Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chris and John are a recently married couple in Australia. They want to make use of the First Home Builders Grant (an incentive payment

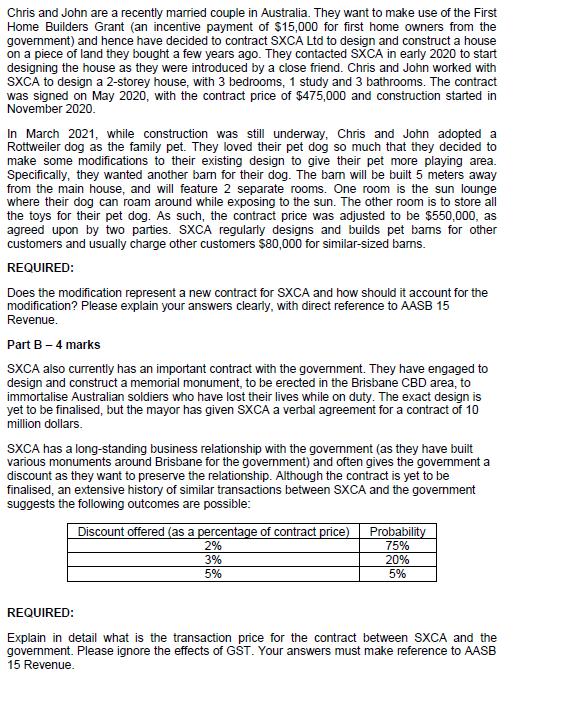

Chris and John are a recently married couple in Australia. They want to make use of the First Home Builders Grant (an incentive payment of $15,000 for first home owners from the government) and hence have decided to contract SXCA Ltd to design and construct a house on a piece of land they bought a few years ago. They contacted SXCA in early 2020 to start designing the house as they were introduced by a close friend. Chris and John worked with SXCA to design a 2-storey house, with 3 bedrooms, 1 study and 3 bathrooms. The contract was signed on May 2020, with the contract price of $475,000 and construction started in November 2020. In March 2021, while construction was still underway, Chris and John adopted a Rottweiler dog as the family pet. They loved their pet dog so much that they decided to make some modifications to their existing design to give their pet more playing area. Specifically, they wanted another barn for their dog. The barn will be built 5 meters away from the main house, and will feature 2 separate rooms. One room is the sun lounge where their dog can roam around while exposing to the sun. The other room is to store all the toys for their pet dog. As such, the contract price was adjusted to be $550,000, as agreed upon by two parties. SXCA regularly designs and builds pet bams for other customers and usually charge other customers $80,000 for similar-sized barms. REQUIRED: Does the modification represent a new contract for SXCA and how should it account for the modification? Please explain your answers clearly, with direct reference to AASB 15 Revenue. Part B - 4 marks SXCA also currently has an important contract with the govermment. They have engaged to design and construct a memorial monument, to be erected in the Brisbane CBD area, to immortalise Australian soldiers who have lost their lives while on duty. The exact design is yet to be finalised, but the mayor has given SXCA a verbal agreement for a contract of 10 million dollars. SXCA has a long-standing business relationship with the government (as they have built various monuments around Brisbane for the government) and often gives the government a discount as they want to preserve the relationship. Although the contract is yet to be finalised, an extensive history of similar transactions between SXCA and the govermment suggests the following outcomes are possible: Discount offered (as a percentage of contract price) 2% Probability 75% 3% 20% 5% 5% REQUIRED: Explain in detail what is the transaction price for the contract between SXCA and the government. Please ignore the effects of GST. Your answers must make reference to AASB 15 Revenue.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

REQUIREMENT A Yes the modification represents a new contract for SXCA and it should account for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started