Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choco acquired 10% of the voting common stock of Cake Company in 1/1/2019 by paying $12,000 in cash. Choco uses the fair value method to

Choco acquired 10% of the voting common stock of Cake Company in 1/1/2019 by paying $12,000 in cash. Choco uses the fair value method to account for its investment and recorded as available for sales security. Cake Company has the book value of net assets of $100,000. During 2020, Cake had a net income of $85,000, paid dividends of $60,000. The fair market value of Cake in 1/1/2020 was $120,000 and in 12/31/2020, it was $132,000.

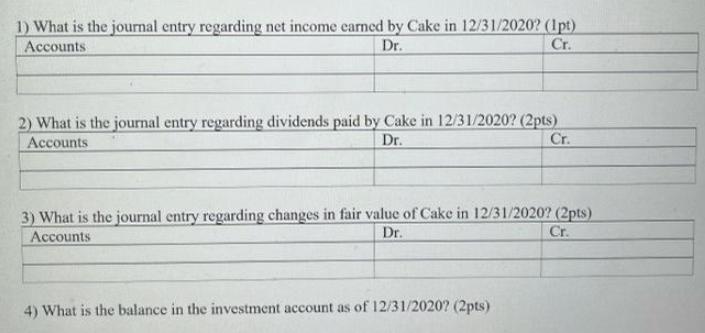

1) What is the journal entry regarding net income earned by Cake in 12/31/2020? (1pt) Accounts Dr. Cr. 2) What is the journal entry regarding dividends paid by Cake in 12/31/2020? (2pts) Accounts Dr. Cr. 3) What is the journal entry regarding changes in fair value of Cake in 12/31/2020? (2pts). Accounts Dr. Cr. 4) What is the balance in the investment account as of 12/31/2020? (2pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 What is the journal entry regarding net income earned by Cake in 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started