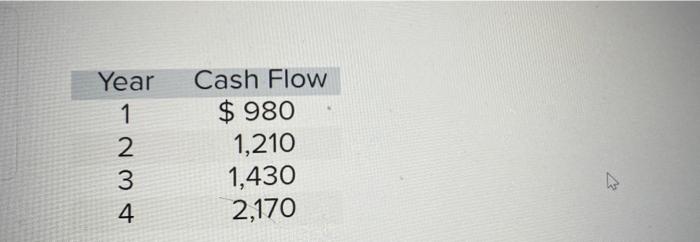

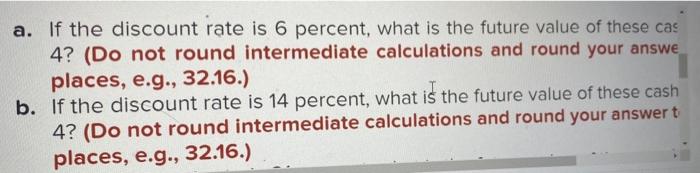

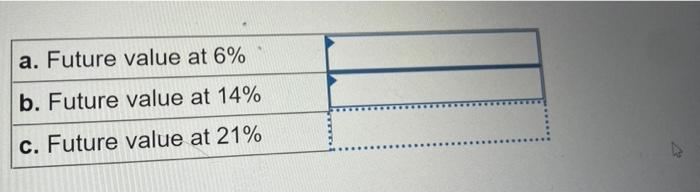

Christie, Incorporated, has identified an investment project with the follow orated, has identified an investment project with the following cash flows. Year1234CashFlow$9801,2101,4302,170 a. If the discount rate is 6 percent, what is the future value of these cas 4? (Do not round intermediate calculations and round your answe places, e.g., 32.16.) b. If the discount rate is 14 percent, what is the future value of these cash 4 ? (Do not round intermediate calculations and round your answer t places, e.g., 32.16.) unt rate is 6 percent, what is the future value of these cash flows in Year round intermediate calculations and round your answer to 2 decimal. , 32.16.) int rate is 14 percent, what is the future value of these cash flows in Year round intermediate calculations and round your answer to 2 decimal , 32.16.) c. If the discount rate is 21 percent, what is the future value of these cash 4? (Do not round intermediate calculations and round your answer t places, e.g., 32.16.) is 21 percent, what is the future value of these cash flows in Year intermediate calculations and round your answer to 2 decimal I a. Future value at 6% b. Future value at 14% c. Future value at 21% Christie, Incorporated, has identified an investment project with the follow orated, has identified an investment project with the following cash flows. Year1234CashFlow$9801,2101,4302,170 a. If the discount rate is 6 percent, what is the future value of these cas 4? (Do not round intermediate calculations and round your answe places, e.g., 32.16.) b. If the discount rate is 14 percent, what is the future value of these cash 4 ? (Do not round intermediate calculations and round your answer t places, e.g., 32.16.) unt rate is 6 percent, what is the future value of these cash flows in Year round intermediate calculations and round your answer to 2 decimal. , 32.16.) int rate is 14 percent, what is the future value of these cash flows in Year round intermediate calculations and round your answer to 2 decimal , 32.16.) c. If the discount rate is 21 percent, what is the future value of these cash 4? (Do not round intermediate calculations and round your answer t places, e.g., 32.16.) is 21 percent, what is the future value of these cash flows in Year intermediate calculations and round your answer to 2 decimal I a. Future value at 6% b. Future value at 14% c. Future value at 21%