Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Christopher Smith owns 25 shares of common stock of Corporation X. Mary Wilson owns 75 shares of common stock of Corporation X. Corporation X

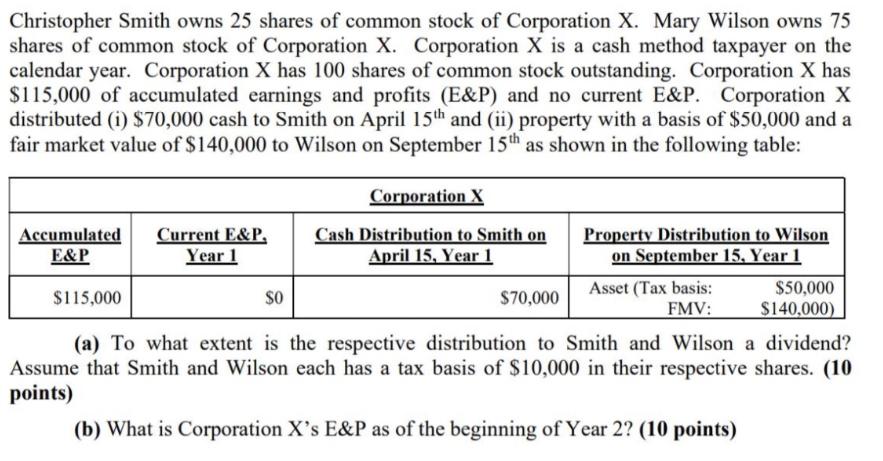

Christopher Smith owns 25 shares of common stock of Corporation X. Mary Wilson owns 75 shares of common stock of Corporation X. Corporation X is a cash method taxpayer on the calendar year. Corporation X has 100 shares of common stock outstanding. Corporation X has $115,000 of accumulated earnings and profits (E&P) and no current E&P. Corporation X distributed (i) $70,000 cash to Smith on April 15th and (ii) property with a basis of $50,000 and a fair market value of $140,000 to Wilson on September 15th as shown in the following table: Accumulated E&P Current E&P. Year 1 SO Corporation X Cash Distribution to Smith on April 15, Year 1 $70,000 Property Distribution to Wilson on September 15, Year 1 Asset (Tax basis: FMV: $50,000 $140,000) $115,000 (a) To what extent is the respective distribution to Smith and Wilson a dividend? Assume that Smith and Wilson each has a tax basis of $10,000 in their respective shares. (10 points) (b) What is Corporation X's E&P as of the beginning of Year 2? (10 points)

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The information provided in the scenario allows us to analyze the extent to which the distributions to Smith and Wilson can be considered dividends Di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started