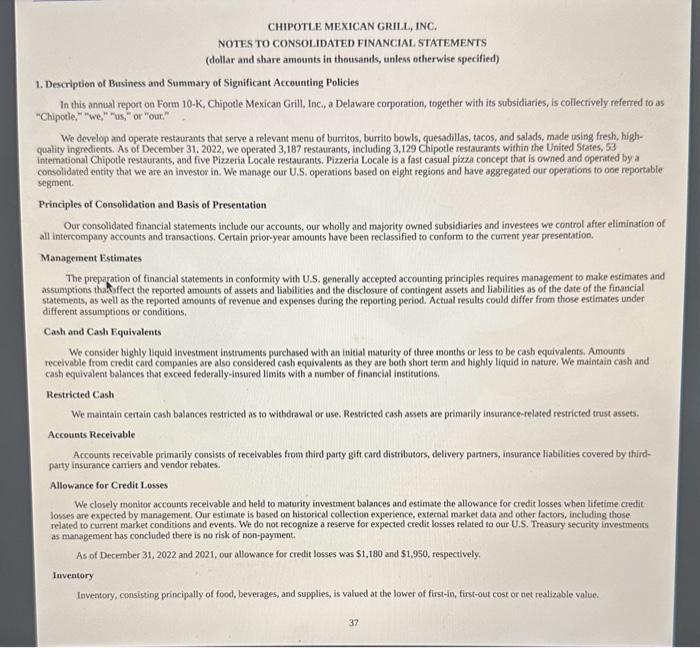

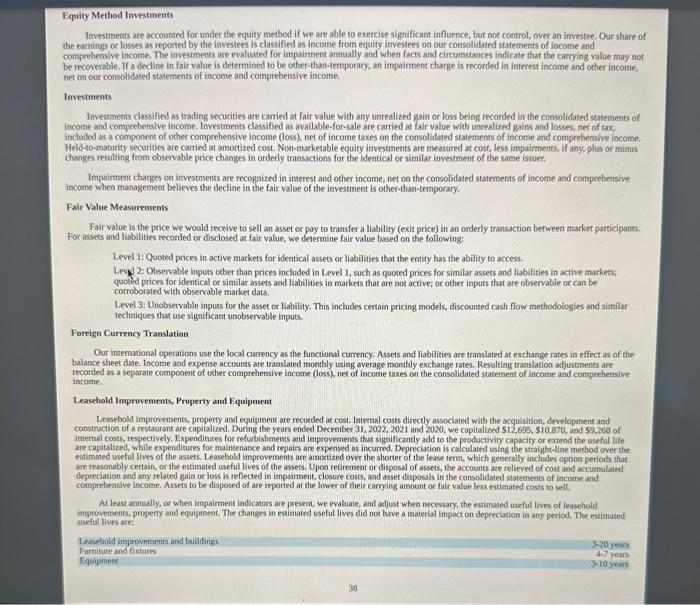

CHIPOTLE MEXICAN GRILL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) The majonty of our operating leases consist of restatrant locations and office space. We determine if a contract contains a lease at inception, Our leases generally bave remaining terms of 120 years and most include options to extend the leases for additional 5 -year periods, Generally, the lease term is the minimum of the poocancelable period of the lease or the lease term inclusive of teasonably certain renewal periods up to a farm of 20 years. We recognize an opetating lease asset and operating lease liability for each lease with a cootractual term greater than 12 months at the time of lease inception. We do not ncord leases with an intial term of 12 months or less on our consolidated balance sheet but continue fo record rent expense on a straight-hine basis oves the lease tem. Operating lease assets and liabilities are recognized at the lease commencement date, which is the date we control the use of the property, Operating lease liabilities represent the present value of lease payments not yet paid. We made the policy election to combine lease and non-lease components. We consider fixed CAM part of our fixed future lease payments therefore, fixed CAM is also included in our lease liability. To determine the present value of lease payments not yet pasd, we estimate incremental bomowing rates corresponding to the lease tern incloding reasonably certain renewal periods. As we have no cutstanding debt nor committed credit facilities, secured or otherwise, we estimate this mte based on prevailing financial market conditions, comparable company and credit anslysis, and management judgment. Total lesse costs recorded primarily as occupancy costs include fixed operating lease costs, variable lease costs and short-tern lease costs Most of our real estate leases require we pay certain expenses, such as CAM costs, real estate raxes and insarance, of which the fixed portion is included in operating lease costs. We recognize operating lease costs on a straight-line basis over the lease term. In addition to the abowe costs, variable lease coses also inclode amounts based on a percentage of gross sales in excess of specified levels and are recognized when probable and are not incloded in determining the present value of oar operating lease liability. Operating lease assets represent our right Io use an underlying asset and are based upon the operating lease liabilities adjusted for prepayments, initial direct costs, lease incentives, and impairment of operating lease assets. For operating leases, operating lease assets are reduced over the lease term by the recognized straight-line lease expense less the amount of acctetion of the lease liabilify. Additionally, tenant incentives used to fund leasehold improvements are geocrally recognized when earned and reduce our right-of-use asset relased to the lease, These are amortized through the cperating lease asset as reductions of expense over the lease temm. Our lease agreements do not conain any material resadual value guarantees or material restrictive covenants. We have not entered into any leases with related parties. Goodwill Goodwill is not subject to amortization, but irstead is tested for impairment annually in the fourth quarter, or more frequently when impairment indicators are present, and we are required to record any necessary impairment adjustments. Impairment is measured as the excess of the camying value over the fair value of the goodwill No impairment charges were recognized on goodwill for the years ended December 31,2022,2021, and 2020 . Other Assets Other assets consist peimanily of a rabbi trust as described further in Note 4. "Fair Value of Financial Instruments," software as a service implementation costs where the service period is greater than one year, an equity method investrueat described further in Note 5 . "Equity Investiments" and transferable liquar licenses. Insurance Liability We are self -insured for a significant portion of our employee health benefies programs, and carry significant reteotions for risks and associated tiabulities with respect to workers' compensation, general liability, property and auto damage, employment practices liability, cyber liability and directors' and officers' Lability. Predetermined loss limits have been arranged with third party insuraoce companies to limit exposure to these claims, We record a liability that represencs oar estimated cost of claims incurred and unpaid as of the balance sheet date, Our estimated tiability is not discounted and is based oe a namber of assumptions and factors, incloding hisforical trends, actuarial assamptions and economic conditions, and is closely monitored and adjasted when warranted by changing circumstances, We are involved in various claims and legal actions that arise in the ordinary course of business. We record an accrual for legal contingencies when we desemine that it is probable that we have incurred a liability and we can reasonably estimate the