Choosing: FACEBOOK, attached is the current financial 10K. Below is a snapshot 10-k report to use. Please show the calculations and steps so i can understand not just the answers. thank you!

- The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment. (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.)

- The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost.

- The annual EBIT for this new project will be 18% of the project's cost.

- The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 35% as the tax rate in this project.

- The hurdle rate for this project will be the WACC Noted as 8.68

Please provide process for:

- Your calculations for the amount of property, plant, and equipment and the annual depreciation for the project

- Your calculations that convert the project's EBIT to free cash flow for the 12 years of the project.

- The following capital budgeting results for the project

- Net present value

- Internal rate of return

- Discounted payback period.

- Your discussion of the results that you calculated above, including a recommendation for acceptance or rejection of the project

Choosing: FACEBOOK, attached is the current financial 10K. Below is a snapshot 10-k report to use. Please show the calculations and steps so i can understand not just the answers. thank you!

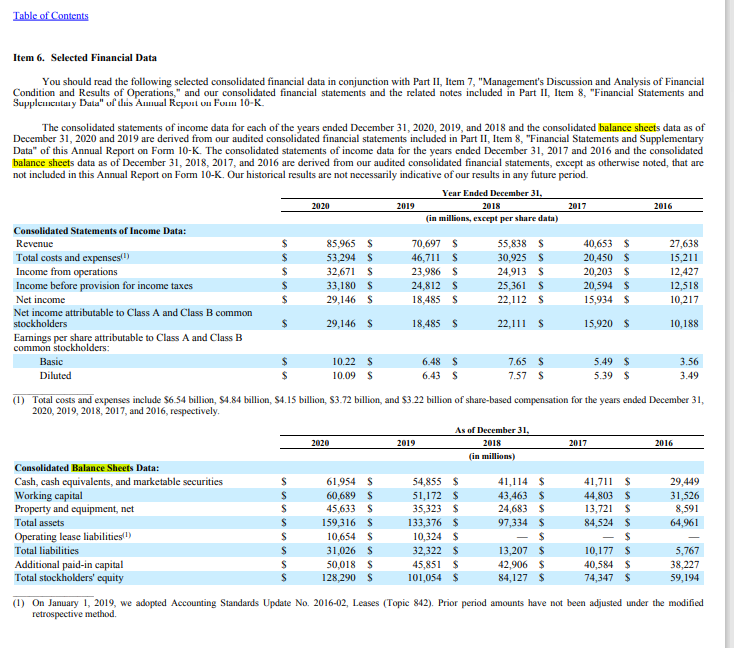

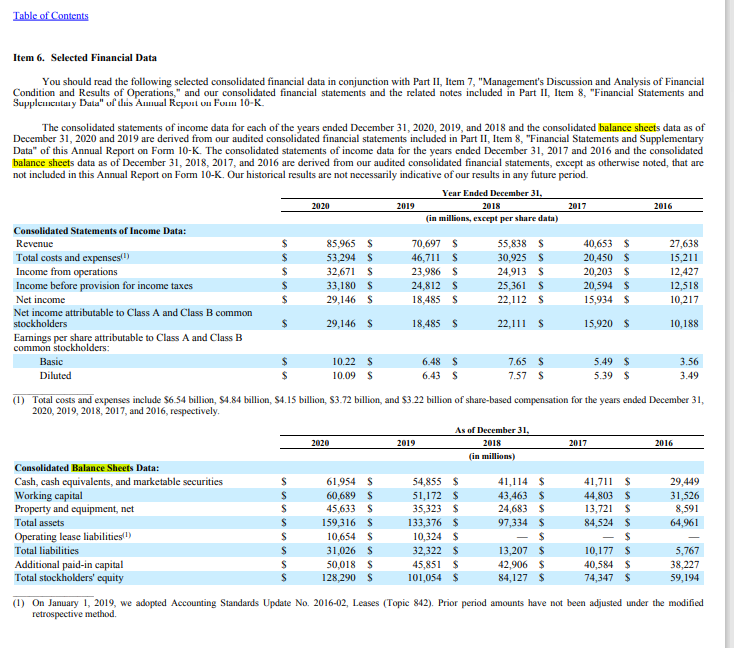

Table of Contents Item 6. Selected Financial Data You should read the following selected consolidated financial data in conjunction with Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included in Part II, Item 8. "Financial Statements and Supplementary Datu" of duis Anual Report ou Foum 10-K. The consolidated statements of income data for each of the years ended December 31, 2020, 2019, and 2018 and the consolidated balance sheets data as of December 31, 2020 and 2019 are derived from our audited consolidated financial statements included in Part II, Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K. The consolidated statements of income data for the years ended December 31, 2017 and 2016 and the consolidated balance sheets data as of December 31, 2018, 2017, and 2016 are derived from our audited consolidated financial statements, except as otherwise noted, that are not included in this Annual Report on Form 10-K. Our historical results are not necessarily indicative of our results in any future period. Year Ended December 31, 2020 2019 2018 2017 2016 (in millions, except per share data) Consolidated Statements of Income Data: Revenue $ 85,965 $ 70,697 s 55,838 S 40,653 $ 27,638 Total costs and expenses $ 53.294 S 46,711 $ 30,925 S 20,450 $ 15,211 Income from operations $ 32,671 S 23,986 $ 24,913 $ 20,203 $ 12,427 Income before provision for income taxes $ 33,180 S 24,812S 25,361 S 20,594 $ 12,518 Net income $ 29,146 S 18,485 S 22,112 s 15,934 $ 10,217 Net income attributable to Class A and Class B common stockholders $ 29,146 S 18,485 S 22,111 S 15,920 $ 10,188 Earnings per share attributable to Class A and Class B common stockholders: Basic $ 10.22 $ 6.48 $ 7.65 S 5.49 $ 3.56 Diluted 10.09 S 6.43S 7.57 S 5.39 $ 3.49 (1) Total costs and expenses include $6.54 billion, 54.84 billion, 54.15 billion, $3.72 billion, and $3.22 billion of share-based compensation for the years ended December 31, 2020, 2019, 2018, 2017, and 2016, respectively As of December 31, 2018 (in millions) Consolidated Balance Sheets Data: Cash, cash equivalents, and marketable securities