Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choose the correct answer for A, B, and C Complete all parts of D Vaughn Company estimated that it will incur $405000 overhead costs each

Choose the correct answer for A, B, and C

Complete all parts of D

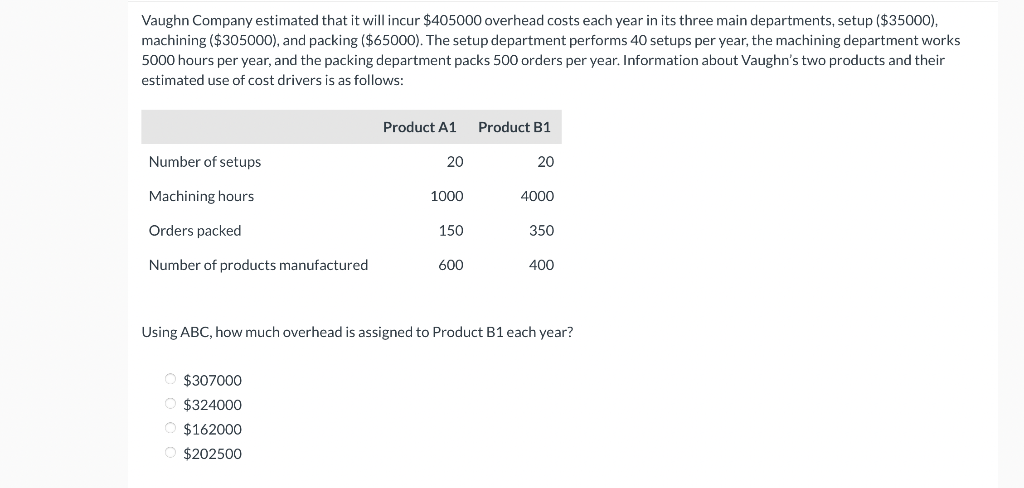

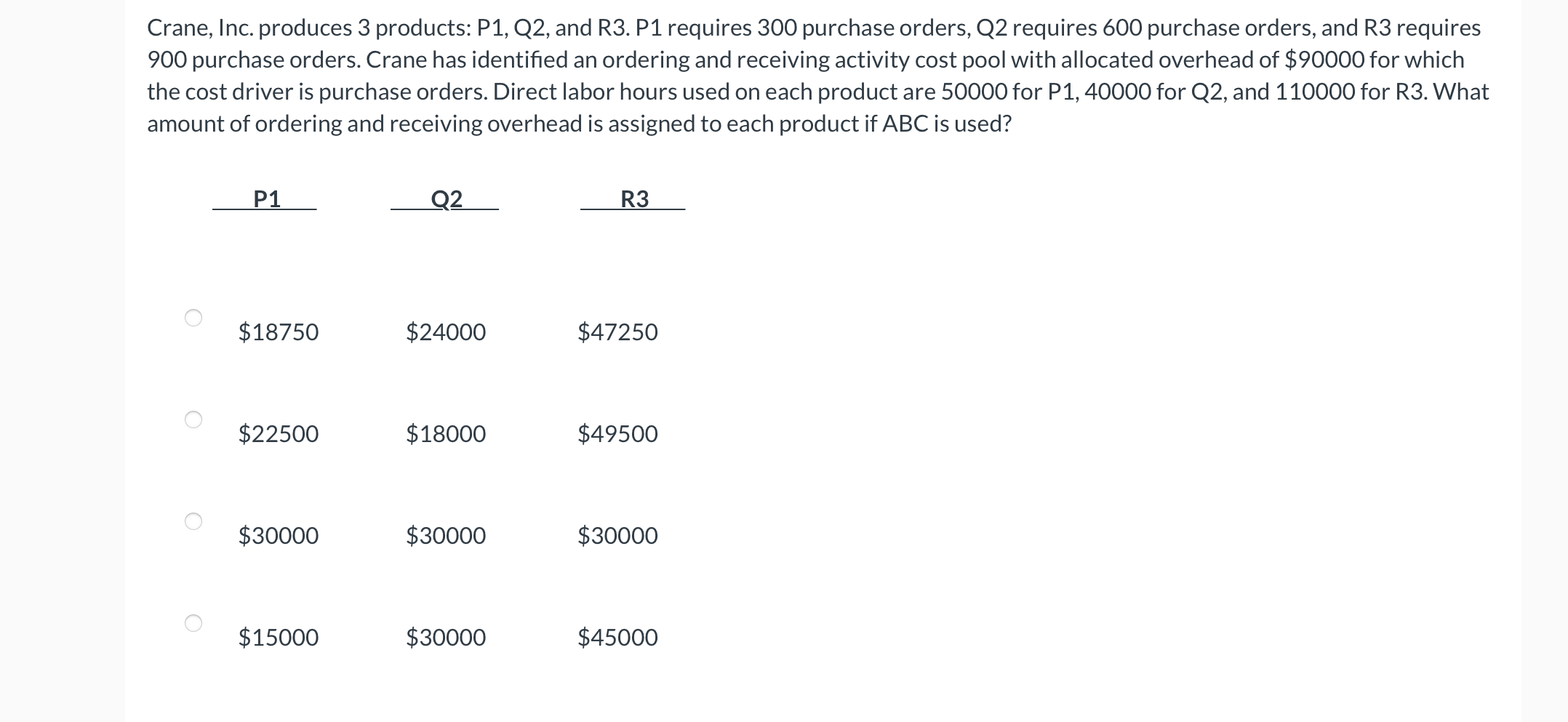

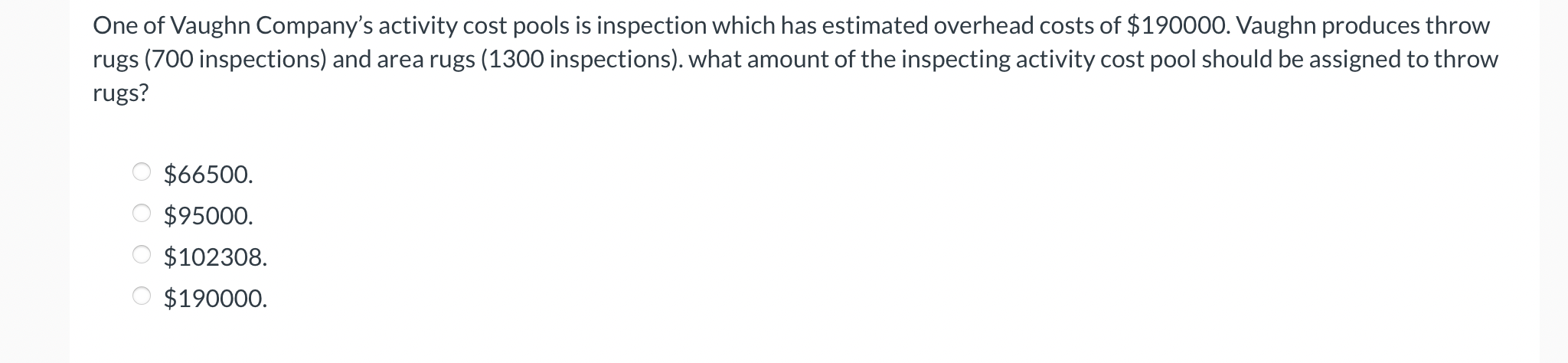

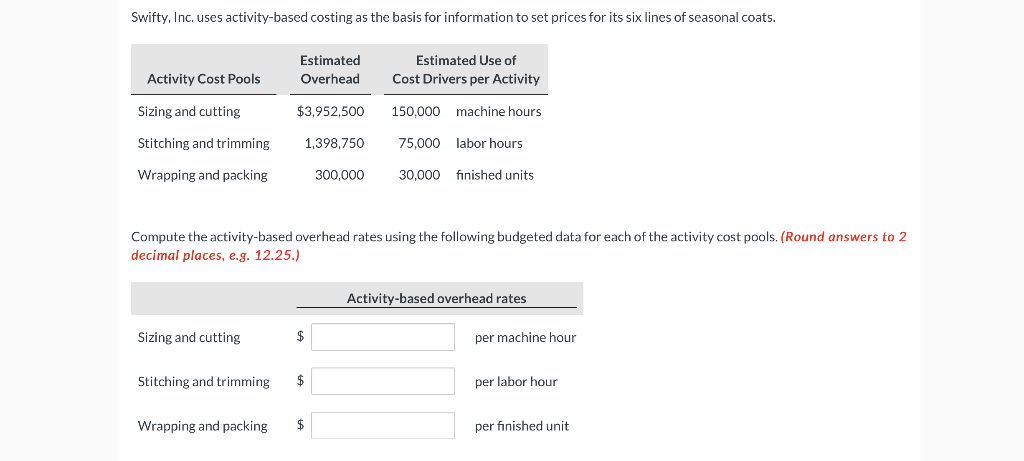

Vaughn Company estimated that it will incur $405000 overhead costs each year in its three main departments, setup (\$35000), machining (\$305000), and packing (\$65000). The setup department performs 40 setups per year, the machining department works 5000 hours per year, and the packing department packs 500 orders per year. Information about Vaughn's two products and their estimated use of cost drivers is as follows: Using ABC, how much overhead is assigned to Product B1 each year? $307000$324000$162000$202500 Crane, Inc. produces 3 products: P1,Q2, and R3. P1 requires 300 purchase orders, Q2 requires 600 purchase orders, and R3 requires 900 purchase orders. Crane has identified an ordering and receiving activity cost pool with allocated overhead of $90000 for which the cost driver is purchase orders. Direct labor hours used on each product are 50000 for P1, 40000 for Q2, and 110000 for R3. What amount of ordering and receiving overhead is assigned to each product if ABC is used? One of Vaughn Company's activity cost pools is inspection which has estimated overhead costs of $190000. Vaughn produces throw rugs (700 inspections) and area rugs ( 1300 inspections). what amount of the inspecting activity cost pool should be assigned to throw rugs? $66500.$95000.$102308.$190000. Swifty, Inc. uses activity-based costing as the basis for information to set prices for its six lines of seasonal coats. Compute the activity-based overhead rates using the following budgeted data for each of the activity cost pools. (Round answers to 2 decimal places, e.g. 12.25.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started