Answered step by step

Verified Expert Solution

Question

1 Approved Answer

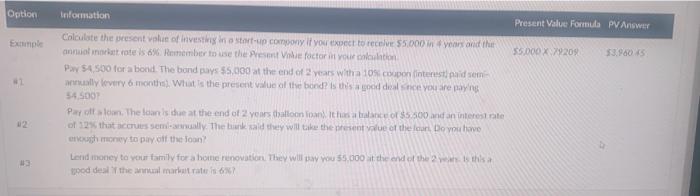

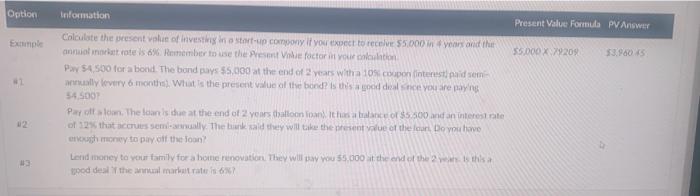

choose one option please thankyou. it is payday you look and see you got a $4,500 bonus, what option do you plan, 1, 2, or

choose one option please thankyou.

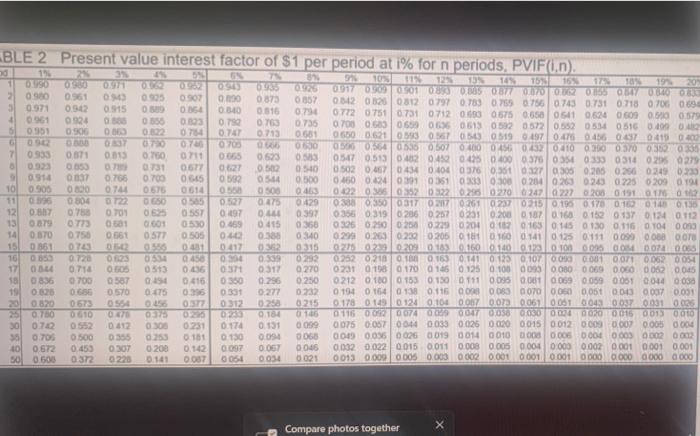

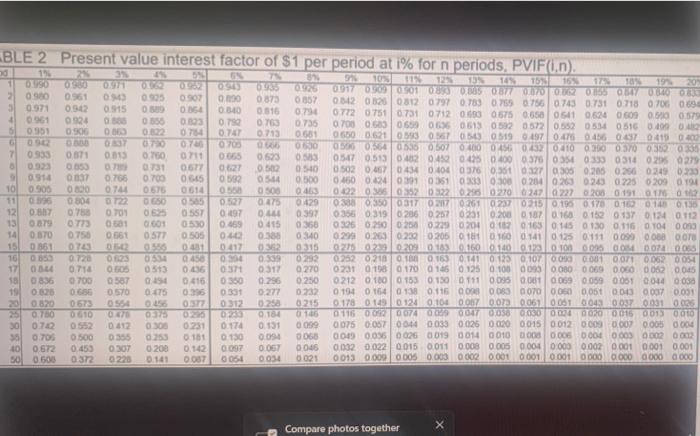

DC SOL 0950 SUF 3.50 GOO CO TO CO 19 4 ORLO SOLO 1990 0090 CO . CCSO LO ICED 5 9190 BLE 2 Present value interest factor of $1 per period at i% for n periods, PVIF(D.D. 32 OSO 101 T5 19 20 0971 01077 W01005377 0070 05 BY DOO 0980 0.561 0307 0873 0357 06420320 0812 0797 0.7830797560743 0731 0.71807060690 5 0.971 0.30 0915 O OVER 0340 01516 07 077207510731 0712 0.03306750658 5410.62406090.500.579 0.961 0924 0556 0.003 07 OTO 0.735 0.700 630 653 06306130520572 0.55205040516 0100 02 0951 0.500 0754 07 0713 06006210307053051997 0.4760456 060415 000 DI 07 05605640556 0.507 000 000 000 57003035 001 760 0.71 0665 0.623 0583 0547 051304020452 045 0.000 0.3700354 0333 0314 0295 0279 8 092 0.650 0677 0627 0.502 0540 0502 046704340404 0376 0.56 027 0305 0.205 0.256 0249 0233 091 0.037 0.768 0.709 05 54 0.500 0.060 0.4240391 0151 033 0300 0204 023 0243 02250209 0.794 10 0.500 0800 07 01516 0161 05 050 0403 0.025 035 03220 290 2700 2470 227208 0191012 11 0096 0304 OT 0650 055 0.527 0.47 01429 0338 035003170270261 0237 0315 0.1900 17001 10.138 12 0.807 0788 05 0557 097 0. 0.39 0356 0.3190 206 0257 0231 0.20 0.17 0.163 0150137 0.14 0.112 13 0879 773 050 0530 0459 0415 0325 0.250 0.250 0.229 0204 120163 015 0130 0.116 0904 0000 14 O TO 0756 0561 0577 040 0140 0295 0200230 0.205 0 0 1600141 0.125 0.111 0099 0008 OOTH 15 0350 OT D 0315 2020-2090 183041600110010100098 00 00 0065 16 0653 0 120 0534 022 0252 0218000.163 0.141 033 0107 000 000 007 0062 0054 17 0.71 0513 0.06 0371 0317 0270 0231 01980 1700146 0125 0100 0093 0.0800069 0.060 0052 0.045 18 0836 700 0587 0416 0350 0250 02120100 0153 0.150 0111 0095 000 0069: 00590051 0044 0038 19 0.000 01688 0570 0.396 0331 0277 0232 0194 01640138 0.116 00 003 00700050 0.051 000 0007 0.031 0820 0573 0554 0312 0.25 0.215 0.178 0129101240104 007 002 00610081004300700310025 0.750 0610 Gare DES OT 01 0 11600820074 0 7 005806300040000015 0093 0.010 30 072 0552 0412 0.300 0231 0176 0.151 009 0075 0.057 0044 0.033 0.026 0.0200015 0012 0.00 0.00 0.005 0.004 35 0.704 0.500 0.550 0.25 0181 150 06 0049 0.035 0.025 019 0014 010 000 000 0004 0.003 0.002 0.002 10 0.672 0.450 0307 0208 0.142 0.06 0046 0032 0.022 0.015 0.011 0.008 0.005 0.000 0.003 0.002 0.001 0.001 0.001 50 0.500 0.372 0228 0.140 007 0054 0034 0013 0.00 0.00 0.003 0002 0.001 0.001 0.001 0000 0000 0000 0000 LOUD 99CO SOSO COCO COCO BESO OSO 1050 CESO 9050 9520 SO STO LIGO SASO 1500 25000 1200 Compare photos together Option Information Present Value Formula PV Answer Example 35.000 X 7920 $3.99045 Calculate the present value of Investing in a start-up company if you expect to receive 55.000 years and that annual inorkat rate is 6%. Remember to use the present i foctor in your lantion PS4 500 for a bond The bond pays 55.000 at the end of 2 years with a 10 coupon intenst paid sem annually every 6 months What's the present value of the bond is is a good deale you are paying 545007 Paroltsoon. The loans ce at the end of 2 years toon on this balance or $5.500 and an intereste of 12that crus semmily. The bank cald they will take the rest vue of the Icon. Do you have chmony to pay of the foon Lend money to your family for a home renovation. They will you 55.000 at the end of the Is this pod deal the anal market rates 3 "it is payday you look and see you got a $4,500 bonus, what option do you plan, 1, 2, or 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started