S 61,954 S 54,855 $ 41,114 $ 41,711 $ 29,449 Working capital S 60,689 $ 51,172 $ 43,463 $ 44,803 $ 31,526 Property and equipment, net S 45,633 S 35,323 $ 24,683 $ 13,721 $ 8,591 Total assets S 159,316 S 133,376 $ 97,334 $ 84,524 $ 64,961 Operating Icase liabilities) s 10,654 S 10,324 $ $ - $ Total liabilities S 31,026 S 32,322 $ 13,207 $ 10,177 $ 5,767 Additional paid-in capital s 50,018 S 45,851 $ 42,906 $ 40,584 $ 38,227 Total stockholders' equity S 128,290 S 101,054 $ 84,127 $ 74,347 $ 59,194 2020 2019 2017 2016 (1) On January 1, 2019, we adopted Accounting Standards Update No. 2016-02, Leases (Topic 842). Prior period amounts have not been adjusted under the modified retrospective method. Table of Contents Item 6. Selected Financial Data You should read the following selected consolidated financial data in conjunction with Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included in Part II, Item 8. "Financial Statements and Supplementary Datu" of duis Anual Report ou Foum 10-K. The consolidated statements of income data for each of the years ended December 31, 2020, 2019, and 2018 and the consolidated balance sheets data as of December 31, 2020 and 2019 are derived from our audited consolidated financial statements included in Part II, Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K. The consolidated statements of income data for the years ended December 31, 2017 and 2016 and the consolidated balance sheets data as of December 31, 2018, 2017, and 2016 are derived from our audited consolidated financial statements, except as otherwise noted, that are not included in this Annual Report on Form 10-K. Our historical results are not necessarily indicative of our results in any future period. Year Ended December 31, 2020 2019 2018 2017 2016 (in millions, except per share data) Consolidated Statements of Income Data: Revenue $ 85,965 $ 70,697 s 55,838 S 40,653 $ 27,638 Total costs and expenses $ 53.294 S 46,711 $ 30,925 S 20,450 $ 15,211 Income from operations $ 32,671 S 23,986 $ 24,913 $ 20,203 $ 12,427 Income before provision for income taxes $ 33,180 S 24,812S 25,361 S 20,594 $ 12,518 Net income $ 29,146 S 18,485 S 22,112 s 15,934 $ 10,217 Net income attributable to Class A and Class B common stockholders $ 29,146 S 18,485 S 22,111 S 15,920 $ 10,188 Earnings per share attributable to Class A and Class B common stockholders: Basic $ 10.22 $ 6.48 $ 7.65 S 5.49 $ 3.56 Diluted 10.09 S 6.43S 7.57 S 5.39 $ 3.49 (1) Total costs and expenses include $6.54 billion, 54.84 billion, 54.15 billion, $3.72 billion, and $3.22 billion of share-based compensation for the years ended December 31, 2020, 2019, 2018, 2017, and 2016, respectively As of December 31, 2018 (in millions) Consolidated Balance Sheets Data: Cash, cash equivalents, and marketable securities S 61,954 S 54,855 $ 41,114 $ 41,711 $ 29,449 Working capital S 60,689 $ 51,172 $ 43,463 $ 44,803 $ 31,526 Property and equipment, net S 45,633 S 35,323 $ 24,683 $ 13,721 $ 8,591 Total assets S 159,316 S 133,376 $ 97,334 $ 84,524 $ 64,961 Operating Icase liabilities) s 10,654 S 10,324 $ $ - $ Total liabilities S 31,026 S 32,322 $ 13,207 $ 10,177 $ 5,767 Additional paid-in capital s 50,018 S 45,851 $ 42,906 $ 40,584 $ 38,227 Total stockholders' equity S 128,290 S 101,054 $ 84,127 $ 74,347 $ 59,194 2020 2019 2017 2016 (1) On January 1, 2019, we adopted Accounting Standards Update No. 2016-02, Leases (Topic 842). Prior period amounts have not been adjusted under the modified retrospective method