Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chuck's Landscaping Ltd. (CLL) had the following transactions involving current liabilities in its first year of operations: 1.CLL signs contracts with customers and requests 50%

Chuck's Landscaping Ltd. (CLL) had the following transactions involving current liabilities in its first year of operations:

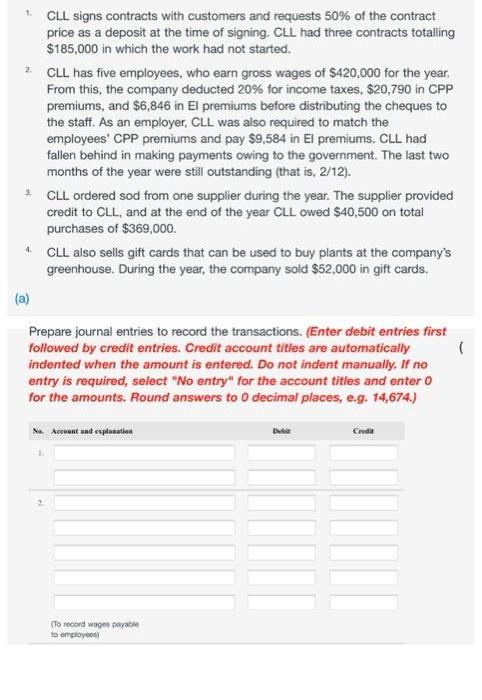

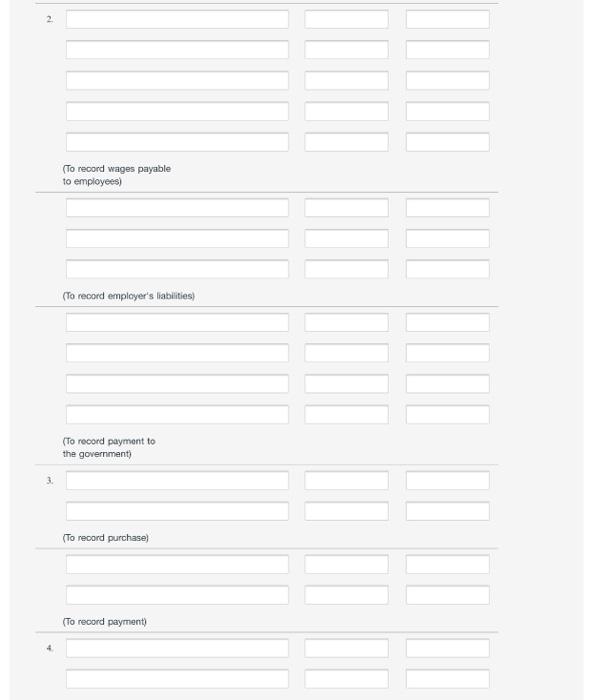

1.CLL signs contracts with customers and requests 50% of the contract price as a deposit at the time of signing. CLL had three contracts totalling $185,000 in which the work had not started. 2. CLL has five employees, who earn gross wages of $420,000 for the year. From this, the company deducted 20% for income taxes, $20,790 in CPP premiums, and $6,846 in El premiums before distributing the cheques to the staff. As an employer, CLL was also required to match the employees' CPP premiums and pay $9,584 in El premiums. CLL had fallen behind in making payments owing to the government. The last two months of the year were still outstanding (that is, 2/12). 3 CLL ordered sod from one supplier during the year. The supplier provided credit to CLL, and at the end of the year CLL owed $40,500 on total purchases of $369,000. 4 CLL also sells gift cards that can be used to buy plants at the company's greenhouse. During the year, the company sold $52,000 in gift cards. (a) Prepare journal entries to record the transactions. (Enter debit entries first followed by credit entries. Credit account titles are automatically ( indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 14,674.) No. Account and explanation Debit Credia 2 (To record wages payable to employees)

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Ref 1 2 3 4 JOURNAL ENTRIES Account Titles Cash Unearned ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started