Answered step by step

Verified Expert Solution

Question

1 Approved Answer

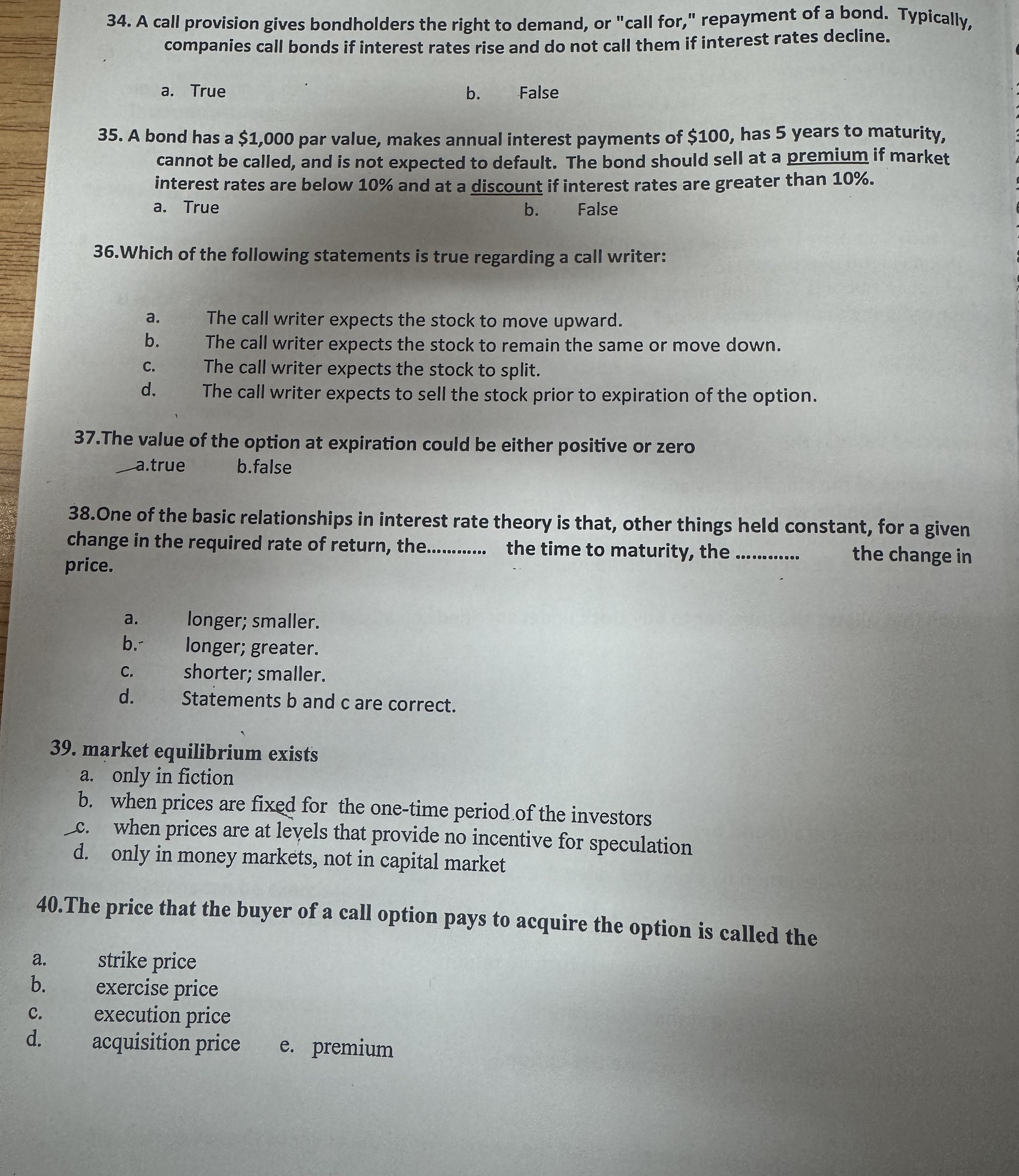

Chosse the correct answer: 1 - A call provision gives bondholders the right to demand, or call for, repayment of a bond. Typically, companies call

Chosse the correct answer: A call provision gives bondholders the right to demand, or "call for," repayment of a bond. Typically, companies call bonds if interest rates rise and do not call them if interest rates decline.

a True

b False

Abond has a $ par value, makes annual interest payments of $ has years to maturity, cannot be called, and is not expected to default. The bond should sell at a premium if market interest rates are below and at a discount if interest rates are greater than

a True

b False

Which of the following statements is true regarding a call writer:

a The call writer expects the stock to move upward.

b The call writer expects the stock to remain the same or move down.

c The call writer expects the stock to split.

d The call writer expects to sell the stock prior to expiration of the option.

The value of the option at expiration could be either positive or zero

atrue

bfalse

One of the basic relationships in interest rate theory is that, other things held constant, for a given change in the required rate of return, the. price. the time to maturity, the the change in

a longer; smaller.

b longer; greater.

c shorter; smaller.

d Statements b and c are correct.

Market equilibrium exists

a only in fiction

b when prices are fixed for the onetime period of the investors

c when prices are at levels that provide no incentive for speculation

d only in money markets, not in capital market

The price that the buyer of a call option pays to acquire the option is called the

a strike price

b exercise price

c execution price

d acquisition price

e premium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started