Christine Erickson is the payroll accountant for Multi Winds Energy of Lincoln, Nebraska. The employees of Multi Winds Energy are paid biweekly. An employee, Linda Larson, comes to her on September 9 and requests a pay advance of $1,140, which she will pay back in equal parts on the September 24 and October 22 paychecks. Linda is single with no dependents and is paid $59,500 per year. She contributes 5 percent of her pay to a 401(k) plan and has $250 per paycheck deducted for a court-ordered garnishment. Assume that no pre-tax deductions exist for any employee and box 2 is not checked.

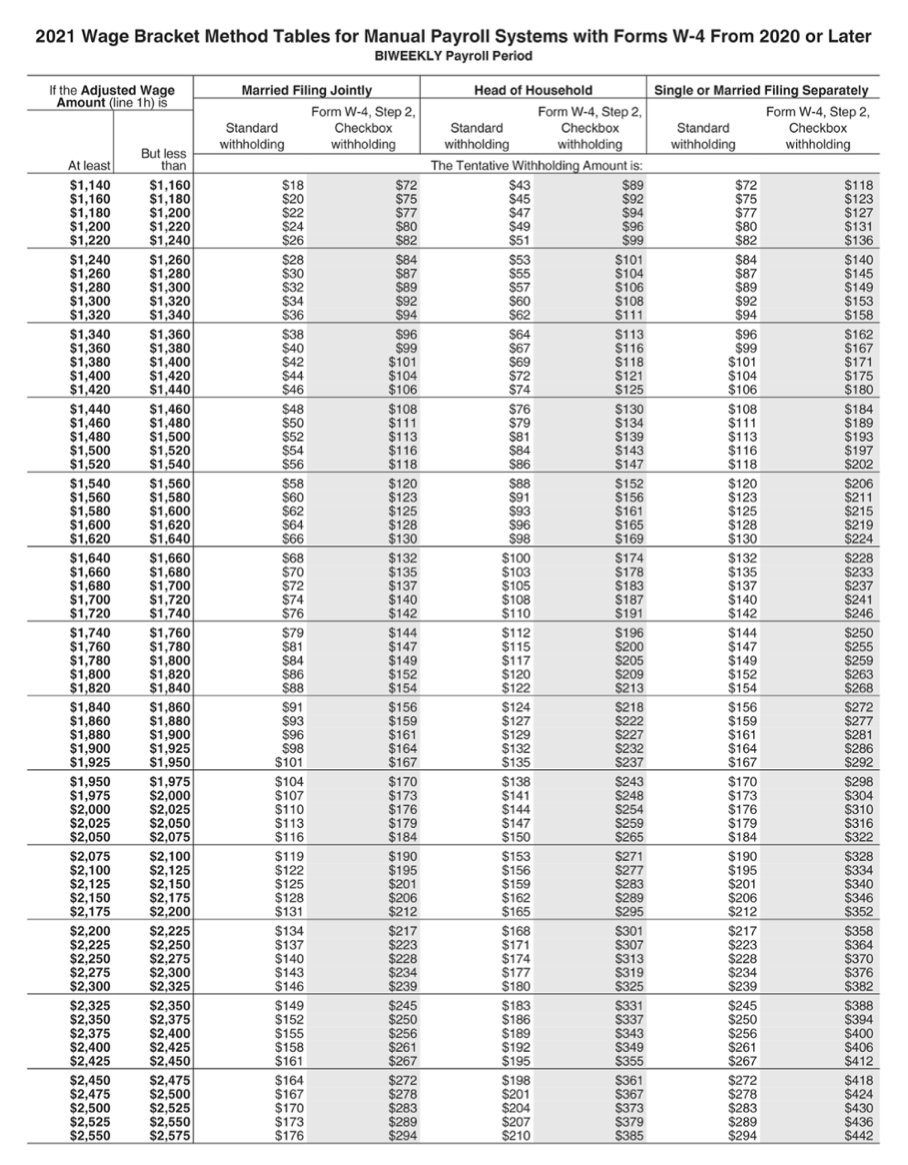

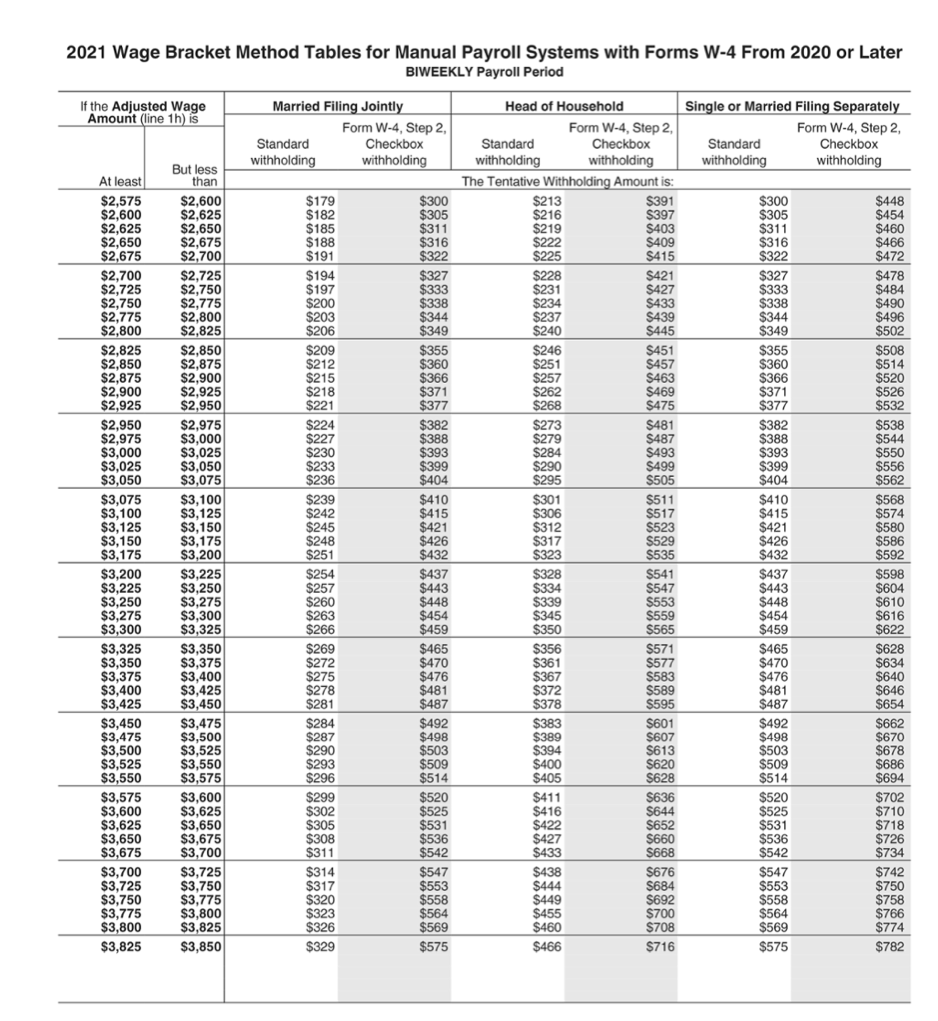

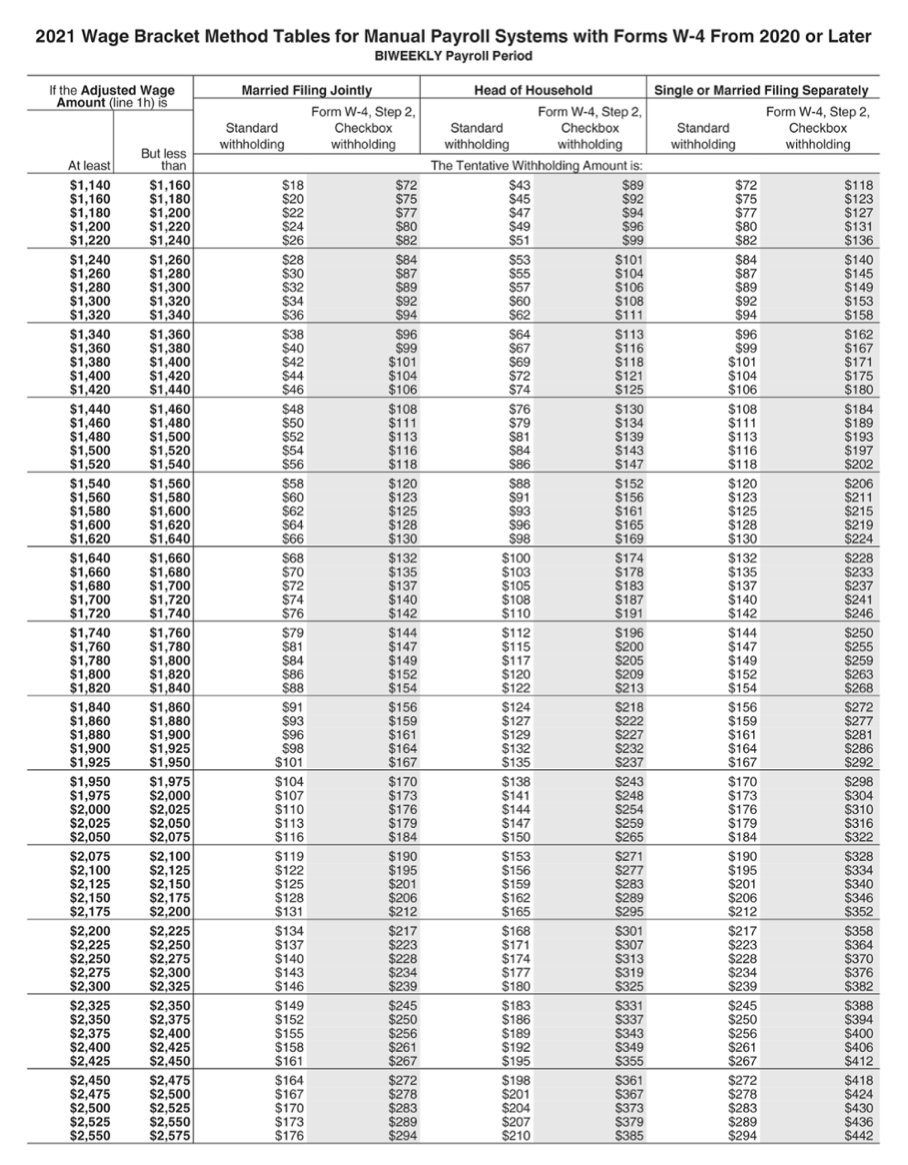