amount of the loss. Income Taxes We compuse income taxes using the asset and liability method, under which deferred income tax assets and liabilities are recognized based on the differences between the financial reportang bases and the respective tax bases of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which we expect the temporary differences to reverse, Any effects of changes in income tax rates or tax laws are included in the provision for income raxes in the period that includes the enactment date. We routinely assess the realizability of our deferred tax assets by juristiction and may record a valuation allowance if, based on all available positive and negative evideoce, we decemine that some portion of the deferred lax assets may not be realized prior to expiration. If we determine that we may be able to realize our deferred tax assets in the future in excess of their net recorded amount, we would make an adjustment to the deferred tax asset valuation allowance, which would reduce the provision for income taxes during the period in which the detemination was made that the deferred tax assef can be realized, We evaluate our tax filing positions and recognize a tax benefit from an uncertain tax position only if it is more likely than not that based on its techinical merits the tax position will be sustained upon examination by the relevant taxing authorities, including resolutions of any related appeals or litigation processes. The tax benefits recognized in the financial statements from such a position are measured based on the largest tax benefit that has a greater than 50% likelhood of being realized upon settlement with a taxing authority. For uncertain tax positions that do not meet this threshold, we record a related tax reserve in the period in which it arises. We adjust our unrecognized tax benefit liability and provision for income taxes in the period in which the uncertain tax position is effectively settled, the statute of limitations expires for the relevant taxing authority to examine the tax position or when new information becomes avallable that requires a change in recognition and or measurement of the liability. We recognize interest to be paid on an underpayment of income taxes in interest expense and any related statutory penalties in the provision for income taxes in our consolidated statements of income and comprehensive income, Accrued interest and penalties are included within the related tax reserve on our consolidated balance sheets. Revenue Recegnition We generally recognize revenue, net of discounts and incentives, when payment is tendered at the point of sale. We report revenue net of sales-related taxes collected from customers and remitted to governmental taxing authorities. Food and beverage revenue primarily relates to the sale of food and beverages. Delivery service reveaue is comprised of delivery and relaged service fees charged to customers on sales made through Chipotie's app and website. Delivery We offer our customers delivery in almost all of our geographic regions. Delivery services are fulfilled by third-party service providers. In some cases, we make delivery sales through our website Chipotle.com or the Chipotle App ("White Label Sales"). In other cases, we make delivery sales through a non-Chipotle owned channel, such as the delivery partner's website or mobile app ("Marketplace Sales"). With respect to White Label Sales, we controi the delivery services and generally recognize revenue, including delivery fees, when the delivery partner transters food to the custorrer. For these sales, we recetve payment directly from the customer at the time of sale. With respect to Marketplace Sales, we generally recognize revenue, excluding delivery fees collected by the delivery partner, when control of the food is transferred to the delivery pariner, We receive payment from the delivery parmer subsequent to the transfer of food and the payment terms are short-term in nature. Gife Cards We sell gift cards, which do not have expiration dates and we do not deduct noo-usage fees from outstanding gift card balances. Gift card balances ate initially recorded as unearned revenue. We recognize revenue from gift cards when the gift card is redeemed by the customer Historically, the majority of gift cards are redeemed withia one year, In addition, a portion of gift cards are not expected to be redeemed and will be recognized as breakage over time in proportion to gift card redemptions ("gift card breakage rate"). The gift card breakage rate is based on company and program specific information, including historical redemption pattems, and expected remittance to govemment agencies under unclaimed property laws, if applicable. We evaluate our gift card breakage rate estimate annually, or more frequently as circumstances warrant, and apply that rate to gift card redemptions. Gift card liability balances are typically highest at the end of each calendar year following increased gift card sales during the holiday season; accordingly, reveaue recognized from gift card liability balances is highest in the first quarter of each