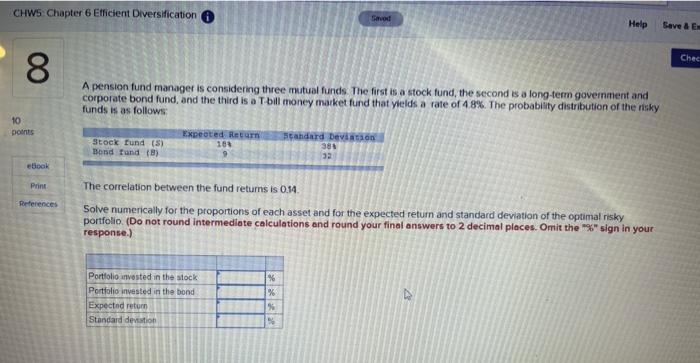

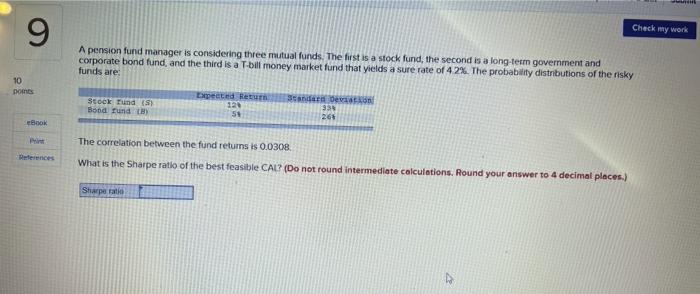

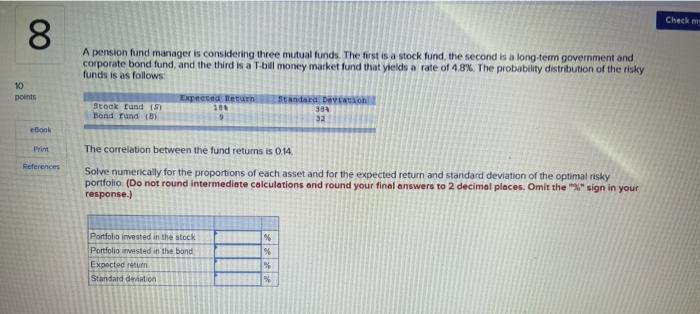

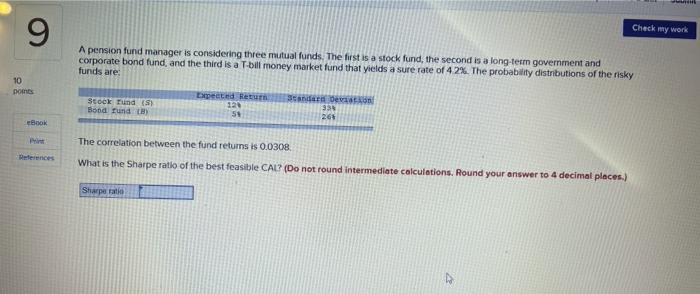

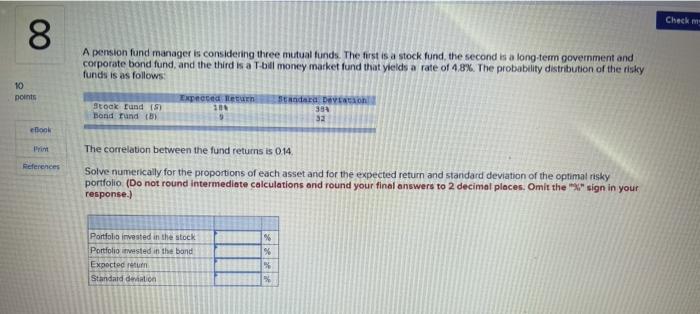

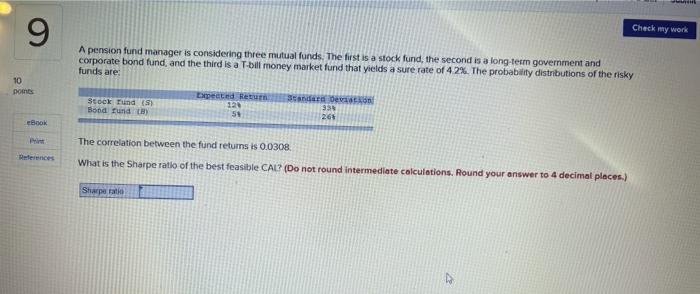

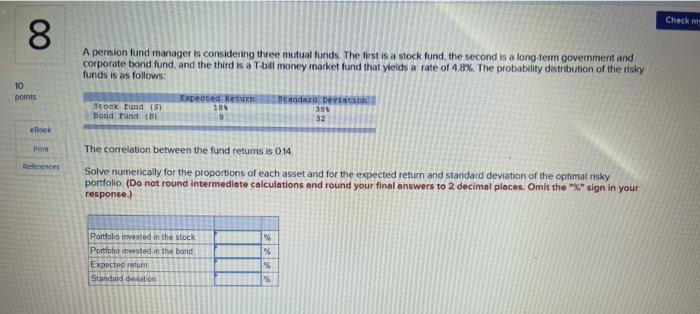

CHW5 Chapter 6 Efficient Diversification Tarot Help Save & E Chee 00 A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a bill money market fund that yields a rate of 48%. The probability distribution of the risky funds is as follows: 10 points Stock Fund (5) Bond Fund (8) Expected Return 164 Standard Devintaan 380 32 book Print The correlation between the fund returns is 0.14 References Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio (Do not round intermediate calculations and round your final answers to 2 decimal places. Omit the "%" sign in your response.) Portfolio invested in the stock Portfolio invested in the bond Expected retum Standard deviation % % % 9 Check my work A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 42%. The probability distributions of the risky funds are 10 Domes Stock Fund (S) Bood rund Expected Return 12 51 an de 26 98 Book The correlation between the fund returns is 0.0308 What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Sharpe ratio Check my 8 A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 48%. The probability distribution of the risky funds is as follows: 10 points Stock Fund is Bond rund (B) EXCEL 104 Stara De 394 32 ook The correlation between the fund returns is 0.14 References Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio (Do not round intermediate calculations and round your final answers to 2 decimal places. Omit the "o" sign in your response.) % % Portfolio invested in the stock Portfolio twisted in the band Expected return Standard in CHW5 Chapter 6 Efficient Diversification Tarot Help Save & E Chee 00 A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a bill money market fund that yields a rate of 48%. The probability distribution of the risky funds is as follows: 10 points Stock Fund (5) Bond Fund (8) Expected Return 164 Standard Devintaan 380 32 book Print The correlation between the fund returns is 0.14 References Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio (Do not round intermediate calculations and round your final answers to 2 decimal places. Omit the "%" sign in your response.) Portfolio invested in the stock Portfolio invested in the bond Expected retum Standard deviation % % % 9 Check my work A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 42%. The probability distributions of the risky funds are 10 Domes Stock Fund (S) Bood rund Expected Return 12 51 an de 26 98 Book The correlation between the fund returns is 0.0308 What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Sharpe ratio Check my 8 A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 48%. The probability distribution of the risky funds is as follows: 10 points Stock Fund is Bond rund (B) EXCEL 104 Stara De 394 32 ook The correlation between the fund returns is 0.14 References Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio (Do not round intermediate calculations and round your final answers to 2 decimal places. Omit the "o" sign in your response.) % % Portfolio invested in the stock Portfolio twisted in the band Expected return Standard in