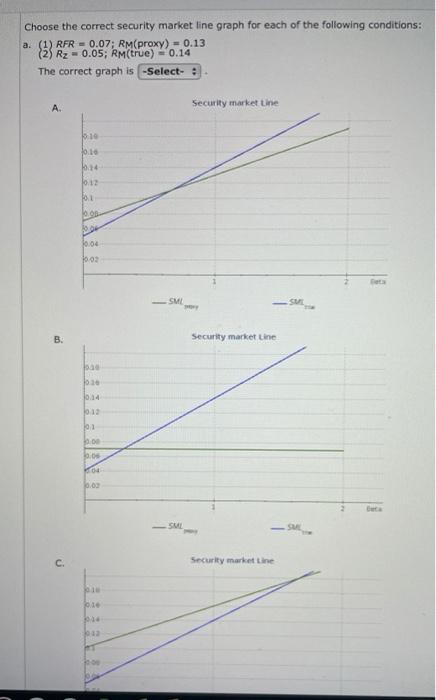

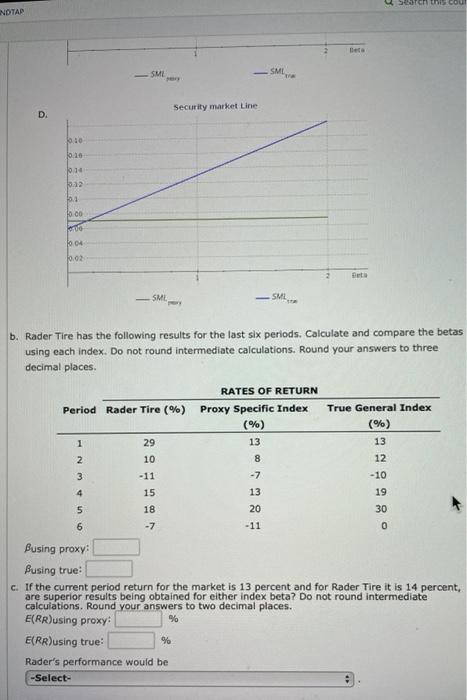

Choose the correct security market line graph for each of the following conditions: a. (1) RFR = 0.07; RM(proxy) = 0.13 (2) Rz - 0.05; RM(true) = 0.14 The correct graph is -Select- : A. Security market Line 0.10 014 10.12 01 . 10.04 10.03 SMI SME B. Security market Line 010 10.14 10:13 101 . 10.05 6.02 SME SUE c. Security market Line 01 on this cou NOTAP SME SMI Security market Line D. 0.80 10:10 101 2 10.1 10.00 10.04 0.02 - SM SML b. Rader Tire has the following results for the last six periods. Calculate and compare the betas using each index. Do not round intermediate calculations. Round your answers to three decimal places RATES OF RETURN Period Rader Tire (%) Proxy Specific Index True General Index (%) (%) 13 2 10 -11 4 15 13 19 5 20 30 6 1 29 13 12 8 -7 3 - 10 18 -7 -11 0 Busing proxy Busing true c. If the current period return for the market is 13 percent and for Rader Tire it is 14 percent, are superior results being obtained for either index beta? Do not round intermediate calculations. Round your answers to two decimal places. E(RR)using proxy E(RR)using true % Rader's performance would be -Select- Choose the correct security market line graph for each of the following conditions: a. (1) RFR = 0.07; RM(proxy) = 0.13 (2) Rz - 0.05; RM(true) = 0.14 The correct graph is -Select- : A. Security market Line 0.10 014 10.12 01 . 10.04 10.03 SMI SME B. Security market Line 010 10.14 10:13 101 . 10.05 6.02 SME SUE c. Security market Line 01 on this cou NOTAP SME SMI Security market Line D. 0.80 10:10 101 2 10.1 10.00 10.04 0.02 - SM SML b. Rader Tire has the following results for the last six periods. Calculate and compare the betas using each index. Do not round intermediate calculations. Round your answers to three decimal places RATES OF RETURN Period Rader Tire (%) Proxy Specific Index True General Index (%) (%) 13 2 10 -11 4 15 13 19 5 20 30 6 1 29 13 12 8 -7 3 - 10 18 -7 -11 0 Busing proxy Busing true c. If the current period return for the market is 13 percent and for Rader Tire it is 14 percent, are superior results being obtained for either index beta? Do not round intermediate calculations. Round your answers to two decimal places. E(RR)using proxy E(RR)using true % Rader's performance would be -Select