Question

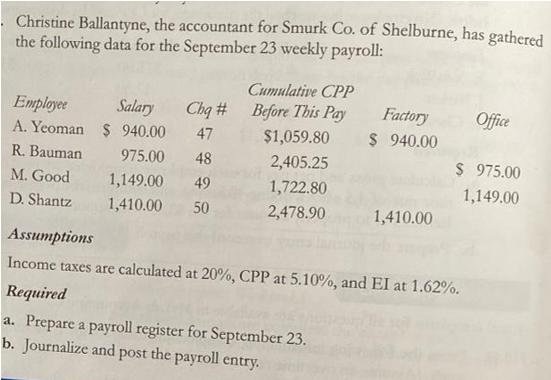

Christine Ballantyne, the accountant for Smurk Co. of Shelburne, has gathered the following data for the September 23 weekly payroll: Cumulative CPP Chq #

Christine Ballantyne, the accountant for Smurk Co. of Shelburne, has gathered the following data for the September 23 weekly payroll: Cumulative CPP Chq # Before This Pay $1,059.80 Factory $ 940.00 Office Employee Salary A. Yeoman $ 940.00 47 R. Bauman 975.00 48 2,405.25 $ 975.00 M. Good 1,149.00 49 1,722.80 1,149.00 D. Shantz 1,410.00 50 2,478.90 1,410.00 Assumptions Income taxes are calculated at 20%, CPP at 5.10%, and EI at 1.62%. Required a. Prepare a payroll register for September 23. b. Journalize and post the payroll entry.

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

CPP BALANCE REGISTER Employee CPP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Transport Operations

Authors: Allen Stuart

2nd Edition

978-0470115398, 0470115394

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App