Answered step by step

Verified Expert Solution

Question

1 Approved Answer

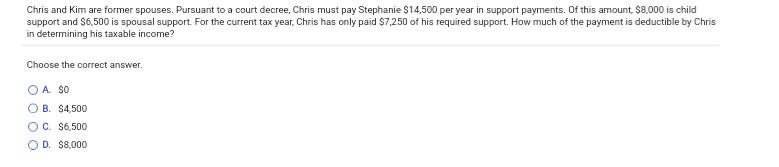

Chris and Kim are former spouses. Pursuant to a court decree, Chris must pay Stephanie $14,500 per year in support payments. Of this amount,

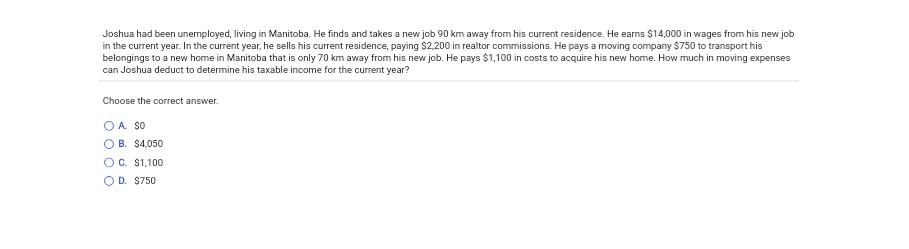

Chris and Kim are former spouses. Pursuant to a court decree, Chris must pay Stephanie $14,500 per year in support payments. Of this amount, $8,000 is child support and $6,500 is spousal support. For the current tax year, Chris has only paid $7,250 of his required support. How much of the payment is deductible by Chris in determining his taxable income? Choose the correct answer. O A SO OB. $4,500 OC. $6,500 OD. $8,000 Joshua had been unemployed, living in Manitoba. He finds and takes a new job 90 km away from his current residence. He earns $14,000 in wages from his new job in the current year. In the current year, he sells his current residence, paying $2,200 in realtor commissions. He pays a moving company $750 to transport his belongings to a new home in Manitoba that is only 70 km away from his new job. He pays $1,100 in costs to acquire his new home. How much in moving expenses can Joshua deduct to determine his taxable income for the current year? Choose the correct answer. O A SO B. $4,050 OC. $1,100 OD. $750

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Chris and Kim Quetion Total required support payments 14 500 Amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started