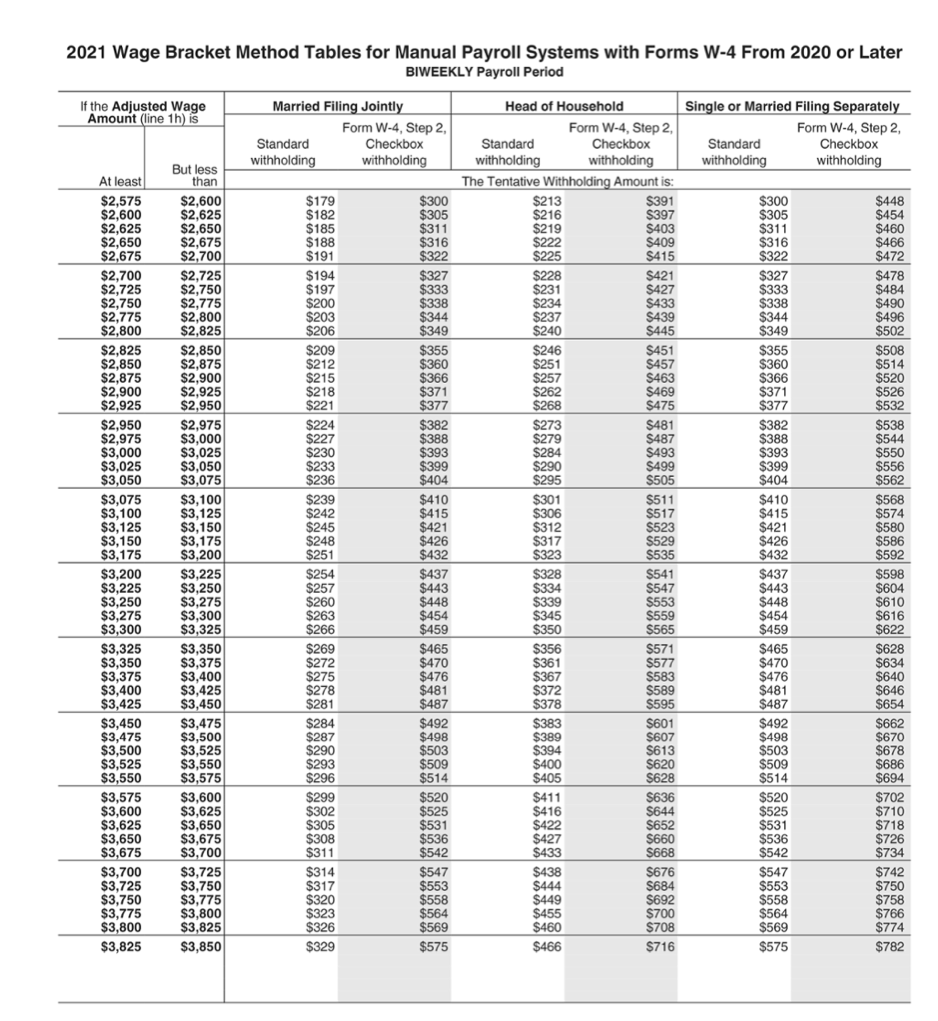

Required: Compute her net pay for her September 24 paycheck. Her state income tax rate is 6.84 percent. Use the wage-bracket tables in Appendix C to determine the federal income tax withholding amount. You do not need to complete the number of hours. (Round your intermediate calculations and final answer to 2 decimal places.)

