Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Christopher had the following charitable contributions during 2022. Christopher's AGI is $125,000. During the current year, Leo spends approximately 90 hours of his time

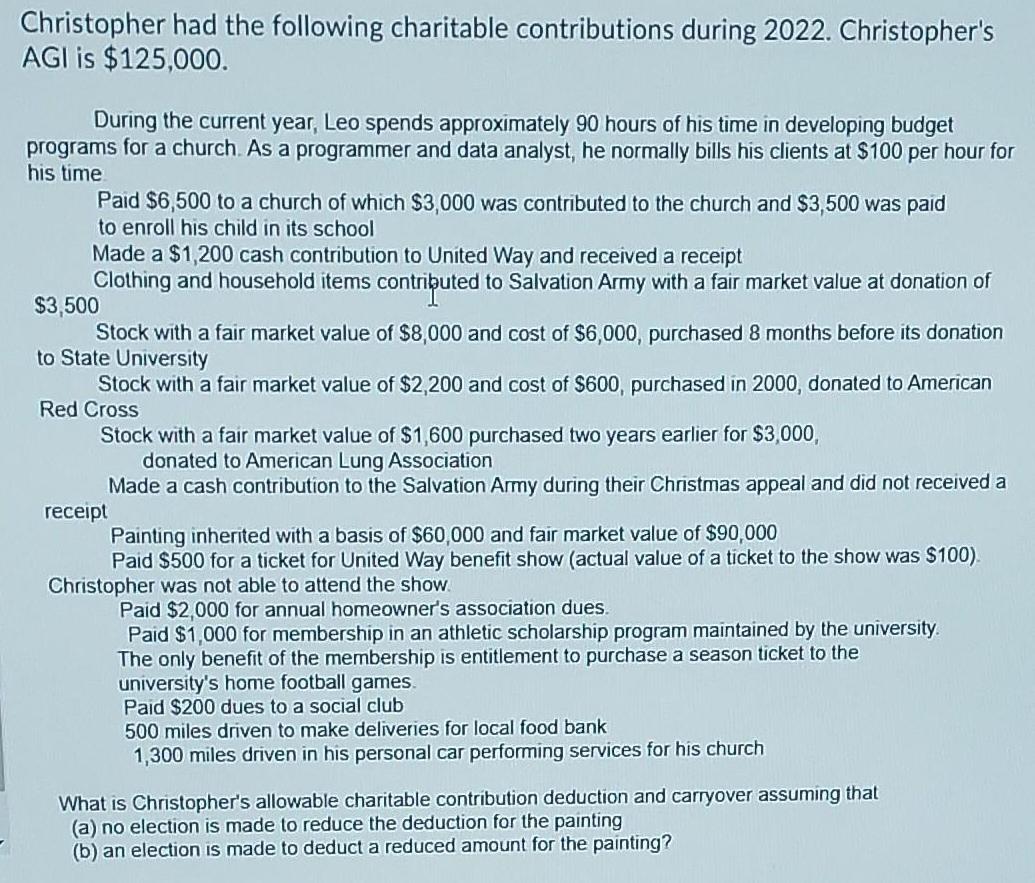

Christopher had the following charitable contributions during 2022. Christopher's AGI is $125,000. During the current year, Leo spends approximately 90 hours of his time in developing budget programs for a church. As a programmer and data analyst, he normally bills his clients at $100 per hour for his time. Paid $6,500 to a church of which $3,000 was contributed to the church and $3,500 was paid to enroll his child in its school Made a $1,200 cash contribution to United Way and received a receipt Clothing and household items contributed to Salvation Army with a fair market value at donation of $3,500 Stock with a fair market value of $8,000 and cost of $6,000, purchased 8 months before its donation to State University Stock with a fair market value of $2,200 and cost of $600, purchased in 2000, donated to American Red Cross Stock with a fair market value of $1,600 purchased two years earlier for $3,000, donated to American Lung Association Made a cash contribution to the Salvation Army during their Christmas appeal and did not received a receipt Painting inherited with a basis of $60,000 and fair market value of $90,000 Paid $500 for a ticket for United Way benefit show (actual value of a ticket to the show was $100). Christopher was not able to attend the show. Paid $2,000 for annual homeowner's association dues. Paid $1,000 for membership in an athletic scholarship program maintained by the university. The only benefit of the membership is entitlement to purchase a season ticket to the university's home football games. Paid $200 dues to a social club 500 miles driven to make deliveries for local food bank 1,300 miles driven in his personal car performing services for his church What is Christopher's allowable charitable contribution deduction and carryover assuming that (a) no election is made to reduce the deduction for the painting A (b) an election is made to deduct a reduced amount for the painting? BONUS: What is the maximum deferral amount to a 401(k) plan in 2022 for a taxpayer under age 50? Age 50 or older?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

PART a The allowable charitable contribution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started