Chuck, a single taxpayer, earns $46,500 in taxable income and $13,600 in interest from an investment in City of Heflin bonds. (Use the U.S

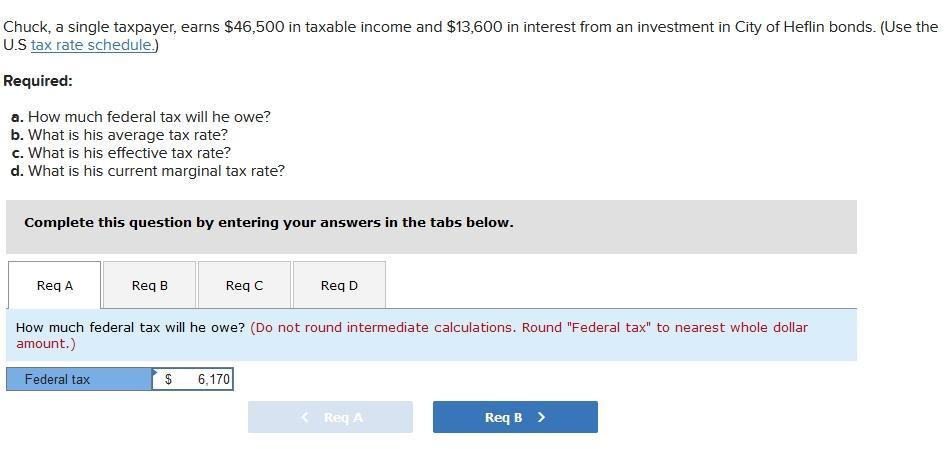

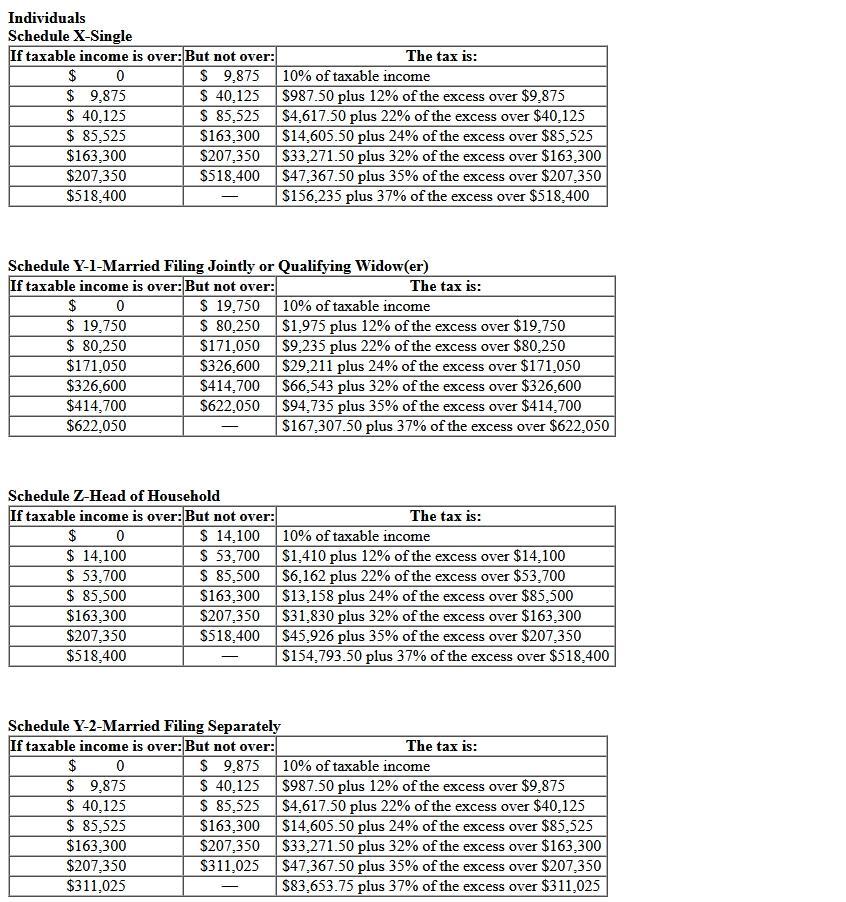

Chuck, a single taxpayer, earns $46,500 in taxable income and $13,600 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Req A Req B Req C Req D How much federal tax will he owe? (Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount.) Federal tax $ 6,170 < Req A Req B > Individuals Schedule X-Single If taxable income is over: But not over: $ 0 $ 9,875 $ 9,875 $ 40,125 $ 40,125 $ 85,525 $ 85,525 $163,300 $207,350 $518,400 $163,300 $207,350 $518,400 $171,050 $326,600 $414,700 $622,050 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: $ 0 $ 19,750 $ 19,750 $ 80,250 $ 80,250 $171,050 $326,600 $414,700 $622,050 - Schedule Z-Head of Household If taxable income is over: But not over: $ 0 $ 14,100 $ 53,700 $ 85,500 $163,300 $207,350 $518,400 The tax is: 10% of taxable income $987.50 plus 12% of the excess over $9,875 $4,617.50 plus 22% of the excess over $40,125 $14,605.50 plus 24% of the excess over $85,525 $33,271.50 plus 32% of the excess over $163,300 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: $ 0 $ 9,875 $ 9,875 $ 40,125 $ 40,125 $ 85,525 $ 85,525 $163,300 $207,350 $311,025 $163,300 $207,350 The tax is: 10% of taxable income $1,975 plus 12% of the excess over $19,750 $9,235 plus 22% of the excess over $80,250 $29,211 plus 24% of the excess over $171,050 $66,543 plus 32% of the excess over $326,600 $94,735 plus 35% of the excess over $414,700 $167,307.50 plus 37% of the excess over $622,050 $ 14,100 10% of taxable income $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 85,500 $6,162 plus 22% of the excess over $53,700 $163,300 $13,158 plus 24% of the excess over $85,500 $207,350 $31,830 plus 32% of the excess over $163,300 $518,400 $45,926 plus 35% of the excess over $207,350 $154,793.50 plus 37% of the excess over $518,400 The tax is: The tax is: 10% of taxable income $987.50 plus 12% of the excess over $9,875 $4,617.50 plus 22% of the excess over $40,125 $14,605.50 plus 24% of the excess over $85,525 $33,271.50 plus 32% of the excess over $163,300 $311,025 $47,367.50 plus 35% of the excess over $207,350 $83,653.75 plus 37% of the excess over $311,025

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information we need to calculate Chucks federal tax obligation average tax rate e...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started