calendar year, CHIPOTLE MEXICAN GRILL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) The majonty of our operating leases consist of restatrant locations and office space. We determine if a contract contains a lease at inception, Our leases generally bave remaining terms of 120 years and most include options to extend the leases for additional 5 -year periods, Generally, the lease term is the minimum of the poocancelable period of the lease or the lease term inclusive of teasonably certain renewal periods up to a farm of 20 years. We recognize an opetating lease asset and operating lease liability for each lease with a cootractual term greater than 12 months at the time of lease inception. We do not ncord leases with an intial term of 12 months or less on our consolidated balance sheet but continue fo record rent expense on a straight-hine basis oves the lease tem. Operating lease assets and liabilities are recognized at the lease commencement date, which is the date we control the use of the property, Operating lease liabilities represent the present value of lease payments not yet paid. We made the policy election to combine lease and non-lease components. We consider fixed CAM part of our fixed future lease payments therefore, fixed CAM is also included in our lease liability. To determine the present value of lease payments not yet pasd, we estimate incremental bomowing rates corresponding to the lease tern incloding reasonably certain renewal periods. As we have no cutstanding debt nor committed credit facilities, secured or otherwise, we estimate this mte based on prevailing financial market conditions, comparable company and credit anslysis, and management judgment. Total lesse costs recorded primarily as occupancy costs include fixed operating lease costs, variable lease costs and short-tern lease costs Most of our real estate leases require we pay certain expenses, such as CAM costs, real estate raxes and insarance, of which the fixed portion is included in operating lease costs. We recognize operating lease costs on a straight-line basis over the lease term. In addition to the abowe costs, variable lease coses also inclode amounts based on a percentage of gross sales in excess of specified levels and are recognized when probable and are not incloded in determining the present value of oar operating lease liability. Operating lease assets represent our right Io use an underlying asset and are based upon the operating lease liabilities adjusted for prepayments, initial direct costs, lease incentives, and impairment of operating lease assets. For operating leases, operating lease assets are reduced over the lease term by the recognized straight-line lease expense less the amount of acctetion of the lease liabilify. Additionally, tenant incentives used to fund leasehold improvements are geocrally recognized when earned and reduce our right-of-use asset relased to the lease, These are amortized through the cperating lease asset as reductions of expense over the lease temm. Our lease agreements do not conain any material resadual value guarantees or material restrictive covenants. We have not entered into any leases with related parties. Goodwill Goodwill is not subject to amortization, but irstead is tested for impairment annually in the fourth quarter, or more frequently when impairment indicators are present, and we are required to record any necessary impairment adjustments. Impairment is measured as the excess of the camying value over the fair value of the goodwill No impairment charges were recognized on goodwill for the years ended December 31,2022,2021, and 2020 . Other Assets Other assets consist peimanily of a rabbi trust as described further in Note 4. "Fair Value of Financial Instruments," software as a service implementation costs where the service period is greater than one year, an equity method investrueat described further in Note 5 . "Equity Investiments" and transferable liquar licenses. Insurance Liability We are self -insured for a significant portion of our employee health benefies programs, and carry significant reteotions for risks and associated tiabulities with respect to workers' compensation, general liability, property and auto damage, employment practices liability, cyber liability and directors' and officers' Lability. Predetermined loss limits have been arranged with third party insuraoce companies to limit exposure to these claims, We record a liability that represencs oar estimated cost of claims incurred and unpaid as of the balance sheet date, Our estimated tiability is not discounted and is based oe a namber of assumptions and factors, incloding hisforical trends, actuarial assamptions and economic conditions, and is closely monitored and adjasted when warranted by changing circumstances, We are involved in various claims and legal actions that arise in the ordinary course of business. We record an accrual for legal contingencies when we desemine that it is probable that we have incurred a liability and we can reasonably estimate the amount of the loss. Income Taxes We compuse income taxes using the asset