Answered step by step

Verified Expert Solution

Question

1 Approved Answer

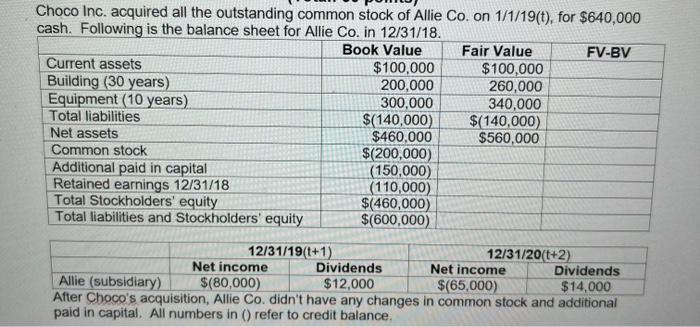

Choco Inc. acquired all the outstanding common stock of Allie Co. on 1/1/19(t), for $640,000 cash. Following is the balance sheet for Allie Co.

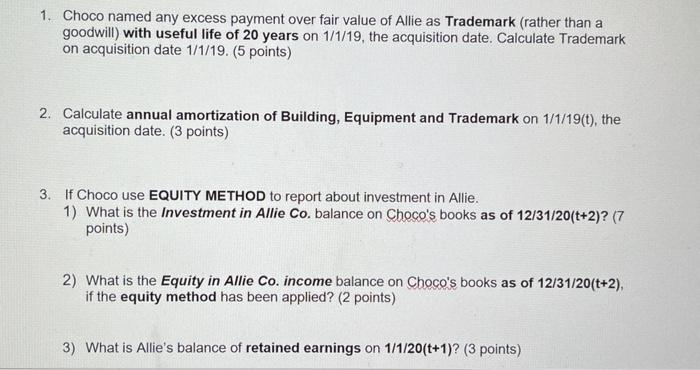

Choco Inc. acquired all the outstanding common stock of Allie Co. on 1/1/19(t), for $640,000 cash. Following is the balance sheet for Allie Co. in 12/31/18. Book Value FV-BV Current assets Building (30 years) Equipment (10 years) Total liabilities Net assets Common stock Additional paid in capital Retained earnings 12/31/18 Total Stockholders' equity Total liabilities and Stockholders' equity 12/31/19(t+1) $100,000 200,000 300,000 $(140,000) $460,000 $(200,000) (150,000) (110,000) $(460,000) $(600,000) Fair Value $100,000 260,000 340,000 $(140,000) $560,000 12/31/20(1+2) Net income Dividends Net income Dividends Allie (subsidiary) $(80,000) $12,000 $(65,000) $14,000 After Choco's acquisition, Allie Co. didn't have any changes in common stock and additional paid in capital. All numbers in () refer to credit balance. 1. Choco named any excess payment over fair value of Allie as Trademark (rather than a goodwill) with useful life of 20 years on 1/1/19, the acquisition date. Calculate Trademark on acquisition date 1/1/19. (5 points) 2. Calculate annual amortization of Building, Equipment and Trademark on 1/1/19(t), the acquisition date. (3 points) 3. If Choco use EQUITY METHOD to report about investment in Allie. 1) What is the Investment in Allie Co. balance on Choco's books as of 12/31/20(t+2)? (7 points) 2) What is the Equity in Allie Co. income balance on Choco's books as of 12/31/20(t+2), if the equity method has been applied? (2 points) 3) What is Allie's balance of retained earnings on 1/1/20(t+1)? (3 points)

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Calculation of Trademark on acquisition date 1119 Trademark Purchase price of Allie Fair value of Allies net assetsTrademark 640000 560000Trademark 80000 Therefore the Trademark on acquisit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started