Answered step by step

Verified Expert Solution

Question

1 Approved Answer

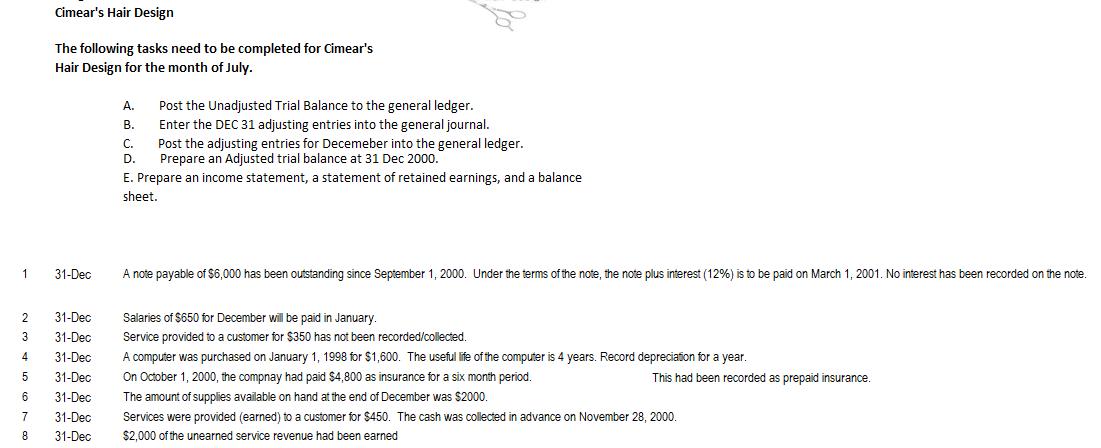

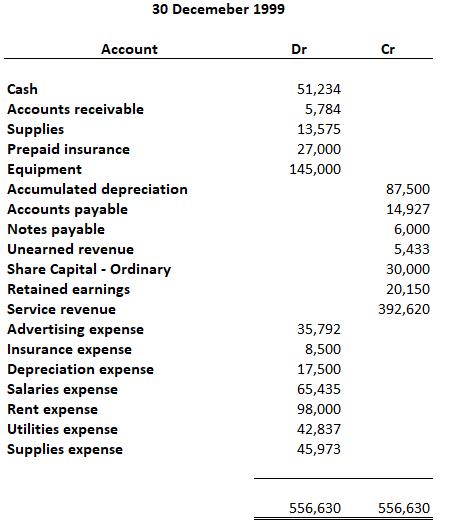

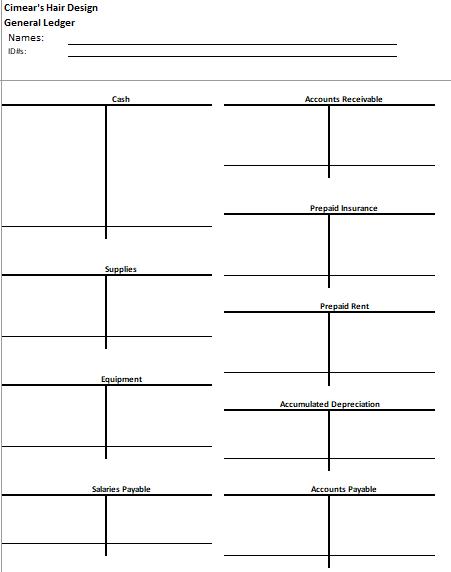

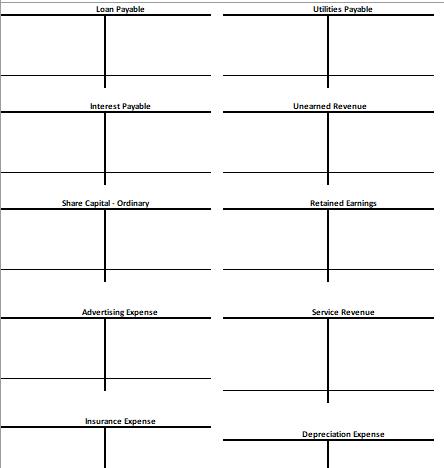

Cimear's Hair Design The following tasks need to be completed for Cimear's Hair Design for the month of July. Post the Unadjusted Trial Balance

