Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chuck Doud, VP of sales for Axiom Supply, had a problem. In a way, it was a good problem but still a problem. One

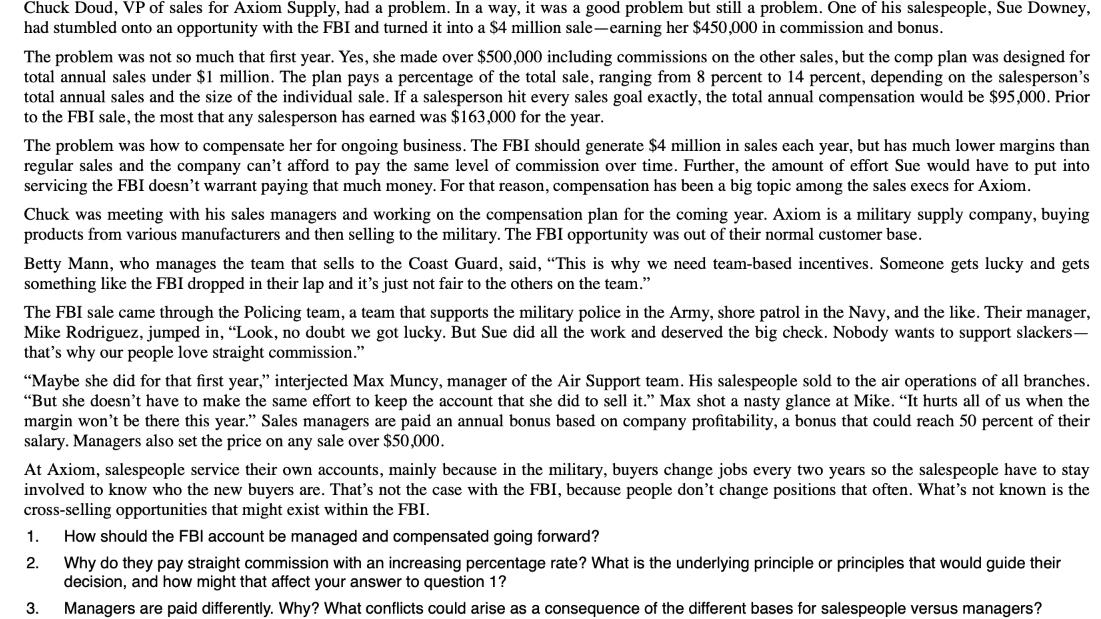

Chuck Doud, VP of sales for Axiom Supply, had a problem. In a way, it was a good problem but still a problem. One of his salespeople, Sue Downey, had stumbled onto an opportunity with the FBI and turned it into a $4 million sale-earning her $450,000 in commission and bonus. The problem was not so much that first year. Yes, she made over $500,000 including commissions on the other sales, but the comp plan was designed for total annual sales under $1 million. The plan pays a percentage of the total sale, ranging from 8 percent to 14 percent, depending on the salesperson's total annual sales and the size of the individual sale. If a salesperson hit every sales goal exactly, the total annual compensation would be $95,000. Prior to the FBI sale, the most that any salesperson has earned was $163,000 for the year. The problem was how to compensate her for ongoing business. The FBI should generate $4 million in sales each year, but has much lower margins than regular sales and the company can't afford to pay the same level of commission over time. Further, the amount of effort Sue would have to put into servicing the FBI doesn't warrant paying that much money. For that reason, compensation has been a big topic among the sales execs for Axiom. Chuck was meeting with his sales managers and working on the compensation plan for the coming year. Axiom is a military supply company, buying products from various manufacturers and then selling to the military. The FBI opportunity was out of their normal customer base. Betty Mann, who manages the team that sells to the Coast Guard, said, "This is why we need team-based incentives. Someone gets lucky and gets something like the FBI dropped in their lap and it's just not fair to the others on the team." The FBI sale came through the Policing team, a team that supports the military police in the Army, shore patrol in the Navy, and the like. Their manager, Mike Rodriguez, jumped in, "Look, no doubt we got lucky. But Sue did all the work and deserved the big check. Nobody wants to support slackers- that's why our people love straight commission." "Maybe she did for that first year," interjected Max Muncy, manager of the Air Support team. His salespeople sold to the air operations of all branches. "But she doesn't have to make the same effort to keep the account that she did to sell it." Max shot a nasty glance at Mike. "It hurts all of us when the margin won't be there this year." Sales managers are paid an annual bonus based on company profitability, a bonus that could reach 50 percent of their salary. Managers also set the price on any sale over $50,000. At Axiom, salespeople service their own accounts, mainly because in the military, buyers change jobs every two years so the salespeople have to stay involved to know who the new buyers are. That's not the case with the FBI, because people don't change positions that often. What's not known is the cross-selling opportunities that might exist within the FBI. How should the FBI account be managed and compensated going forward? Why do they pay straight commission with an increasing percentage rate? What is the underlying principle or principles that would guide their decision, and how might that affect your answer to question 1? Managers are paid differently. Why? What conflicts could arise as a consequence of the different bases for salespeople versus managers? 1. 2. 3.

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Managing and Compensating the FBI Account Several options can be considered for managing and compensating the FBI account going forward a Hybrid Model Dedicated Specialist Assign a dedicated special...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started