Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choice America Bank has the following equity allocation. The firm's CFO is considering an increase or decrease in one or multiple equity sources. Assume

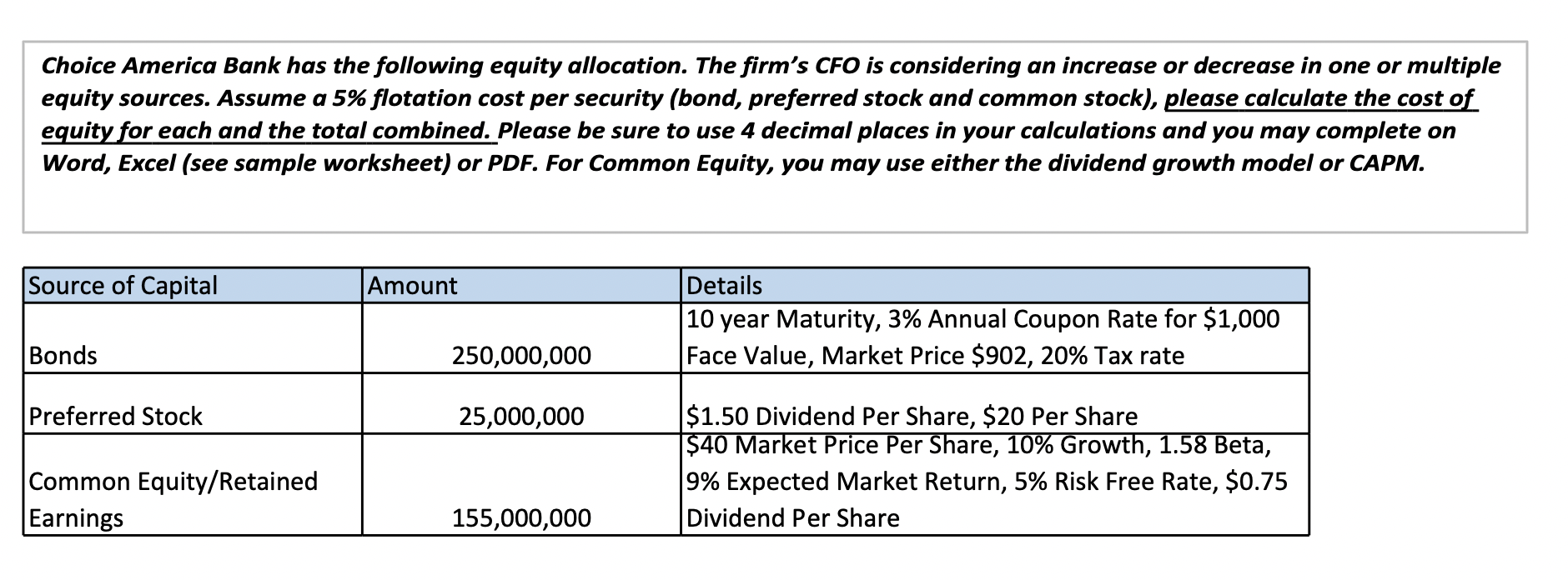

Choice America Bank has the following equity allocation. The firm's CFO is considering an increase or decrease in one or multiple equity sources. Assume a 5% flotation cost per security (bond, preferred stock and common stock), please calculate the cost of equity for each and the total combined. Please be sure to use 4 decimal places in your calculations and you may complete on Word, Excel (see sample worksheet) or PDF. For Common Equity, you may use either the dividend growth model or CAPM. Source of Capital Bonds Preferred Stock Amount 250,000,000 25,000,000 Common Equity/Retained Earnings 155,000,000 Details 10 year Maturity, 3% Annual Coupon Rate for $1,000 Face Value, Market Price $902, 20% Tax rate $1.50 Dividend Per Share, $20 Per Share $40 Market Price Per Share, 10% Growth, 1.58 Beta, 9% Expected Market Return, 5% Risk Free Rate, $0.75 Dividend Per Share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started