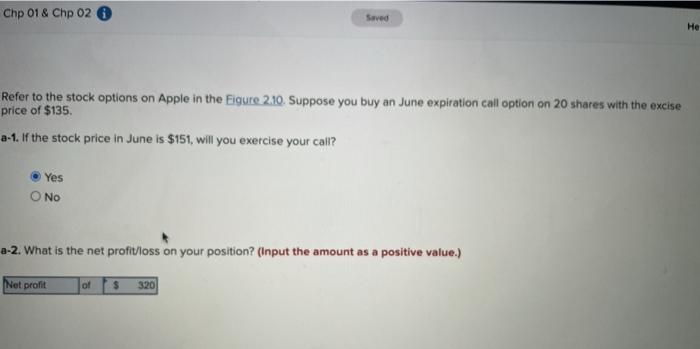

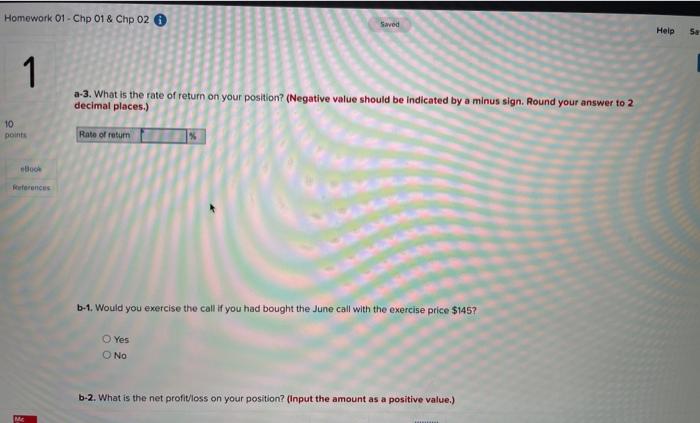

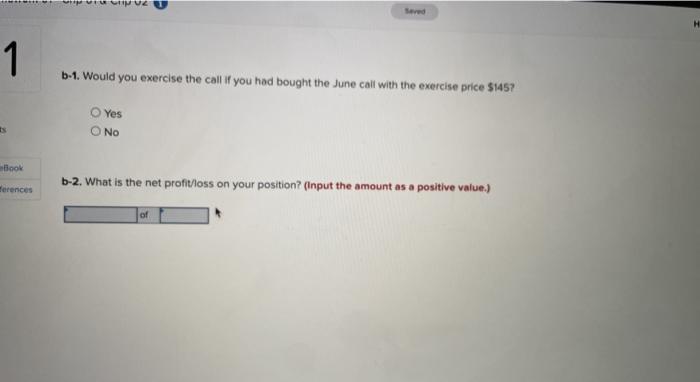

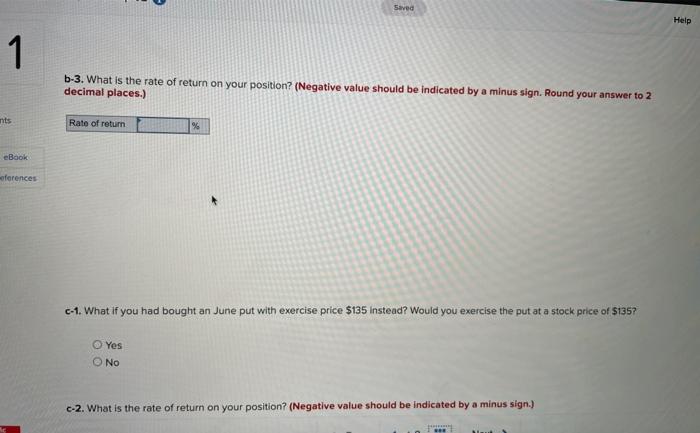

Chp 01 & Chp 02 Saved He Refer to the stock options on Apple in the Figure 2.10. Suppose you buy an June expiration call option on 20 shares with the excise price of $135. a-1. If the stock price in June is $151, will you exercise your call? Yes O No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit ol $ 320 Homework 01 - Chp 01 & Chp 02 Saved Help Se 1 a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) 10 points Rate of return References b.1. Would you exercise the call if you had bought the June call with the exercise price $145? Yes O No b-2. What is the net profit/loss on your position (input the amount as a positive value.) ME MU H 1 b-1. Would you exercise the call if you had bought the June call with the exercise price $1457 Yes O No book b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) erences of Saved Help 1 b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) nts Rate of return % eBook ferences C-1. What if you had bought an June put with exercise price $135 Instead? Would you exercise the put at a stock price of $135? Yes c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) mework 01 - Chp 01 & Chp 02 Saved 1 c-1. What if you had bought an June put with exercise price $135 instead? Would you exercise the put at a stock price of $135? nts Book Yes No References c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return % Saved mework 01- Chp 01 & Chp 02 1 c-1. What if you had bought an June put with exercise price $135 Instead? Would you exercise the put at a stock price of $135? eBook Yes No References c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return % Chp 01 & Chp 02 Saved He Refer to the stock options on Apple in the Figure 2.10. Suppose you buy an June expiration call option on 20 shares with the excise price of $135. a-1. If the stock price in June is $151, will you exercise your call? Yes O No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit ol $ 320 Homework 01 - Chp 01 & Chp 02 Saved Help Se 1 a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) 10 points Rate of return References b.1. Would you exercise the call if you had bought the June call with the exercise price $145? Yes O No b-2. What is the net profit/loss on your position (input the amount as a positive value.) ME MU H 1 b-1. Would you exercise the call if you had bought the June call with the exercise price $1457 Yes O No book b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) erences of Saved Help 1 b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) nts Rate of return % eBook ferences C-1. What if you had bought an June put with exercise price $135 Instead? Would you exercise the put at a stock price of $135? Yes c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) mework 01 - Chp 01 & Chp 02 Saved 1 c-1. What if you had bought an June put with exercise price $135 instead? Would you exercise the put at a stock price of $135? nts Book Yes No References c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return % Saved mework 01- Chp 01 & Chp 02 1 c-1. What if you had bought an June put with exercise price $135 Instead? Would you exercise the put at a stock price of $135? eBook Yes No References c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return %