Answered step by step

Verified Expert Solution

Question

1 Approved Answer

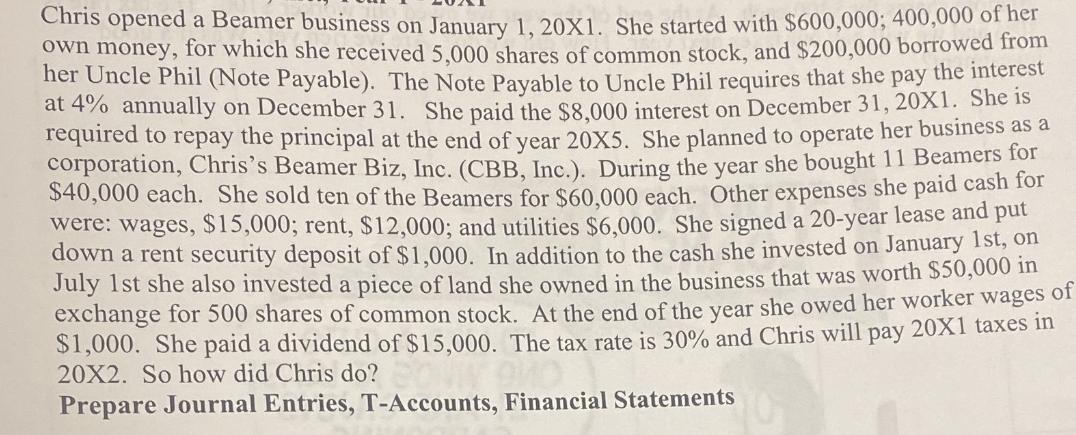

Chris opened a Beamer business on January 1, 20X1. She started with $600,000; 400,000 of her own money, for which she received 5,000 shares

Chris opened a Beamer business on January 1, 20X1. She started with $600,000; 400,000 of her own money, for which she received 5,000 shares of common stock, and $200,000 borrowed from her Uncle Phil (Note Payable). The Note Payable to Uncle Phil requires that she pay the interest at 4% annually on December 31. She paid the $8,000 interest on December 31, 20X1. She is required to repay the principal at the end of year 20X5. She planned to operate her business as a corporation, Chris's Beamer Biz, Inc. (CBB, Inc.). During the year she bought 11 Beamers for $40,000 each. She sold ten of the Beamers for $60,000 each. Other expenses she paid cash for were: wages, $15,000; rent, $12,000; and utilities $6,000. She signed a 20-year lease and put down a rent security deposit of $1,000. In addition to the cash she invested on January 1st, on July 1st she also invested a piece of land she owned in the business that was worth $50,000 in exchange for 500 shares of common stock. At the end of the year she owed her worker wages of $1,000. She paid a dividend of $15,000. The tax rate is 30% and Chris will pay 20X1 taxes in 20X2. So how did Chris do? Prepare Journal Entries, T-Accounts, Financial Statements

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started