NET PAY?

NET PAY?

2021 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Form W-4, Step 2 Standard Checkbox withholding withholding Single or Married Filing Separately Form W-4, Step 2 Standard Checkbox withholding withholding At least $1,140 $18 $1,160 $1,180 $1,200 $1,220 $1,240 $1,260 $1,280 $1,300 $1,320 $1,340 $1,360 $1,380 $1,400 $1,420 $1,440 $1,460 $1,480 $1,500 $1,520 $1,540 $1,560 $1,580 $1,600 $1,620 $1,640 $1,660 $1,680 $1,700 $1,720 $1,740 $1,760 $1,780 $1,800 $1,820 $1,840 $1,860 $1,880 $1,900 $1,925 $1,950 $1,975 $2,000 $2,025 $2,050 $2.075 $2,100 $2,125 $2,150 $2,175 $2,200 $2,225 $2,250 $2,275 $2,300 $2,325 $2,350 $2,375 $2,400 $2,425 $2,450 $2,475 $2,500 $2,525 $2,550 But less than $1,160 $1,180 $1,200 $1,220 $1,240 $1,260 $1,280 $1,300 $1,320 $1,340 $1,360 $1,380 $1,400 $1,420 $1,440 $1,460 $1,480 $1,500 $1,520 $1,540 $1,560 $1,580 $1,600 $1,620 $1,640 $1,660 $1,680 $1,700 $1,720 $1,740 $1,760 $1,780 $1,800 $1,820 $1,840 $1,860 $1.880 $1,900 $1,925 $1,950 $1,975 $2,000 $2,025 $2.050 $2,075 $2,100 $2,125 $2,150 $2,175 $2,200 $2,225 $2,250 $2,275 $2,300 $2,325 $2,350 $2,375 $2,400 $2,425 $2,450 $2,475 $2,500 $2,525 $2,550 $2,575 $20 $22 $24 $26 $28 $30 $32 $34 $36 $ $38 $40 $42 $44 $46 $48 $50 $52 $ $54 $56 $58 $60 $62 $64 $66 $68 $70 $72 $74 $76 $79 $81 $84 $ $86 $88 $91 $ $93 $96 $98 $101 $165 $72 $75 $77 $80 $82 $84 $87 $89 $ $92 $94 $ $96 $99 $101 $104 $106 $108 $111 $113 $116 $118 $120 $123 $125 $128 $130 $132 $135 $137 $140 $142 $144 $147 $149 $152 $154 $156 $159 $161 $164 $167 $170 $173 $176 $179 $184 $190 $195 $201 $206 $212 $217 $223 $228 $234 $239 $245 $250 $256 $261 $267 $272 $278 $283 $289 $294 Head of Household Form W-4, Step 2 Standard Checkbox withholding withholding The Tentative Withholding Amount is: $43 $89 $45 $92 $47 $94 $49 $96 $51 $99 $ $53 $101 $55 $104 $57 $106 $60 $108 $62 $111 $64 $113 $ $67 $116 $69 $118 $72 $121 $74 $125 $76 $130 $79 $134 $81 $139 $84 $143 $86 $147 $88 $152 $91 $156 $93 $161 $96 $98 $169 $100 $174 $103 $178 $105 $183 $108 $ $187 $110 $191 $112 $196 $115 $200 $117 $205 $120 $209 $122 $213 $124 $218 $127 $222 $129 $227 $132 $232 $135 S237 $138 $243 $141 $248 $144 $254 $147 $259 $150 $265 $153 $271 $156 $277 $159 $283 $162 $289 $165 $295 $168 $301 $ $307 $174 $313 $177 $319 $180 $325 $183 $331 $186 $337 $189 $343 $192 $349 $195 $355 $198 $361 $201 $367 $204 $373 $207 $379 $210 $385 $72 $75 $77 $80 $82 $84 $87 $89 $92 $94 $96 $99 $101 $104 $106 $108 $111 $113 $116 $118 $120 $123 $125 $128 $130 $132 $135 $137 $140 $142 $144 $147 $149 $152 $154 $156 $159 $161 $164 $167 $118 $123 $127 $131 $136 $140 $145 $149 $153 $158 $162 $167 $171 $175 $180 $184 $189 $193 $197 $202 $206 $211 $215 $219 $224 $228 $233 $237 $241 $246 $250 $255 $259 $263 $268 $272 $277 $281 $286 $292 $298 $304 $310 $316 $322 $328 $334 $340 $346 $352 $358 $364 $370 $376 $382 $388 $394 $400 $406 $412 $418 $424 $430 $436 $442 $104 $170 $171 $107 $110 $113 $116 $119 $122 $125 $128 $131 $134 $137 $140 $143 $146 $149 $152 $155 $158 $161 $164 $167 $170 $173 $176 $173 $176 $179 $184 $190 $195 $201 $206 $212 $217 $223 $228 $234 $239 $245 $250 $256 $261 $267 $272 $278 $283 $289 $294 2021 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Form W-4, Step 2 Standard Checkbox withholding withholding Single or Married Filing Separately Form W-4, Step 2 Standard Checkbox withholding withholding But less $391 $300 $ $305 $311 $316 $322 $327 $448 $454 $460 $466 $472 $478 $484 $490 $496 $502 $508 $514 $333 $520 At least $2,575 $2,600 $2,625 $2,650 $2,675 $2,700 $2,725 $2,750 $2,775 $2,800 $2,825 $2,850 $2,875 $2,900 $2,925 $2,950 $2,975 $3,000 $3,025 $3,050 $3,075 $3,100 $3,125 $3,150 $3,175 $3,200 $3,225 $3,250 $3,275 $3,300 $3,325 $3,350 $3,375 $3,400 $3,425 $3,450 $3,475 $3,500 $3,525 $3,550 $3,575 $3,600 $3,625 $3,650 $3,675 $3,700 $3,725 $3,750 $3,775 $3,800 $3,825 than $2,600 $2,625 $2,650 $2,675 $2,700 $2,725 $2,750 $2,775 $2,800 $2,825 $2,850 $2,875 $2,900 $2,925 $2,950 $2,975 $3,000 $3,025 $3,050 $3,075 $3,100 $3,125 $3,150 $3,175 $3,200 $3,225 $3,250 $3,275 $3,300 $3,325 $3,350 $3,375 $3,400 $3,425 $3,450 $3,475 $3,500 $3,525 $3,550 $3,575 $3,600 $3,625 $3,650 $3,675 $3,700 $3,725 $3,750 $3.775 $3,800 $3,825 $3,850 $179 $182 $185 $188 $191 $194 $197 $200 $203 $ $206 $209 $212 $215 $218 $221 $224 $227 $230 $233 $236 $239 $242 $245 $248 $251 $254 $257 $260 $263 $266 $269 $272 $275 $278 $281 $284 $287 $290 $293 $296 $299 $302 $305 $308 $311 $314 $317 $320 $323 $326 $329 $300 $305 $311 $316 $322 $327 $333 $338 $344 $349 $355 $360 $366 $371 $377 $382 $388 $393 $399 $404 $410 $415 $421 $426 $432 $437 $443 $448 $454 $459 $465 $470 $476 $481 $487 $492 $498 $503 $509 $514 $520 $525 $531 $536 $542 $547 $553 $558 $564 $569 $575 Head of Household Form W-4, Step 2 Standard Checkbox withholding withholding The Tentative Withholding Amount is: $213 $216 $397 $219 $403 $222 $409 $225 $415 $228 $421 $231 $427 $234 $433 $237 $439 $240 $445 $246 $451 $251 $457 $257 $463 $262 $469 $268 $475 $273 $481 $279 $487 $284 $493 $290 $499 $295 $505 $301 $511 $306 $517 $312 $523 $317 $529 $323 $535 $328 $541 $334 $547 $339 $553 $345 $559 $350 $565 $356 $571 $361 $577 $367 $583 $372 $589 $378 $595 $383 $601 $389 $607 $394 $613 $400 $620 $405 $628 $411 $636 $416 $644 $422 $652 $427 $660 $433 $668 $438 $676 $444 $684 $449 $692 $455 $700 $708 $466 $716 $338 $344 $349 $355 $360 $366 $371 $377 $382 $388 $393 $399 $404 $410 $415 $421 $426 $432 $437 $443 $448 $454 $ $459 $465 $470 $476 $481 $487 $492 $498 $503 $509 $514 $520 $525 $531 $536 $542 $547 $553 $558 $564 $569 $575 $526 $532 $538 $544 $550 $556 $562 $568 $574 $580 $586 $592 $598 $604 $610 $616 $622 $628 $634 $640 $646 $654 $662 $670 $678 $686 $694 $702 $710 $718 $726 $734 $742 $750 $758 $766 $774 $782 $460

NET PAY?

NET PAY?