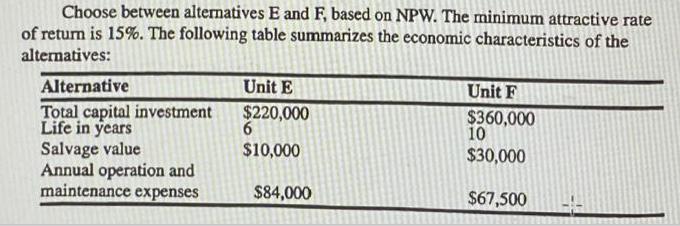

Question: Choose between alternatives E and F, based on NPW. The minimum attractive rate of return is 15%. The following table summarizes the economic characteristics

Choose between alternatives E and F, based on NPW. The minimum attractive rate of return is 15%. The following table summarizes the economic characteristics of the alternatives: Alternative Total capital investment Life in years Salvage value Annual operation and maintenance expenses Unit E $220,000 6 $10,000 $84,000 Unit F $360,000 10 $30,000 $67,500

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

To determine which alternative to choose based on the Net Present Worth NPW method we need to calcul... View full answer

Get step-by-step solutions from verified subject matter experts