Answered step by step

Verified Expert Solution

Question

1 Approved Answer

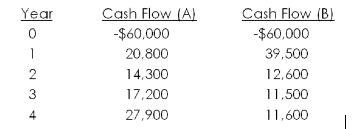

Chstnut Tr Frms hs idntifid th following two mutully xclusiv projcts: Ovr wht rng of discount rts would you choos Projct A? A. 8.28 prcnt

- Chstnut Tr Frms hs idntifid th following two mutully xclusiv projcts:

Ovr wht rng of discount rts would you choos Projct A? A. 8.28 prcnt or lss B. 8.28 prcnt or mor C. 9.33 prcnt or mor D. 9.55 prcnt or lss E. 9.55 prcnt or mor

Ovr wht rng of discount rts would you choos Projct A? A. 8.28 prcnt or lss B. 8.28 prcnt or mor C. 9.33 prcnt or mor D. 9.55 prcnt or lss E. 9.55 prcnt or mor

- You'r trying to dtrmin whthr or not to xpnd your businss by building nw mnufcturing plnt. Th plnt hs n instlltion cost of $26 million, which will b dprcitd stright-lin to zro ovr its thr-yr lif. If th plnt hs projctd nt incom of $2,348,000, $2,680,000, nd $1,920,000 ovr ths thr yrs, wht is th projct's vrg ccounting rturn (AAR)? A. 11.69 prcnt B. 14.14 prcnt C. 15.08 prcnt D. 17.82 prcnt E. 19.21 prcnt

- Th nt prsnt vlu of projct's csh inflows is $8,216 t 14 prcnt discount rt. Th profitbility indx is 1.03 nd th firm's tx rt is 34 prcnt. Wht is th initil cost of th projct?

- Th Blu Goos is considring projct with n initil cost of $42,700. Th projct will produc csh inflows of $8,000 yr for th first two yrs nd $12,000 yr for th following thr yrs. Wht is th pybck priod?

- Curtis is considring projct with csh inflows of $918, $867, $528, nd $310 ovr th nxt four yrs, rspctivly. Th rlvnt discount rt is 11 prcnt. Wht is th nt prsnt vlu of this projct if it th strt up cost is $2,100?

- Mry hs just bn skd to nlyz n invstmnt to dtrmin if it is ccptbl. Unfortuntly, sh is not bing givn sufficint tim to nlyz th projct using vrious mthods. Sh must slct on mthod of nlysis nd provid n nswr bsd solly on tht mthod. Which mthod do you suggst sh us in this sitution? A. Intrnl rt of rturn B. Pybck C. Avrg ccounting rt of rturn D. Nt prsnt vlu E. Profitbility indx

- If projct with convntionl csh flows hs profitbility indx of 1.0, th projct will: A. nvr py bck. B. hv ngtiv nt prsnt vlu. C. hv ngtiv intrnl rt of rturn. D. produc mor csh inflows thn outflows in tody's dollrs. E. hv n intrnl rt of rturn tht quls th rquird rturn.

- Which on of th following nlyticl mthods is bsd on nt incom? A. Profitbility indx B. Intrnl rt of rturn C. Avrg ccounting rturn D. Modifid intrnl rt of rturn E. Pybck

I. Stwrt's is considring nw projct. Th compny hs dbt-quity rtio of 0.72. Th compny's cost of quity is 15.1 prcnt, nd th ftrtx cost of dbt is 7.2 prcnt. Th firm fls tht th projct is riskir thn th compny s whol nd tht it should us n djustmnt fctor of +2 prcnt. Wht is th WACC it should us for th projct?

Year 0 1 1 Cash Flow (A) -$60,000 20,800 14,300 17,200 27.900 Cash Flow (B) -$60,000 39,500 12,600 11,500 11,600 2 3 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started