Answered step by step

Verified Expert Solution

Question

1 Approved Answer

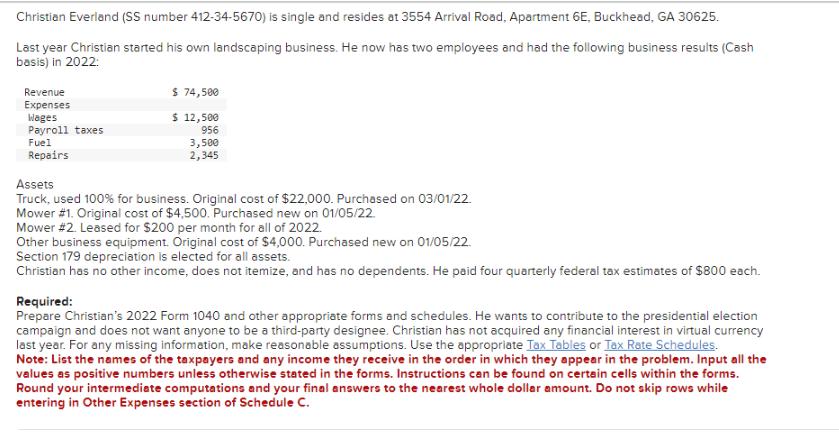

Christian Everland (SS number 412-34-5670) is single and resides at 3554 Arrival Road, Apartment 6E, Buckhead, GA 30625. Last year Christian started his own

Christian Everland (SS number 412-34-5670) is single and resides at 3554 Arrival Road, Apartment 6E, Buckhead, GA 30625. Last year Christian started his own landscaping business. He now has two employees and had the following business results (Cash basis) in 2022: Revenue $ 74,500 Expenses Wages $ 12,500 Payroll taxes 956 3,500 2,345 Fuel Repairs Assets Truck, used 100% for business. Original cost of $22,000. Purchased on 03/01/22 Mower #1. Original cost of $4,500. Purchased new on 01/05/22. Mower #2. Leased for $200 per month for all of 2022. Other business equipment. Original cost of $4,000. Purchased new on 01/05/22. Section 179 depreciation is elected for all assets. Christian has no other income, does not itemize, and has no dependents. He paid four quarterly federal tax estimates of $800 each. Required: Prepare Christian's 2022 Form 1040 and other appropriate forms and schedules. He wants to contribute to the presidential election campaign and does not want anyone to be a third-party designee. Christian has not acquired any financial interest in virtual currency last year. For any missing information, make reasonable assumptions. Use the appropriate Tax Tables or Tax Rate Schedules. Note: List the names of the taxpayers and any income they receive in the order in which they appear in the problem. Input all the values as positive numbers unless otherwise stated in the forms. Instructions can be found on certain cells within the forms. Round your intermediate computations and your final answers to the nearest whole dollar amount. Do not skip rows while entering in Other Expenses section of Schedule C.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started