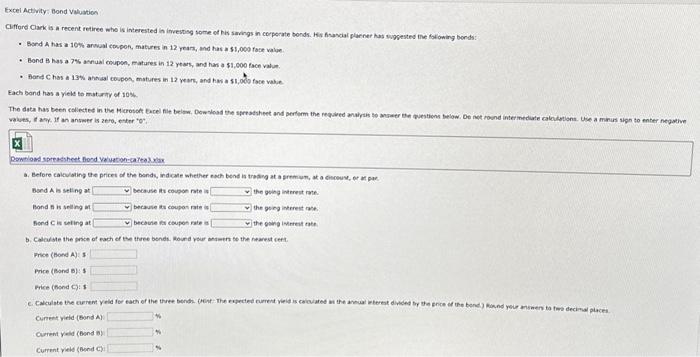

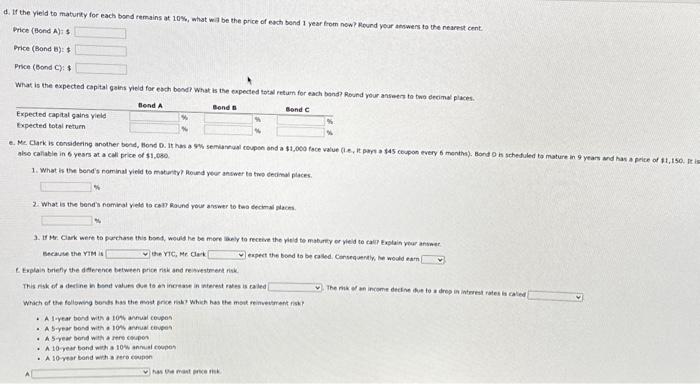

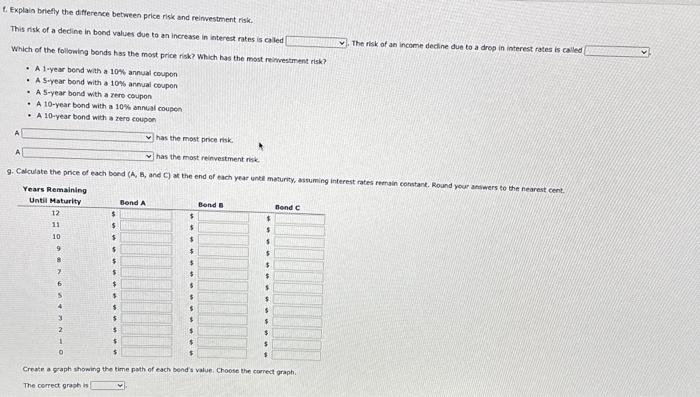

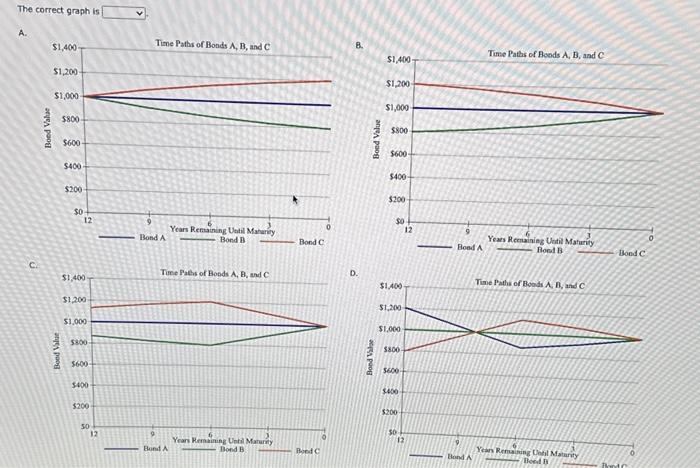

Cifford Clark is a recent retiree who is interested in ifvesosg some of his savings in corperate bonds. His funcial plarner has wogested the fol owing bonds: - Sond 4 has a 10% anwal cospor, matures in 12 years, and has a 51,000 foce value. - Bond B has a 7 s. acnual coupon, fratures in 12 years, and has a $1,000 face valun. - Bard C has a 13% anhal coupes, matures in 12 veary, and has a 11,000 face vabe. Each Band has a yele to matartry of 10%. values, it avy. If an answer is zero, ether ter, x a. Before calculating the pricet of the bends, indcale whether each bend is trading at a gremiun, at a owouve, or af pee. Frice (hond A) : 3 Price (Bond b): 3 Frice (hond C):s Cunest vieid (Bond A) Curent yeld (Bond w) Curtent yeld (oonid c) i d. If the yieid to maturiy for each bord remains at 10%, what wa be the price of each bend 1 year form now? Round yeur abowers to the nearest cent. Price (Bond A) is Price (Bond b):$ Price (Bond C): $ What is the expected capital gains yieid for each bond? what is the expected tocal retum for each bond? Round your anseers to two decimal places. ako caflable in 6 years at a eal price of $1,000 1. What is the bend's nominal vield to maberty? Round vou anower te tres dedimal places. 2. What is the bond nominat yeld to carr Bound your answer to twa decimal Maces. Becaule the rim is the ric, Me Clek eapect the beed to be caled. Corsequentw he wodd ean E Explais triefir the dalesence between price nisk and rewvestent risk. The ma of en income dectine the to a dres in intreses rates b caled Whach of the foliewing bonds has the most proce nali which has the mot reinveterent risk? - A lryear bond wits a tosit ammual ceveos - A Syear bond with a loks arnual celveos - A 5 year bond with a rere ceupor - A to year bond wim a low anmal ceepos - A 10 year bond wh a rere elupon 4. Explain briefly the difference between price rikk and reimestment risk. This risk of a decine in bond values due to an increase in itereat rates is aled Which of the following bonds has the most peice risk? Which has the most reimestment risk? The risk of se income decline due to a drop in interest rates is called - A 1-year bond wath a 10% annual coupon - A S-year band with a 10 \% annual coupon - A 5-year bond with a zero coupon - A 10-year bond with a 10% annital coupen - A 10-year bond with a zero coupon A has the most price risk. A has the most reinvestment rise. 9. Calculate the price of each bond (A,8, and C) at the end of each year unte maturty, assuming interest rates retrain corvtant. Round your amswers to the nearest cent. Years Damaininn Create a gaph showing the time path of each bends value. choose the curreat oraph. The correct graph is The correct graph is