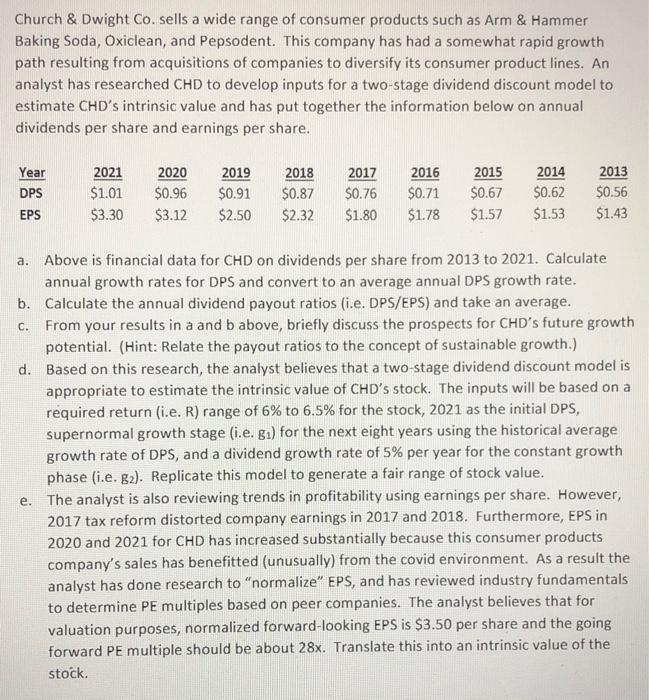

Church & Dwight Co. sells a wide range of consumer products such as Arm & Hammer Baking Soda, Oxiclean, and Pepsodent. This company has had a somewhat rapid growth path resulting from acquisitions of companies to diversify its consumer product lines. An analyst has researched CHD to develop inputs for a two-stage dividend discount model to estimate CHD's intrinsic value and has put together the information below on annual dividends per share and earnings per share. Year DPS EPS 2021 $1.01 $3.30 2020 $0.96 $3.12 2019 $0.91 $2.50 2018 $0.87 $2.32 2017 $0.76 $1.80 2016 $0.71 $1.78 2015 $0.67 $1.57 2014 $0.62 $1.53 2013 $0.56 $1.43 a. Above is financial data for CHD on dividends per share from 2013 to 2021. Calculate annual growth rates for DPS and convert to an average annual DPS growth rate. b. Calculate the annual dividend payout ratios (i.e. DPS/EPS) and take an average. c. From your results in a and b above, briefly discuss the prospects for CHD's future growth potential. (Hint: Relate the payout ratios to the concept of sustainable growth.) d. Based on this research, the analyst believes that a two-stage dividend discount model is appropriate to estimate the intrinsic value of CHD's stock. The inputs will be based on a required return (i.e. R) range of 6% to 6.5% for the stock, 2021 as the initial DPS, supernormal growth stage (i.e. ga) for the next eight years using the historical average growth rate of DPS, and a dividend growth rate of 5% per year for the constant growth phase (i.e. 82). Replicate this model to generate a fair range of stock value. e. The analyst is also reviewing trends in profitability using earnings per share. However, 2017 tax reform distorted company earnings in 2017 and 2018. Furthermore, EPS in 2020 and 2021 for CHD has increased substantially because this consumer products company's sales has benefitted (unusually) from the covid environment. As a result the analyst has done research to "normalize" EPS, and has reviewed industry fundamentals to determine PE multiples based on peer companies. The analyst believes that for valuation purposes, normalized forward-looking EPS is $3.50 per share and the going forward PE multiple should be about 28x. Translate this into an intrinsic value of the stock