Question

Chris Paul inherited a plot of land. He can either convert it to a parking lot or build a gas station on it. The

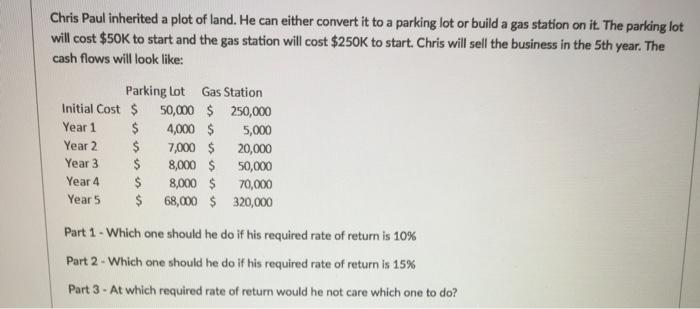

Chris Paul inherited a plot of land. He can either convert it to a parking lot or build a gas station on it. The parking lot will cost $50K to start and the gas station will cost $250K to start. Chris will sell the business in the 5th year. The cash flows will look like: Parking Lot Initial Cost $ 50,000 Year 1 $ Year 2 Year 3 Year 4 Year 5 Gas Station $250,000 $ 4,000 $ 5,000 7,000 $ 20,000 $ 8,000 $50,000 $ 8,000 $ 70,000 $ 68,000 $ 320,000 Part 1 - Which one should he do if his required rate of return is 10% Part 2 - Which one should he do if his required rate of return is 15% Part 3-At which required rate of return would he not care which one to do?

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Question NPV OF PARKING LOT YEAR CASH FLOW DISCOUNTING FACTOR DISCOUNTED CASH FLOW 0 50000 1000 5000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Texts and Cases

Authors: Robert Anthony, David Hawkins, Kenneth Merchant

13th edition

1259097129, 978-0073379593, 007337959X, 978-1259097126

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App