Cimear's Hair Design The following tasks need to be completed for Cimear's Hair Design for the month of July. Post the Unadjusted Trial Balance to the general ledger. Enter the DEC 31 adjusting entries into the general journal. Post the adjusting entries for Decemeber into the general ledger. Prepare an Adjusted trial balance at 31 Dec 2000. . . . D. E. Prepare an income statement, a statement of retained earnings, and a balance sheet. 1 31-Dec A note payable of $6,000 has been outstanding since September 1, 2000. Under the terms of the note, the note plus interest (12%) is to be paid on March 1, 2001. No interest has been recorded on the note. 31-Dec Salaries $650 for December will be paid in January 31-Dec Service provided to a customer for $350 has not been recorded/collected. A computer was purchased on January 1, 1998 for $1,600. The useful life of the computer is 4 years. Record depreciation for a year. On October 1, 2000, the compnay had paid $4,800 as insurance for a six month period. 4 31-Dec 5 31-Dec This had been recorded as prepaid insurance. 6. 31-Dec The amount of supplies available on hand at the end of December was $2000. 7 31-Dec Services were provided (earned) to a customer for $450. The cash was collected in advance on November 28 , 2000. 8 31-Dec $2,000 of the unearned service revenue had been earned 30 Decemeber 1999 Account Dr Cr Cash 51,234 Accounts receivable 5,784 Supplies Prepaid insurance 13,575 27,000 145,000 Equipment Accumulated depreciation Accounts payable Notes payable Unearned revenue 87,500 14,927 6,000 5,433 Share Capital - Ordinary Retained earnings 30,000 20,150 Service revenue 392,620 Advertising expense Insurance expense 35,792 8,500 Depreciation expense 17,500 Salaries expense 65,435 Rent expense Utilities expense 98,000 42,837 Supplies expense 45,973 556,630 556,630 Cimear's Hair Design General Journal Names: ID #: Date Account Dr Cr Cimear's Hair Design General Ledger Names: IDs: Cash Accounts Receivable Prepaid Insurance Supplies Prepaid Rent Equipment Accumulated Depreciation Salaries Payable Accounts Payable Loan Payable Utilities Payable Interest Payable Unearned Revenue Share Capital - Ordinary Retained Earning Advertising Expense Service Revenue Insurance Expense Depreciation Expense Salaries Expense Rent Expense Utilities Expense Supplies Expense Interest Expense Dividends Cimear's Hair Design The following tasks need to be completed for Cimear's Hair Design for the month of July. Post the Unadjusted Trial Balance to the general ledger. Enter the DEC 31 adjusting entries into the general journal. Post the adjusting entries for Decemeber into the general ledger. Prepare an Adjusted trial balance at 31 Dec 2000. . . . D. E. Prepare an income statement, a statement of retained earnings, and a balance sheet. 1 31-Dec A note payable of $6,000 has been outstanding since September 1, 2000. Under the terms of the note, the note plus interest (12%) is to be paid on March 1, 2001. No interest has been recorded on the note. 31-Dec Salaries $650 for December will be paid in January 31-Dec Service provided to a customer for $350 has not been recorded/collected. A computer was purchased on January 1, 1998 for $1,600. The useful life of the computer is 4 years. Record depreciation for a year. On October 1, 2000, the compnay had paid $4,800 as insurance for a six month period. 4 31-Dec 5 31-Dec This had been recorded as prepaid insurance. 6. 31-Dec The amount of supplies available on hand at the end of December was $2000. 7 31-Dec Services were provided (earned) to a customer for $450. The cash was collected in advance on November 28 , 2000. 8 31-Dec $2,000 of the unearned service revenue had been earned 30 Decemeber 1999 Account Dr Cr Cash 51,234 Accounts receivable 5,784 Supplies Prepaid insurance 13,575 27,000 145,000 Equipment Accumulated depreciation Accounts payable Notes payable Unearned revenue 87,500 14,927 6,000 5,433 Share Capital - Ordinary Retained earnings 30,000 20,150 Service revenue 392,620 Advertising expense Insurance expense 35,792 8,500 Depreciation expense 17,500 Salaries expense 65,435 Rent expense Utilities expense 98,000 42,837 Supplies expense 45,973 556,630 556,630 Cimear's Hair Design General Journal Names: ID #: Date Account Dr Cr Cimear's Hair Design General Ledger Names: IDs: Cash Accounts Receivable Prepaid Insurance Supplies Prepaid Rent Equipment Accumulated Depreciation Salaries Payable Accounts Payable Loan Payable Utilities Payable Interest Payable Unearned Revenue Share Capital - Ordinary Retained Earning Advertising Expense Service Revenue Insurance Expense Depreciation Expense Salaries Expense Rent Expense Utilities Expense Supplies Expense Interest Expense Dividends Cimear's Hair Design The following tasks need to be completed for Cimear's Hair Design for the month of July. Post the Unadjusted Trial Balance to the general ledger. Enter the DEC 31 adjusting entries into the general journal. Post the adjusting entries for Decemeber into the general ledger. Prepare an Adjusted trial balance at 31 Dec 2000. . . . D. E. Prepare an income statement, a statement of retained earnings, and a balance sheet. 