Chris (for Christine or Christopher) and Sam (for Samuel or Samantha) are a couple who live in Toronto and are somewhat recent graduates from George

Chris (for Christine or Christopher) and Sam (for Samuel or Samantha) are a couple who live in Toronto and are somewhat recent graduates from George Brown. They each earn $60,000 per year. And both are 25 years old. They have four financial goals: pay off a loan for a car, save for a down payment for a house, save for post-secondary education for their children they hope to have in three and five years from now, and save for a retirement.

They have bought a 2022 Ford EcoSport with no accessories. The cost was $25,599 but after fees and taxes the cost was $31,408.

below is the link address where you can find the car info..

https://shop.ford.ca/configure/ecosport/config/paint/Config%5B%7CFord%7CEcoSport%7C2022%7C1%7C1.%7C.S3F..PTY...VS-AE.%5D

Determine the loan payments, interest rate, and length of the loan. You may use the loan offered by Ford. Support your choice.

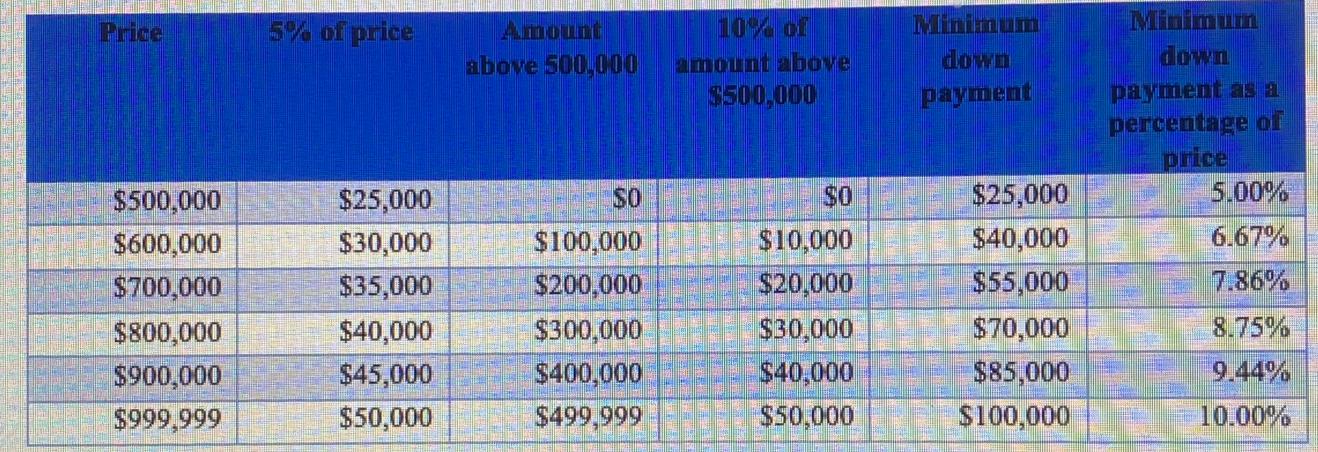

Chris and Sam would like to buy a townhouse that has a current price of about $650,000. An example that is currently for sale is 1059 -100 Mornelle Court, which is in the Morningside-Ellesmere area south of 401. Their timeframe for purchasing a house is about five years when they plan on having their second child. However, they know that prices for houses rise, even though there has been a temporary decline in prices. The Toronto Star reports that in January 2016 the average price of detached houses in Toronto was $1,061,789 and in December 2022 it was $1,627,635 (Kalinowski, 2023). While they are not buying a detached house, they decided to use that rate of increase to determine the likely cost of their future townhouse. They have also decided to save the minimum down payment. Table 1 shows the minimum down payment required for the cost of the house. You will see that the minimum down payment increases with the price of the house. Houses that cost $1 million or more require a 20% down payment. And houses that are not primary residences also require a 20% down payment regardless of their prices.

How much will they have to save each year to get the required down payment? The money that they save will be invested. You choose the rate of investment and the length of time they will be saving. Again, support your answer.

Parents can start saving for a child's post-secondary education from when they are born. It cannot be done earlier, even while the mother is pregnant. Chris and Sam would like to save enough so that each child has $50,000 by the time each is 18. Registered Education Savings Plans have a provision where the Government of Canada through the Canada Education Savings Grant (CESG) provides a grant of 20% of donations subject to a contribution limit of $2,500 per year per child. CESGs are not payable to accounts for children 18 years or older. Actually, there are qualification that must be met for CESG grants for children 16 and 17 years old, but assume, for purposes of this assignment, that the qualifications are met.

Determine how much must be saved each year for the account to hold $50,000 for each child. Like the amounts saved for down payment, the money will be invested.

Determine a rate of return on the investments in the RESP and any other account they use and support your answer.

Chris and Sam plan on retiring at age 65. They assume that their wages will rise 2% per year, which the inflation rate for which the Bank of Canada aims. When they retire, they would like to receive 70% of their wages from Canada Pension Plan (CPP), Old Age Security (OAS), and their own savings. In 2022 the average CPP monthly payment was $727.61, and the maximum was $1,253.59. The maximum OAS benefit was $666.83 for those aged 65 to 74 and $733.51 for those aged 75 and above. Because the CPP benefits will improve over the next years, we will assume that they will receive $1,500 a month in today's money. And they should receive the maximum OAS benefit as they will have resided in Canada for at least 40 years between the ages of 18 and 65. CPP and OAS benefits increase at the rate of inflation, for this assignment, 2% annually. Like most Canadians, neither Chris nor Sam are members of an employer- or union-run pension plan. Determine how much they need to save each year to fund a pension of 70% of their future income. In more detail, when Chris and Sam turn 65, the sum of CPP and OAS benefits plus the withdrawal from their savings should equal 70% of their earnings when they turn 65. And while the CPP and OAS benefits will increase over time, the withdrawal from their savings will remain the same. Chris and Sam have assumed that they will live for only 20 years beyond retirement, so the withdrawals should assume that the annuity will end in 20 years

Conclusion

Based on your calculations, can they afford the savings that you propose? Why or why not?

Price $500,000 $600,000 $700,000 $800,000 $900,000 $999,999 5% of price $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 Amount above 500,000 SO $100,000 $200,000 $300,000 $400,000 $499,999 10% of amount above $500,000 $10,000 $20,000 $30,000 $40,000 $50,000 Minimum down payment $25,000 $40,000 $55,000 $70,000 $85,000 $100,000 Minimum down payment as a percentage of price 5.00% 6.67% 7.86% 8.75% 9.44% 10.00%

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the loan payments interest rate and length of the loan for the car we can use the information provided The cost of the car after fees and taxes is 31408 Lets assume they make a d...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started