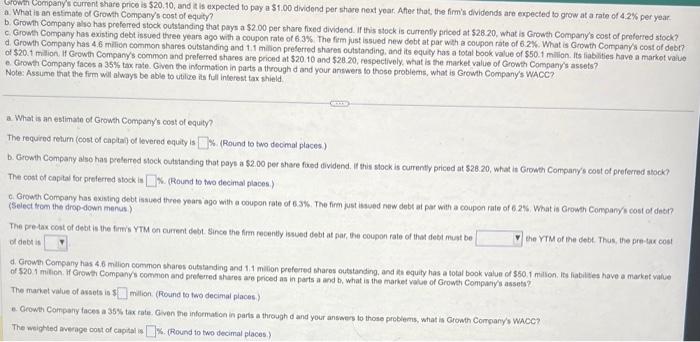

CHWwt Company's current share price is $20.10, and $ is expected to pay a $1.00 dividend per shoce next year. After that, the firm's dividends are erpected to grow at a rate of 4.2% per year. a. What is an estmate ol Growth Company's cost of equty? b. Growth Company abo has preferred stock outstanding that pays a \$2.00 per share fixed dividend. If this stock is currently griced at $28 20, what is Growth Company's cost of preforred stock? c. Groma Company has exsting debt issued three years ago with a coupon rate of 6.3%. The ferm just issued new dobt at par with a coupen rate of 62%. What is Growth Companys cost of debr? d. Growh Company has 4.6 milion common shares cutstanding and 1.1 milion preferted sharen outstanding, and its equey has a total book value of $50.1 milion. Its fiabuities have a markot value e. Groat Compary races a 3sta lax rate. Gven the information in parts a through d and your answers to those problems, what is Growth Companys WhCC? Note: Assume that the firm woll always be able to utilue its full interest tax shield. a What is an estimath of Grawth Company's cost of equity? The required return (cost of captay of levered equaty is 5 . (Reind to two deoimal places) b. Growth Company also has prolerred slock outstanding that pays a $2.00 per share food dividend. If this slock is cumenty priced at $28.20, what is Growth Conpany's coet of prefered atock? The cost of capital for prelerred stock is K. (Round to two decimal places.) c. Growth Company has exisho debt issued three years ago with a coupon rate of 6.3\%. The firm just issued new debe at par with a coupon rale of 62%. What is Growth Company's cost of dect? (Select trom the drapdown menus) The pe-tax cost of debt is the firmis YTM ca cureen debt. Since the firm recently issued debt at far, the coupon rale of that debi muat be the YTM of the debt. Thus, the pre-tar coet! of debt is d. Growq Company has 4.6 milion common shares outstanding and 1.1 mition prefered sharos outstanding, and he equity has a total book value of $60.1 milson. its fiabiltes have a market ville of 5201 mition. H Growti Company's commen and phefered ahares a's priced as in perts a and b, what is the market value of Grower Compaty's assets? The market value of arsots is $ milion. (Roound to two decimal places.) e. Geowth Conpany faces a 35% tax rate. Gven the information in parts a through d and your ansaers to those preblems, what is Growh Comparys WACC? The meighted average oost of capital is W. (Round to two decimal places.)