Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choose the most accurate statement Select one: O a. If the systematic risk of an asset is zero, then the beta of this asset must

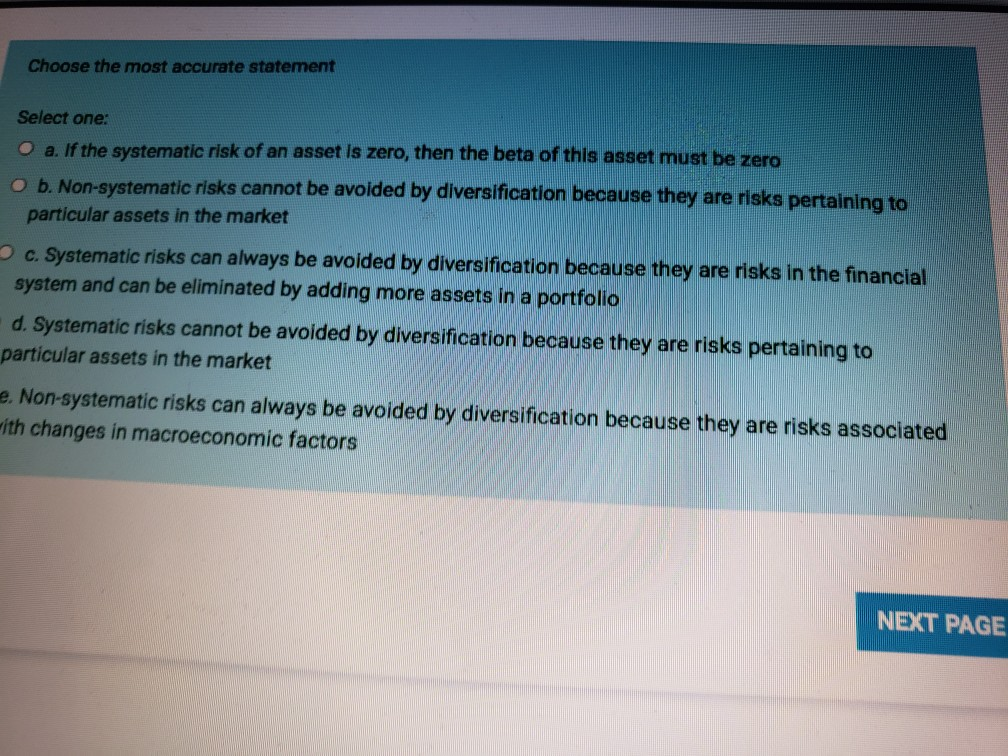

Choose the most accurate statement Select one: O a. If the systematic risk of an asset is zero, then the beta of this asset must be zero O b. Non-systematic risks cannot be avoided by diversification because they are risks pertaining to particular assets in the market c. Systematic risks can always be avoided by diversification because they are risks in the financial system and can be eliminated by adding more assets in a portfolio d. Systematic risks cannot be avoided by diversification because they are risks pertaining to particular assets in the market e. Non-systematic risks can always be avoided by diversification because they are risks associated with changes in macroeconomic factors NEXT PAGE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started