Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Christine, a 28-year-old fashion consultant, advises female CPAs on stylish business attire. She generates a net profit of $50,000 per year from her business. She

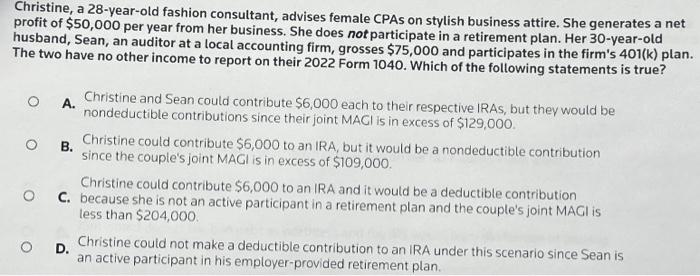

Christine, a 28-year-old fashion consultant, advises female CPAs on stylish business attire. She generates a net profit of $50,000 per year from her business. She does not participate in a retirement plan. Her 30-year-old husband, Sean, an auditor at a local accounting firm, grosses $75,000 and participates in the firm's 401(k) plan. The two have no other income to report on their 2022 Form 1040. Which of the following statements is true? A.Christine and Sean could contribute $6,000 each to their respective IRAs, but they would be nondeductible contributions since their joint MAGI is in excess of $129,000. B. Christine could contribute $6,000 to an IRA, but it would be a nondeductible contribution since the couple's joint MAGI is in excess of $109,000. Christine could contribute $6,000 to an IRA and it would be a deductible contribution C. because she is not an active participant in a retirement plan and the couple's joint MAGI is less than $204,000. D.Christine could not make a deductible contribution to an IRA under this scenario since Sean is an active participant in his employer-provided retirement plan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started