Answered step by step

Verified Expert Solution

Question

1 Approved Answer

cial decision. 2 4. You as the manager of Vertex Company have been asked by your president to purchase a machine for your production

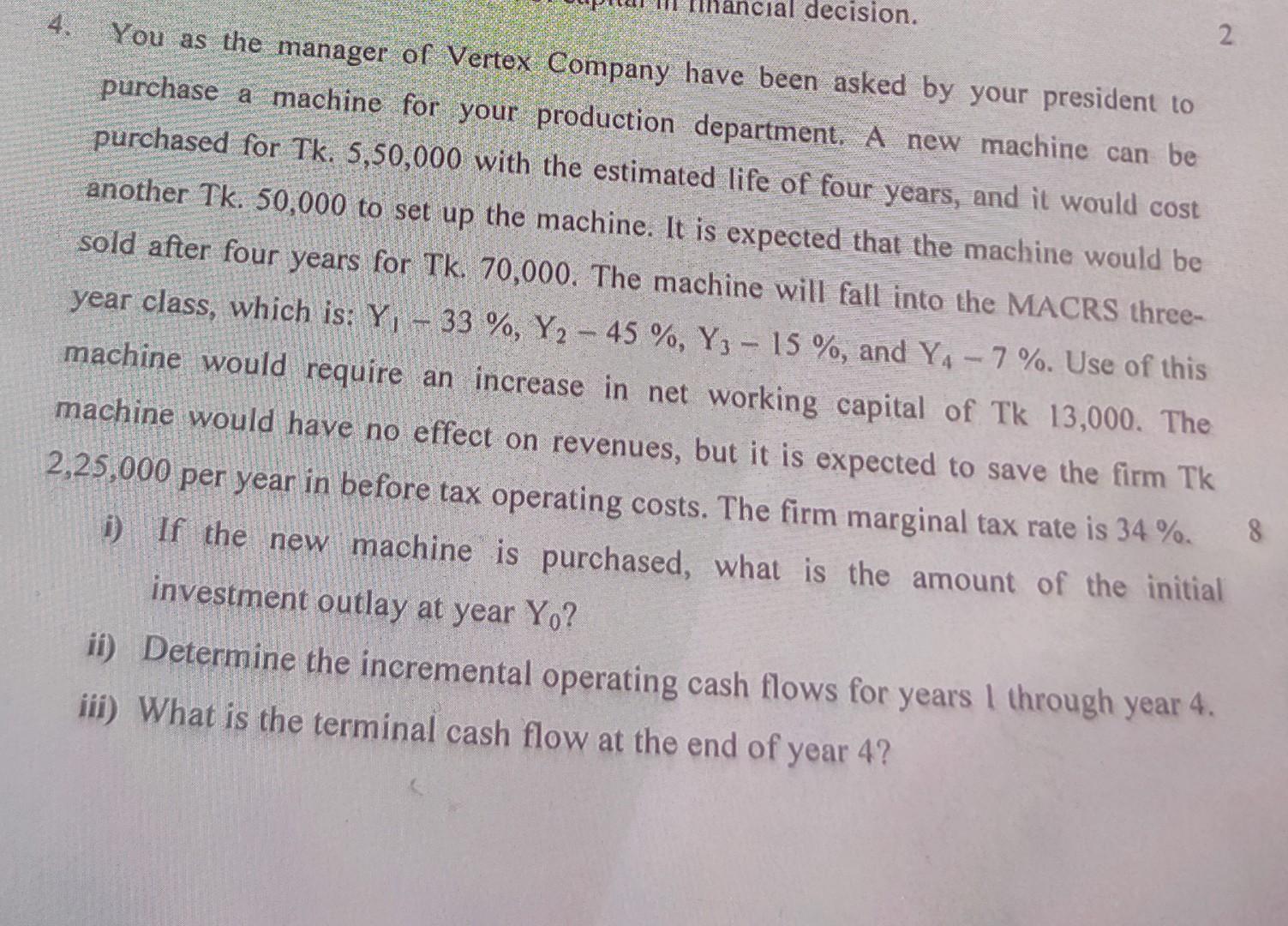

cial decision. 2 4. You as the manager of Vertex Company have been asked by your president to purchase a machine for your production department. A new machine can be purchased for Tk. 5,50,000 with the estimated life of four years, and it would cost another Tk. 50,000 to set up the machine. It is expected that the machine would be sold after four years for Tk. 70,000. The machine will fall into the MACRS three- year class, which is: Y - 33 %, Y2 - 45 %, Y3 - 15 %, and Y4-7%. Use of this machine would require an increase in net working capital of Tk 13,000. The machine would have no effect on revenues, but it is expected to save the firm Tk 2,25,000 per year in before tax operating costs. The firm marginal tax rate is 34 %. i) If the new machine is purchased, what is the amount of the initial investment outlay at year Yo? ii) Determine the incremental operating cash flows for years I through year 4. iii) What is the terminal cash flow at the end of year 4? 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Initial investment outlay at year 0 Cost of machine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663ddb09276ff_961601.pdf

180 KBs PDF File

663ddb09276ff_961601.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started