choose the right answer

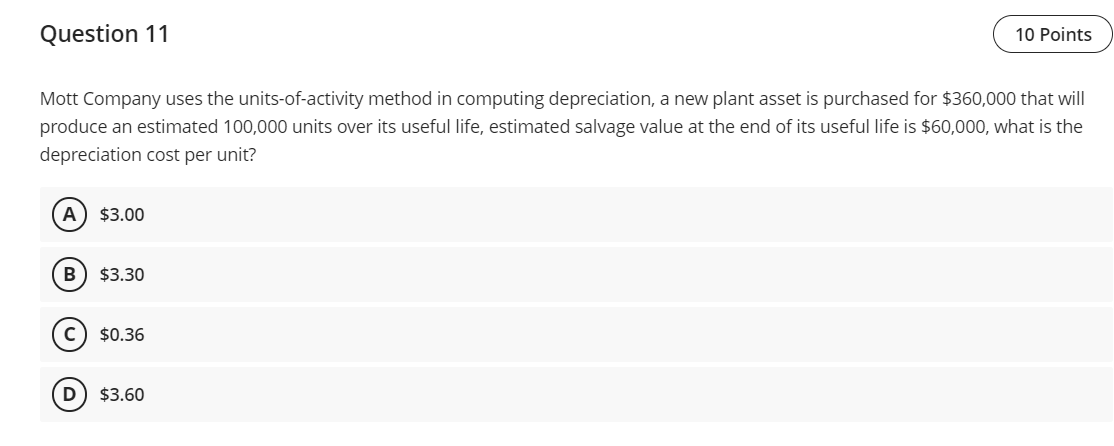

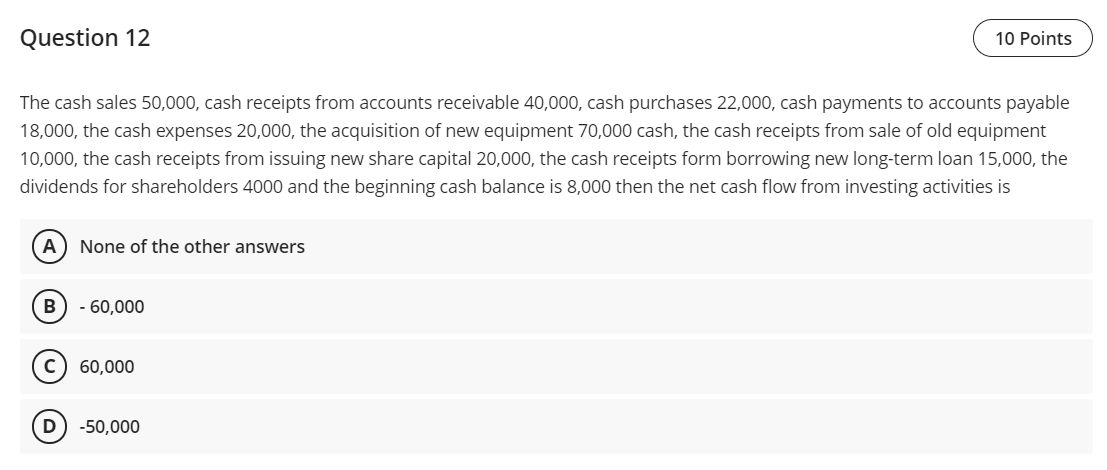

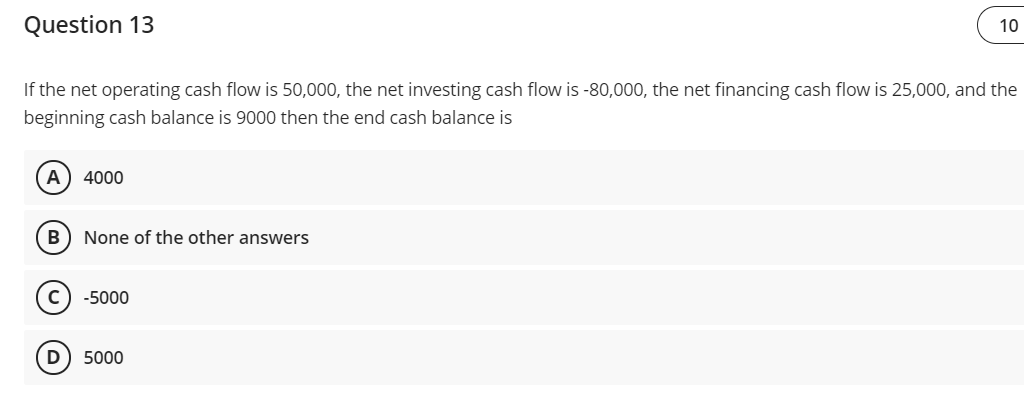

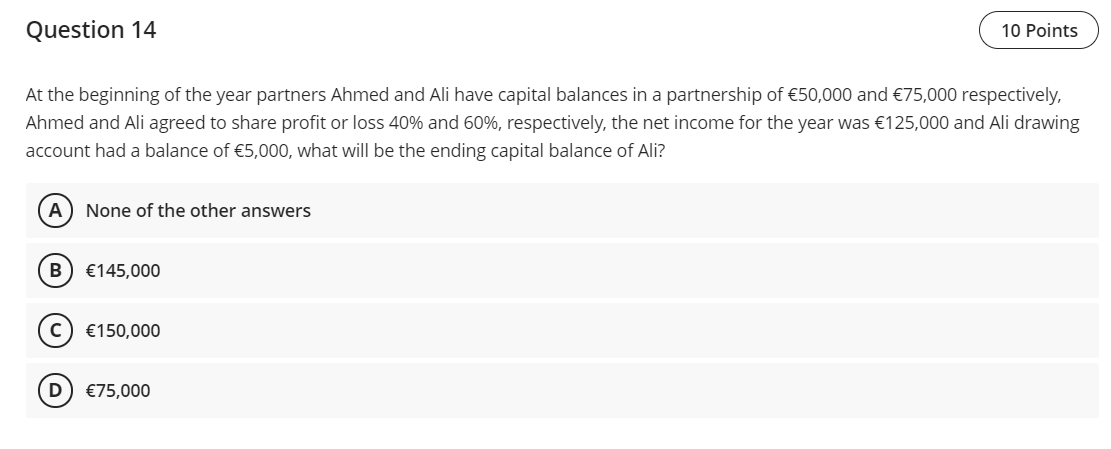

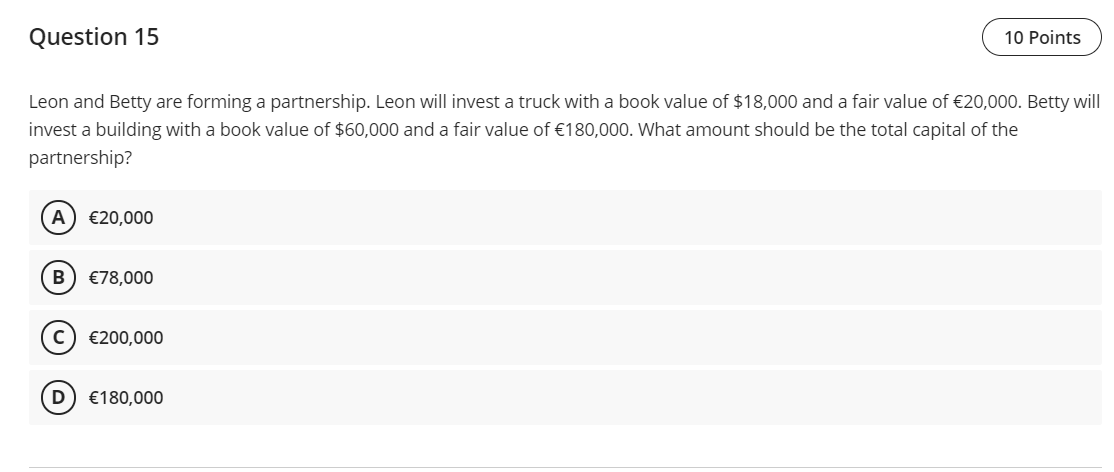

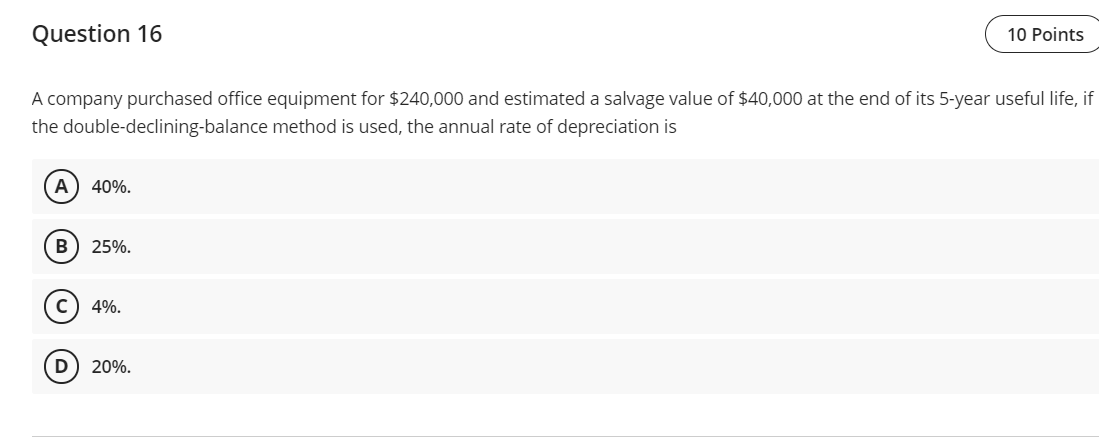

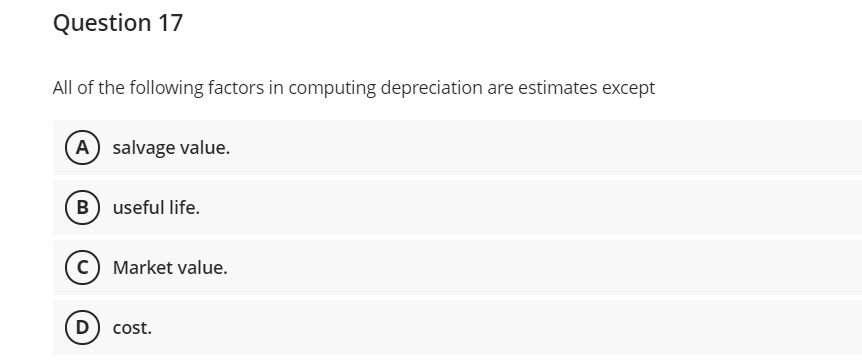

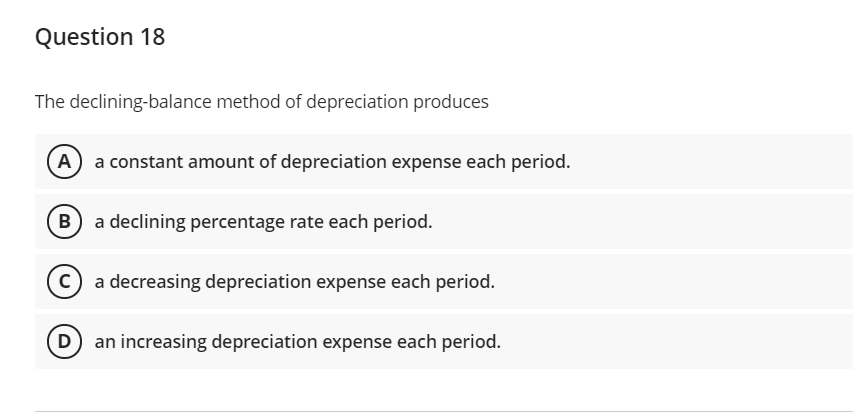

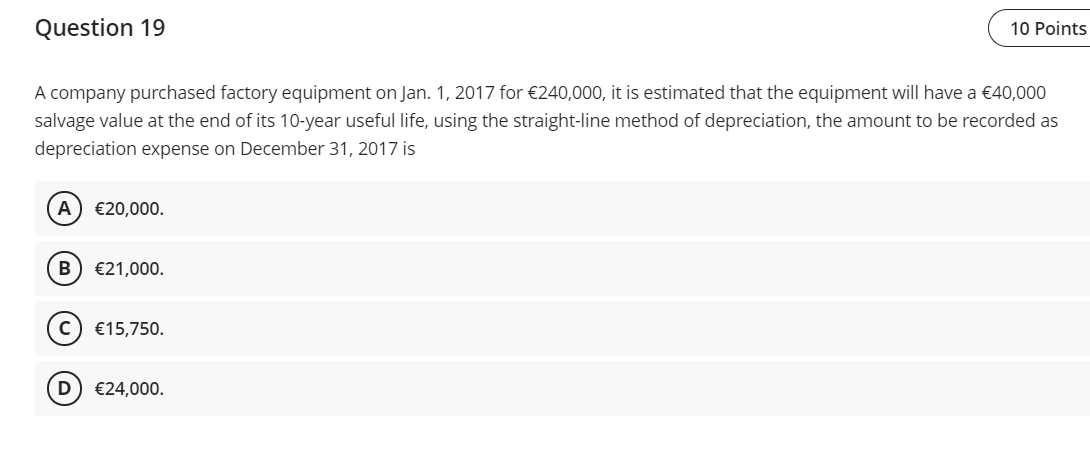

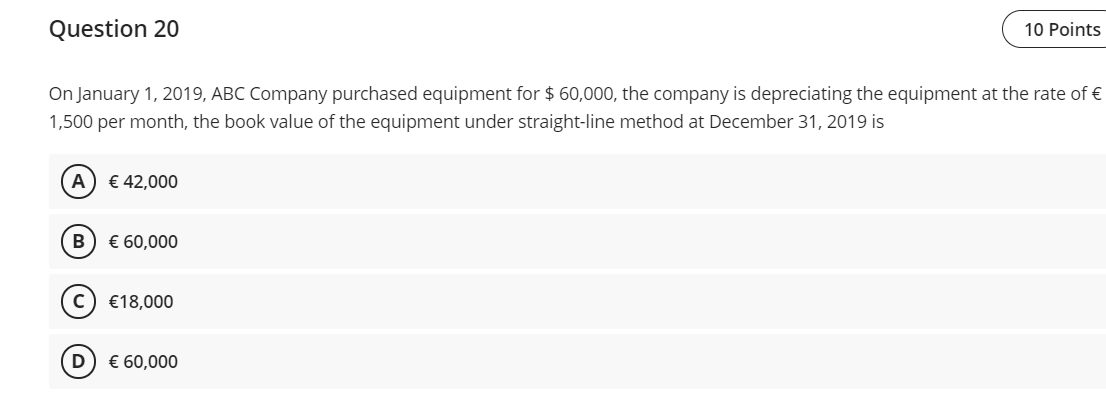

Mott Company uses the units-ofactivity method in computing depreciation. a new plant asset is purchased for $360,000 that will produce an estimated 100,000 units over its useful life, estimated salvage value at the end of its useful life is $60,000, what is the depreciation cost per unit? The cash sales 50,000, cash receipts from accounts receivable 40.000, cash purchases 22,000, cash payments to accounts payable 18,000, the