Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Churchill Company has been in business for 3 years now, and things are going well. Greg Johnson has been able to expand the company

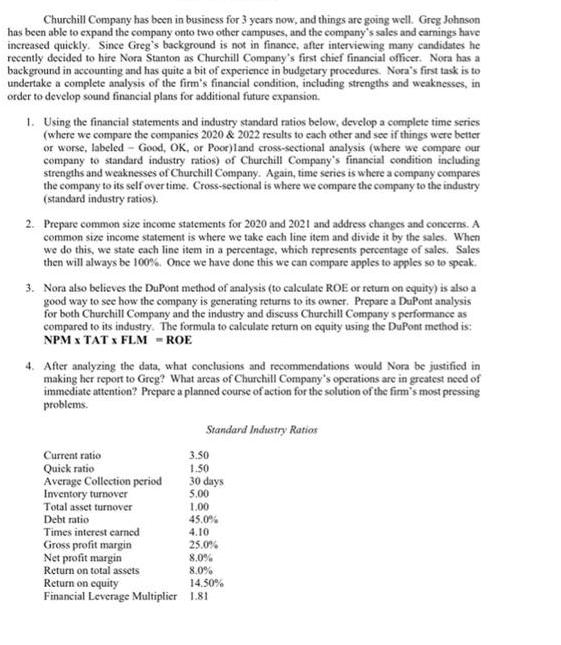

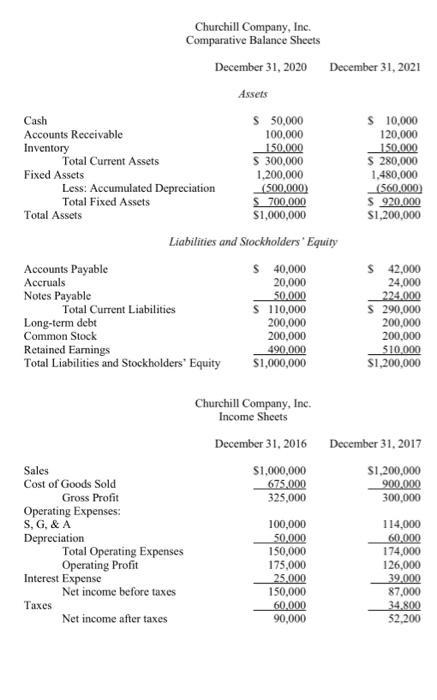

Churchill Company has been in business for 3 years now, and things are going well. Greg Johnson has been able to expand the company onto two other campuses, and the company's sales and earnings have increased quickly. Since Greg's background is not in finance, after interviewing many candidates he recently decided to hire Nora Stanton as Churchill Company's first chief financial officer. Nora has a background in accounting and has quite a bit of experience in budgetary procedures. Nora's first task is to undertake a complete analysis of the firm's financial condition, including strengths and weaknesses, in order to develop sound financial plans for additional future expansion. 1. Using the financial statements and industry standard ratios below, develop a complete time series (where we compare the companies 2020 & 2022 results to each other and see if things were better or worse, labeled - Good, OK, or Poor)land cross-sectional analysis (where we compare our company to standard industry ratios) of Churchill Company's financial condition including strengths and weaknesses of Churchill Company. Again, time series is where a company compares the company to its self over time. Cross-sectional is where we compare the company to the industry (standard industry ratios). 2. Prepare common size income statements for 2020 and 2021 and address changes and concerns. A common size income statement is where we take each line item and divide it by the sales. When we do this, we state each line item in a percentage, which represents percentage of sales. Sales then will always be 100%. Once we have done this we can compare apples to apples so to speak. 3. Nora also believes the DuPont method of analysis (to calculate ROE or return on equity) is also a good way to see how the company is generating returns to its owner. Prepare a DuPont analysis for both Churchill Company and the industry and discuss Churchill Company s performance as compared to its industry. The formula to calculate return on equity using the DuPont method is: NPM x TATX FLM - ROE 4. After analyzing the data, what conclusions and recommendations would Nora be justified in making her report to Greg? What areas of Churchill Company's operations are in greatest need of immediate attention? Prepare a planned course of action for the solution of the firm's most pressing problems. Standard Industry Ratios 3.50 Current ratio Quick ratio 1.50 Average Collection period 30 days Inventory turnover 5.00 Total asset turnover 1.00 Debt ratio 45.0% Times interest earned 4.10 Gross profit margin 25.0% Net profit margin 8.0% Return on total assets 8.0% Return on equity 14.50% Financial Leverage Multiplier 1.81 Churchill Company, Inc. Comparative Balance Sheets December 31, 2020 December 31, 2021 Assets $ 10,000 $ 50,000 100,000 120,000 150,000 150,000 $ 300,000 $ 280,000 1,200,000 1,480,000 (560.000) S 920,000 $1,200,000 $ 42,000 24,000 224.000 $ 290,000 200,000 200,000 $10,000 $1,200,000 December 31, 2017 $1,200,000 900,000 300,000 114,000 60,000 174,000 126,000 39,000 87,000 34,800 52,200 Cash Accounts Receivable Inventory Fixed Assets Total Assets Accounts Payable Accruals Notes Payable Total Current Liabilities Long-term debt Common Stock Retained Earnings Total Liabilities and Stockholders' Equity Sales Cost of Goods Sold Gross Profit Operating Expenses: S, G, & A Depreciation Interest Expense Taxes Total Current Assets Less: Accumulated Depreciation Total Fixed Assets Total Operating Expenses Operating Profit Net income before taxes Net income after taxes (500,000) $ 700,000 $1,000,000 Liabilities and Stockholders' Equity $ 40,000 20,000 50,000 $ 110,000 200,000 200,000 490,000 $1,000,000 Churchill Company, Inc. Income Sheets December 31, 2016 $1,000,000 675,000 325,000 100,000 50,000 150,000 175,000 25,000 150,000 60,000 90,000

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Dec 312016 Dec 312017 Indy Ratios Current Ratio Current assetsCurrent Liabilities 300000110000 273 280000290000 097 35 Liquidityie Capacity to meet lesthana year obligations very low compared to ind...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started