Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CI03 1/2 will upvote Which of the following statements is incorrect? If the quick ratio is the same as the current ratio; it will indicate

CI03 1/2 will upvote

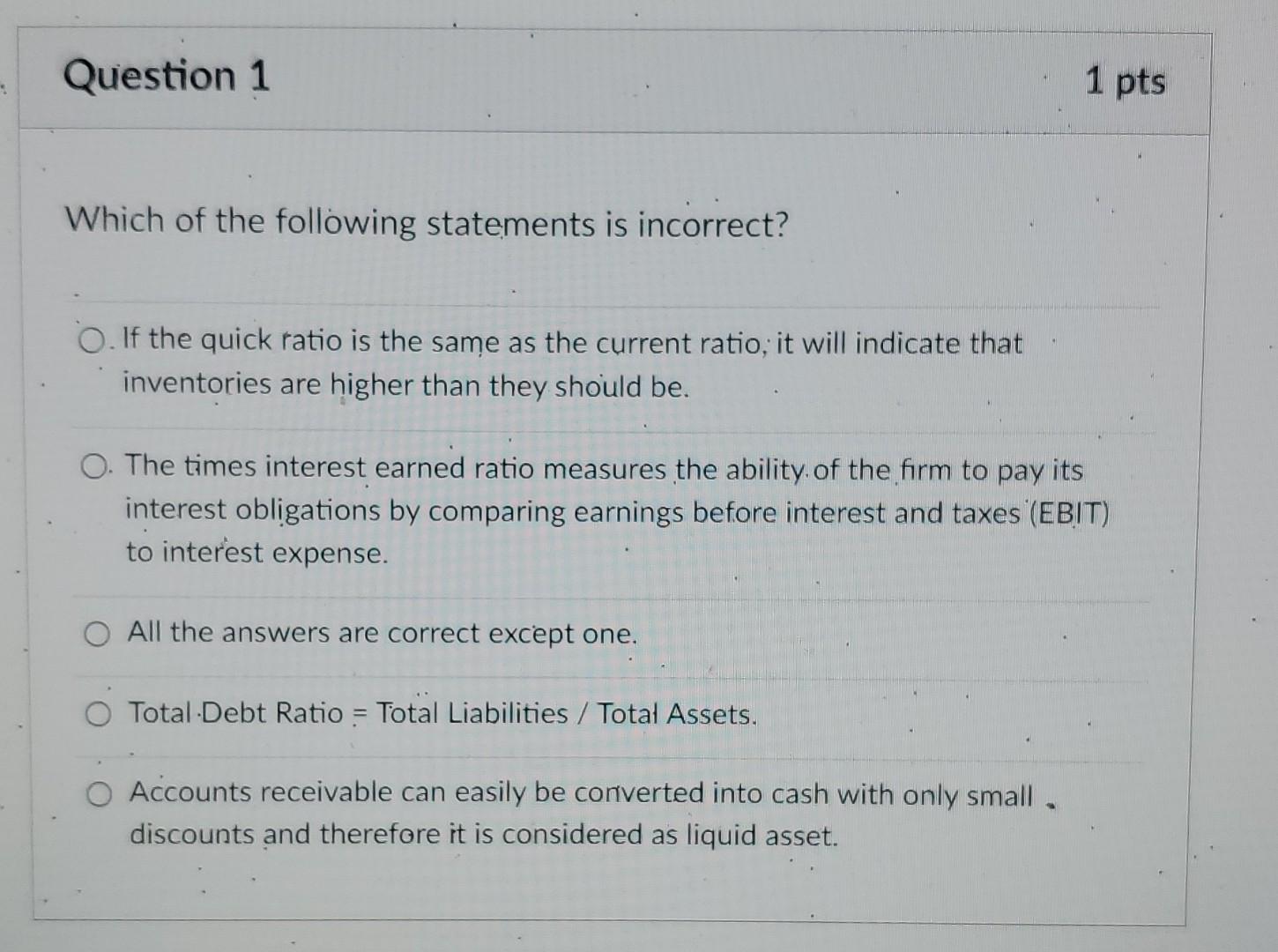

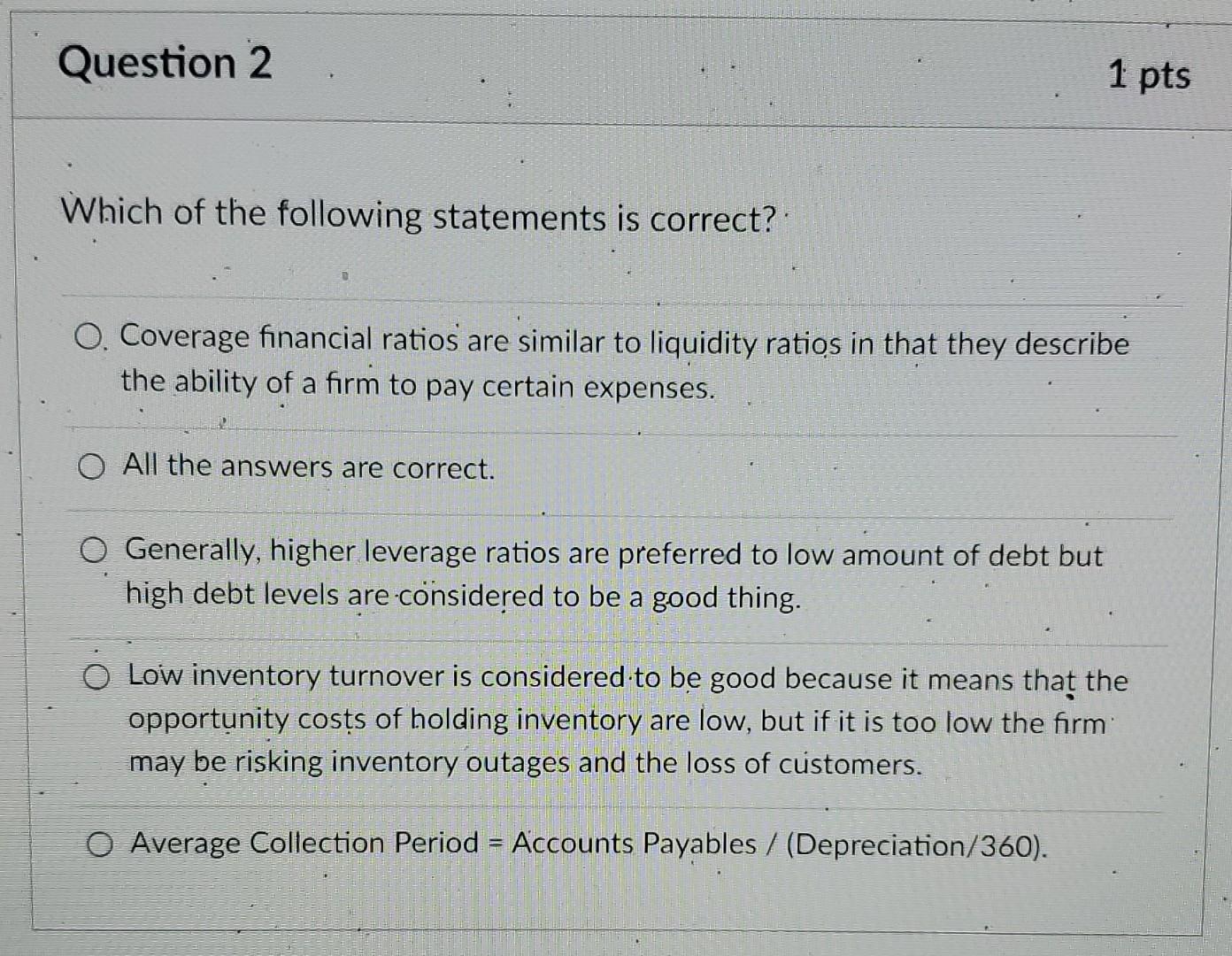

Which of the following statements is incorrect? If the quick ratio is the same as the current ratio; it will indicate that inventories are higher than they should be. The times interest earned ratio measures the ability of the firm to pay its interest obligations by comparing earnings before interest and taxes (EBIT) to interest expense. All the answers are correct except one. Total Debt Ratio = Total Liabilities / Total Assets. Accounts receivable can easily be corverted into cash with only small . discounts and therefore it is considered as liquid asset. Which of the following statements is correct? Coverage financial ratios are similar to liquidity ratios in that they describe the ability of a firm to pay certain expenses. All the answers are correct. Generally, higher leverage ratios are preferred to low amount of debt but high debt levels are coinsidered to be a good thing. Low inventory turnover is considered to be good because it means that the opportunity costs of holding inventory are low, but if it is too low the firm. may be risking inventory outages and the loss of cuistomers. Average Collection Period = Accounts Payables / (Depreciation/360)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started