cash expenses 20,000. the acquisition of new equipment 70,000 cash, the cash receipts from sale of old equipment 10,000, the cash receipts from issuing new share capital 20,000, the cash receipts form borrowing new long-term loan 15,000. the dividends for shareholders 4000 and the beginning cash balance is 8,000 then the net cash ow from investing activities is G) None of the other answers 0 -60,000 60.000 50.000 Question 13 ( 10 If the net operating cash flow is 50,000, the net investing cash flow is -80.000, the net nancing cash flow is 25,000. and the beginning cash balance is 9000 then the end cash balance is G) 4000 None of the other answers Question 14 10 Points At the beginning of the year partners Ahmed and Ali have capital balances in a partnership of $50,000 and $75,000 respectively, Ahmed and Ali agreed to share profit or loss 40% and 60%, respectively, the net income for the year was $125,000 and Ali drawing account had a balance of $5,000, what will be the ending capital balance of Ali? A None of the other answers B (145,000 (150,000 D (75,000Question 15 10 Points Leon and Betty are forming a partnership. Leon will invest a truck with a book value of $18,000 and a fair value of E20,000. Betty will invest a building with a book value of $60,000 and a fair value of E180,000. What amount should be the total capital of the partnership? A (20,000 B (78,000 (200,000 D (180,000Question 16 l 10 Points A company purchased office equipment for $240,000 and estimated a salvage value of $40,000 at the end of its 5-year useful life. if the double-decliningbalance method is used, the annual rate of depreciation is Question 17 All of the following factors in computing depreciation are estimates except salvage value. useful life. Question 18 The declining-balance method of depreciation produces A a constant amount of depreciation expense each period. B a declining percentage rate each period. C a decreasing depreciation expense each period. D an increasing depreciation expense each period.Question 19 ( 10 Points A company purchased factory equipment onJan. 'l, 2017 for 240,000. it is estimated that the equipment will have a 40,000 salvage value at the end ofits10-year useful life, using the straight-line method of depreciation, the amount to be recorded as depreciation expense on December 31. 2017 is Question 20 10 Points On January 1, 2019, ABC Company purchased equipment for $ 60,000, the company is depreciating the equipment at the rate of E 1,500 per month, the book value of the equipment under straight-line method at December 31, 2019 is A E 42,000 B E 60,000 C (18,000 D E 60,000