Answered step by step

Verified Expert Solution

Question

1 Approved Answer

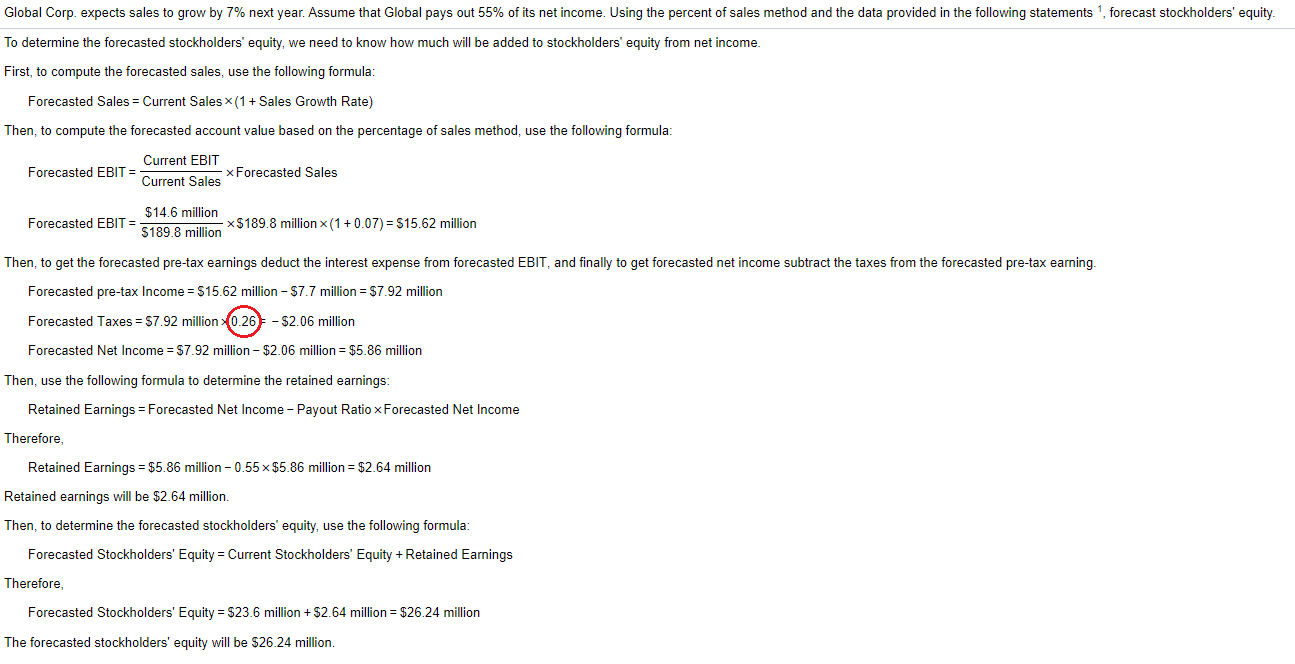

Circled in red: How did they get 0.26 when calculating Forecasted Taxes? Please explain, and, if any, show the work how they calculated it. To

Circled in red: How did they get 0.26 when calculating Forecasted Taxes? Please explain, and, if any, show the work how they calculated it.

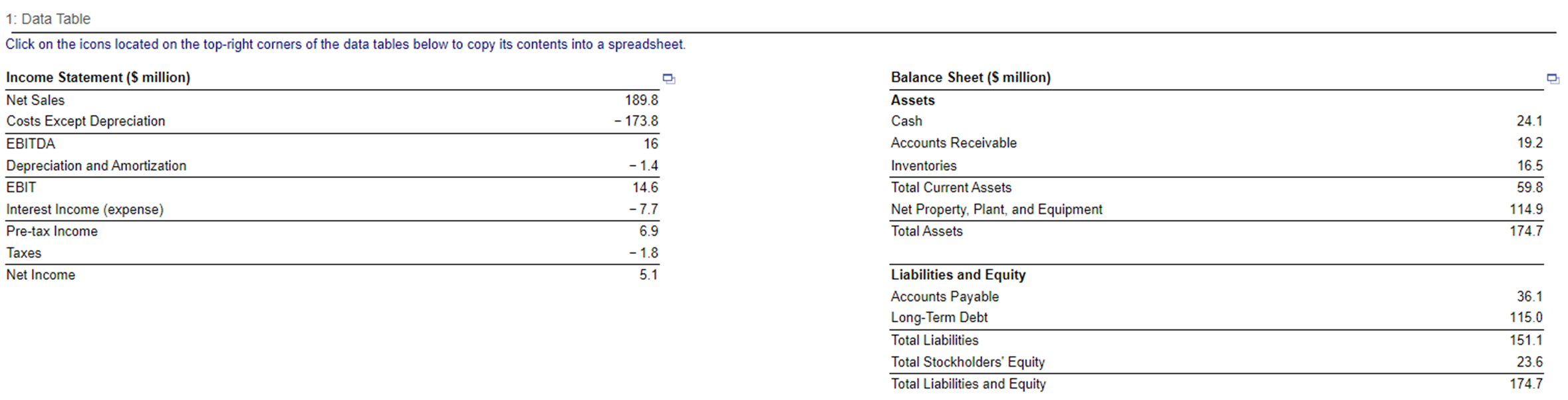

To determine the forecasted stockholders' equity, we need to know how much will be added to stockholders' equity from net income. First, to compute the forecasted sales, use the following formula: Forecasted Sales = Current Sales (1+ Sales Growth Rate ) Then, to compute the forecasted account value based on the percentage of sales method, use the following formula: Forecasted EBIT =CurrentSalesCurrentEBIT Forecasted Sales Forecasted EBIT =$189.8million$14.6million$189.8 million (1+0.07)=$15.62 million Forecasted pre-tax Income =$15.62 million $7.7 million =$7.92 million Forecasted Taxes =$7.92 million (0.26)$2.06 million Forecasted Net Income =$7.92 million $2.06 million =$5.86 million Then, use the following formula to determine the retained earnings: Retained Earnings = Forecasted Net Income - Payout Ratio Forecasted Net Income Therefore, Retained Earnings =$5.86 million 0.55$5.86 million =$2.64 million Retained earnings will be $2.64 million. Then, to determine the forecasted stockholders' equity, use the following formula: Forecasted Stockholders' Equity = Current Stockholders' Equity + Retained Earnings Therefore, Forecasted Stockholders' Equity =$23.6 million +$2.64 million =$26.24 million The forecasted stockholders' equity will be $26.24 million. 1: Data Table Click on the icons located on the top-right corners of the data tables below to copy its contents into a spreadsheet. \begin{tabular}{lr} Income Statement (\$ million) & 189.8 \\ \hline Net Sales & -173.8 \\ Costs Except Depreciation & 16 \\ \hline EBITDA & -1.4 \\ Depreciation and Amortization & 14.6 \\ \hline EBIT & -7.7 \\ Interest Income (expense) & 6.9 \\ \hline Pre-tax Income & -1.8 \\ Taxes & 5.1 \end{tabular} Balance Sheet ( $ million) \begin{tabular}{lr} \hline Assets & 24.1 \\ Cash & 19.2 \\ Accounts Receivable & 16.5 \\ Inventories & 59.8 \\ \hline Total Current Assets & 114.9 \\ Net Property, Plant, and Equipment & 174.7 \\ \hline Total Assets & \\ \hline Liabilities and Equity & 36.1 \\ Accounts Payable & 115.0 \\ Long-Term Debt & 151.1 \\ \hline Total Liabilities & 23.6 \\ \hline Total Stockholders' Equity & 174.7 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started