1 31-Dec A note payable of $6,000 has been outstanding since September 1, 2000. Under the terms of the note, the note plus interest (12%) is to be paid on March 1, 2001. No interest has been recorded on the note. 31-Dec Salaries $650 for December will be paid in January 31-Dec Service provided to a customer for $350 has not been recorded/collected. A computer was purchased on January 1, 1998 for $1,600. The useful life of the computer is 4 years. Record depreciation for a year. On October 1, 2000, the compnay had paid $4,800 as insurance for a six month period. 4 31-Dec 5 31-Dec This had been recorded as prepaid insurance. 6. 31-Dec The amount of supplies available on hand at the end of December was $2000. 7 31-Dec Services were provided (earned) to a customer for $450. The cash was collected in advance on November 28 , 2000. 8 31-Dec $2,000 of the unearned service revenue had been earned 30 Decemeber 1999 Account Dr Cr Cash 51,234 Accounts receivable 5,784 Supplies Prepaid insurance 13,575 27,000 145,000 Equipment Accumulated depreciation Accounts payable Notes payable Unearned revenue 87,500 14,927 6,000 5,433 Share Capital - Ordinary Retained earnings 30,000 20,150 Service revenue 392,620 Advertising expense Insurance expense 35,792 8,500 Depreciation expense 17,500 Salaries expense 65,435 Rent expense Utilities expense 98,000 42,837 Supplies expense 45,973 556,630 556,630 Cimear's Hair Design General Journal Names: ID #: Date Account Dr Cr Cimear's Hair Design General Ledger Names: IDs: Cash Accounts Receivable Prepaid Insurance Supplies Prepaid Rent Equipment Accumulated Depreciation Salaries Payable Accounts Payable Loan Payable Utilities Payable Interest Payable Unearned Revenue Share Capital - Ordinary Retained Earning Advertising Expense Service Revenue Insurance Expense Depreciation Expense Salaries Expense Rent Expense Utilities Expense Supplies Expense Interest Expense Dividends Cimear's Hair Design The following tasks need to be completed for Cimear's Hair Design for the month of July. Post the Unadjusted Trial Balance to the general ledger. Enter the DEC 31 adjusting entries into the general journal. Post the adjusting entries for Decemeber into the general ledger. Prepare an Adjusted trial balance at 31 Dec 2000. . . . D. E. Prepare an income statement, a statement of retained earnings, and a balance sheet. 1 31-Dec A note payable of $6,000 has been outstanding since September 1, 2000. Under the terms of the note, the note plus interest (12%) is to be paid on March 1, 2001. No interest has been recorded on the note. 31-Dec Salaries $650 for December will be paid in January 31-Dec Service provided to a customer for $350 has not been recorded/collected. A computer was purchased on January 1, 1998 for $1,600. The useful life of the computer is 4 years. Record depreciation for a year. On October 1, 2000, the compnay had paid $4,800 as insurance for a six month period. 4 31-Dec 5 31-Dec This had been recorded as prepaid insurance. 6. 31-Dec The amount of supplies available on hand at the end of December was $2000. 7 31-Dec Services were provided (earned) to a customer for $450. The cash was collected in advance on November 28 , 2000. 8 31-Dec $2,000 of the unearned service revenue had been earned 30 Decemeber 1999 Account Dr Cr Cash 51,234 Accounts receivable 5,784 Supplies Prepaid insurance 13,575 27,000 145,000 Equipment Accumulated depreciation Accounts payable Notes payable Unearned revenue 87,500 14,927 6,000 5,433 Share Capital - Ordinary Retained earnings 30,000 20,150 Service revenue 392,620 Advertising expense Insurance expense 35,792 8,500 Depreciation expense 17,500 Salaries expense 65,435 Rent expense Utilities expense 98,000 42,837 Supplies expense 45,973 556,630 556,630 Cimear's Hair Design General Journal Names: ID #: Date Account Dr Cr Cimear's Hair Design General Ledger Names: IDs: Cash Accounts Receivable Prepaid Insurance Supplies Prepaid Rent Equipment Accumulated Depreciation Salaries Payable Accounts Payable Loan Payable Utilities Payable Interest Payable Unearned Revenue Share Capital - Ordinary Retained Earning Advertising Expense Service Revenue Insurance Expense Depreciation Expense Salaries Expense Rent Expense Utilities Expense Supplies Expense Interest Expense Dividends

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Adjustment Journal Entries TAc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started