Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chuma Company Ltd is considering various levels of debt. Currently it has no debt. It has a total market value of Sh.30 million. By

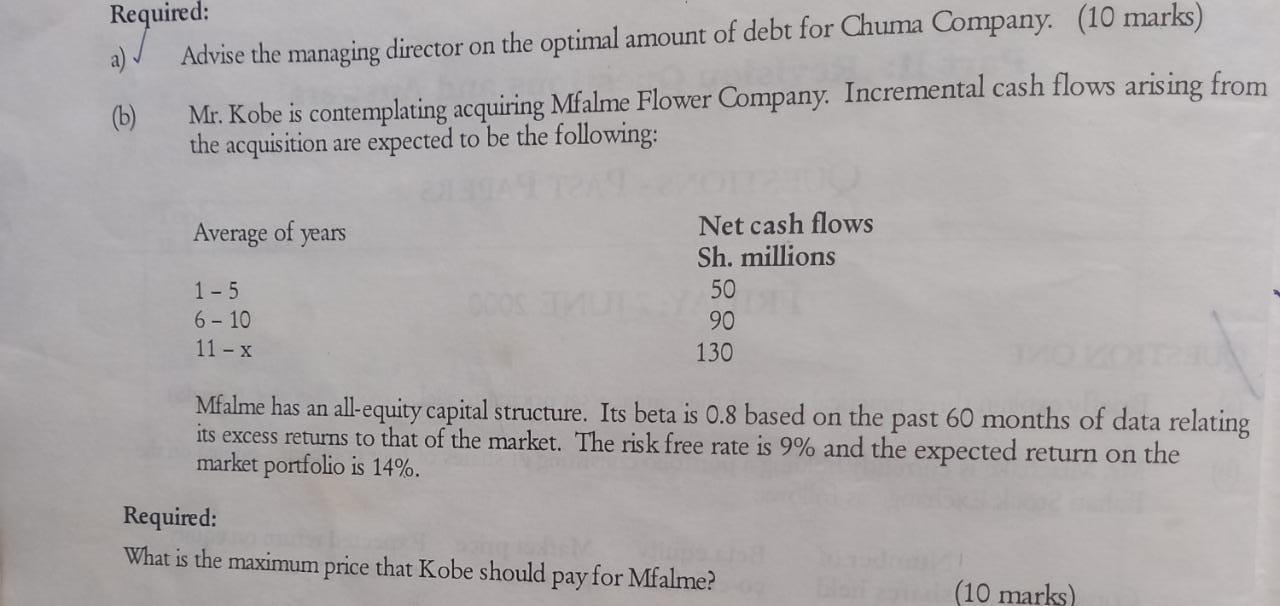

Chuma Company Ltd is considering various levels of debt. Currently it has no debt. It has a total market value of Sh.30 million. By undertaking debt it believes that it can achieve a net tax advantage equal to 20% of the amount of debt. However the company will incur bankruptcy and agency costs as well as lenders increasing their interest rate if it borrows too much. The company's managing director believes that the company can borrow up to Sh.10 million without incurring any of these costs. However, each additional Sh.10 million increment in borrowing is expected to result in the three costs cited being incurred. Moreover, the three costs are expected to increase at an increasing rate with leverage. The present value cost of various levels of debt is as follows: Debt in millions of shillings 10 888885 20 30 40 50 60 PV cost of bankruptcy, agency and increased interest rate 0 0.6 2.4 4.0 6.4 10.0 Required: a) (b) Advise the managing director on the optimal amount of debt for Chuma Company. (10 marks) Mr. Kobe is contemplating acquiring Mfalme Flower Company. Incremental cash flows arising from the acquisition are expected to be the following: Average of years 1-5 6-10 11 - x Net cash flows Sh. millions 50 90 130 Mfalme has an all-equity capital structure. Its beta is 0.8 based on the past 60 months of data relating its excess returns to that of the market. The risk free rate is 9% and the expected return on the market portfolio is 14%. Required: What is the maximum price that Kobe should pay for Mfalme? (10 marks)

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started