and liability method, under which deferred income tax assets and liabilities are recognized based on the differences between the financial reportang bases and the respective tax bases of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which we expect the temporary differences to reverse, Any effects of changes in income tax rates or tax laws are included in the provision for income raxes in the period that includes the enactment date. We routinely assess the realizability of our deferred tax assets by juristiction and may record a valuation allowance if, based on all available positive and negative evideoce, we decemine that some portion of the deferred lax assets may not be realized prior to expiration. If we determine that we may be able to realize our deferred tax assets in the future in excess of their net recorded amount, we would make an adjustment to the deferred tax asset valuation allowance, which would reduce the provision for income taxes during the period in which the detemination was made that the deferred tax assef can be realized, We evaluate our tax filing positions and recognize a tax benefit from an uncertain tax position only if it is more likely than not that based on its techinical merits the tax position will be sustained upon examination by the relevant taxing authorities, including resolutions of any related appeals or litigation processes. The tax benefits recognized in the financial statements from such a position are measured based on the largest tax benefit that has a greater than 50% likelhood of being realized upon settlement with a taxing authority. For uncertain tax positions that do not meet this threshold, we record a related tax reserve in the period in which it arises. We adjust our unrecognized tax benefit liability and provision for income taxes in the period in which the uncertain tax position is effectively settled, the statute of limitations expires for the relevant taxing authority to examine the tax position or when new information becomes avallable that requires a change in recognition and or measurement of the liability. We recognize interest to be paid on an underpayment of income taxes in interest expense and any related statutory penalties in the provision for income taxes in our consolidated statements of income and comprehensive income, Accrued interest and penalties are included within the related tax reserve on our consolidated balance sheets. Revenue Recegnition We generally recognize revenue, net of discounts and incentives, when payment is tendered at the point of sale. We report revenue net of sales-related taxes collected from customers and remitted to governmental taxing authorities. Food and beverage revenue primarily relates to the sale of food and beverages. Delivery service reveaue is comprised of delivery and relaged service fees charged to customers on sales made through Chipotie's app and website. Delivery We offer our customers delivery in almost all of our geographic regions. Delivery services are fulfilled by third-party service providers. In some cases, we make delivery sales through our website Chipotle.com or the Chipotle App ("White Label Sales"). In other cases, we make delivery sales through a non-Chipotle owned channel, such as the delivery partner's website or mobile app ("Marketplace Sales"). With respect to White Label Sales, we controi the delivery services and generally recognize revenue, including delivery fees, when the delivery partner transters food to the custorrer. For these sales, we recetve payment directly from the customer at the time of sale. With respect to Marketplace Sales, we generally recognize revenue, excluding delivery fees collected by the delivery partner, when control of the food is transferred to the delivery pariner, We receive payment from the delivery parmer subsequent to the transfer of food and the payment terms are short-term in nature. Gife Cards We sell gift cards, which do not have expiration dates and we do not deduct noo-usage fees from outstanding gift card balances. Gift card balances ate initially recorded as unearned revenue. We recognize revenue from gift cards when the gift card is redeemed by the customer Historically, the majority of gift cards are redeemed withia one year, In addition, a portion of gift cards are not expected to be redeemed and will be recognized as breakage over time in proportion to gift card redemptions ("gift card breakage rate"). The gift card breakage rate is based on company and program specific information, including historical redemption pattems, and expected remittance to govemment agencies under unclaimed property laws, if applicable. We evaluate our gift card breakage rate estimate annually, or more frequently as circumstances warrant, and apply that rate to gift card redemptions. Gift card liability balances are typically highest at the end of each calendar year following increased gift card sales during the holiday season; accordingly, reveaue recognized from gift card liability balances is highest in the first quarter of each calendar year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started