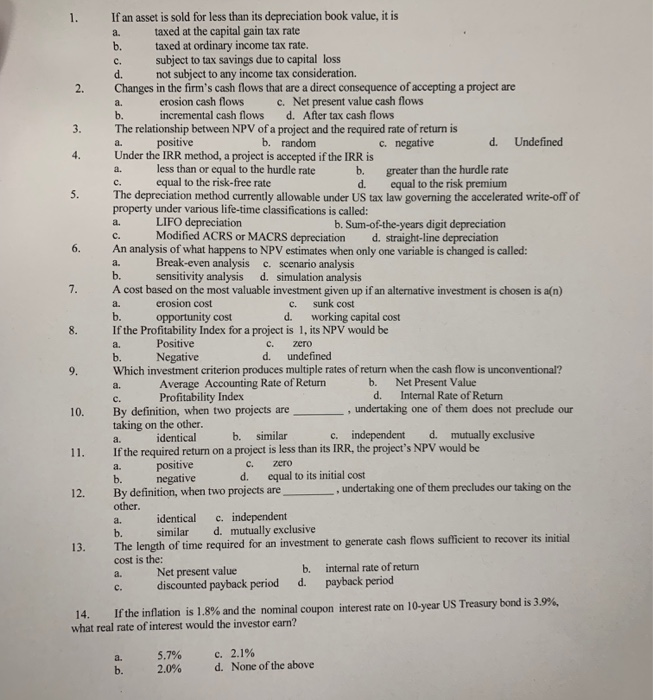

Choose the appropriate multiple choice answer for the following

If an asset is sold for less than its depreciation book value, it is a. taxed at the capital gain tax rate b. taxed at ordinary income tax rate. c. subject to tax savings due to capital loss d. not subject to any income tax consideration. Changes in the firm's cash flows that are a direct consequence of accepting a project are erosion cash flows c . Net present value cash flows b. incremental cash flows d. After tax cash flows The relationship between NPV of a project and the required rate of return is a positive b. random c. negative d. Undefined Under the IRR method, a project is accepted if the IRR is a. less than or equal to the hurdle rate b. greater than the hurdle rate c. equal to the risk-free rate d. equal to the risk premium The depreciation method currently allowable under US tax law governing the accelerated write-off of property under various life-time classifications is called: LIFO depreciation b. Sum-of-the-years digit depreciation c. Modified ACRS or MACRS depreciation d. straight-line depreciation An analysis of what happens to NPV estimates when only one variable is changed is called: a. Break-even analysis c. scenario analysis b. sensitivity analysis d. simulation analysis A cost based on the most valuable investment given up if an alternative investment is chosen is a(n) a. erosion cost c. sunk cost b. opportunity cost d . working capital cost If the Profitability Index for a project is 1, its NPV would be a. Positive c. zero b. Negative d. undefined Which investment criterion produces multiple rates of return when the cash flow is unconventional? Average Accounting Rate of Return b. Net Present Value c. Profitability Index d. Internal Rate of Return By definition, when two projects are ... undertaking one of them does not preclude our taking on the other. a. identical b. similar c. independent d mutually exclusive If the required return on a project is less than its IRR, the project's NPV would be a. positive c. zero b. negative d. equal to its initial cost By definition, when two projects are undertaking one of them precludes our taking on the other. a. identical c. independent b. similar d. mutually exclusive The length of time required for an investment to generate cash flows sufficient to recover its initial cost is the: a. Net present value b. internal rate of return d iscounted payback period d. payback period C 14. If the inflation is 1.8% and the nominal coupon interest rate on 10-year US Treasury bond is 3.9%. what real rate of interest would the investor earn? 5.7% 2.0% c. 2.1% d. None of the above b