Question

Citigroup SmithBarney (Dollar). Petrobrs Petrleo Brasileiro S.A. or Petrobras is the national oil company of Brazil. It is publicly traded, but the government of Brazil

Citigroup SmithBarney (Dollar). Petrobrs Petrleo Brasileiro S.A. or Petrobras is the national oil company of Brazil. It is publicly traded, but the government of Brazil holds the controlling share. It is the largest company in the Southern Hemisphere by market capitalization and the largest in all of Latin America. As an oil company, the primary product of its production has a price set on global marketsthe price of oiland much of its business is conducted in the global currency of oil, the U.S. dollar.

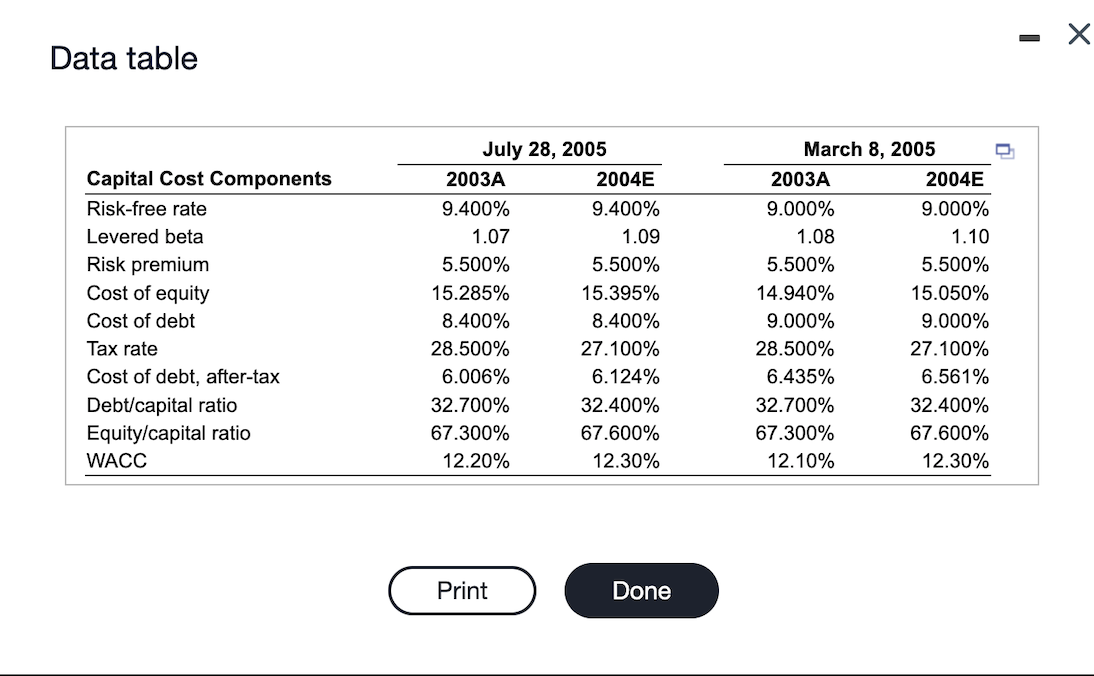

Citigroup regularly performs a U.S. dollar-based discount cash flow (DCF) valuation of Petrobrs in its coverage. That DCF analysis requires the use of a discount rate on which they base the company's weighted average cost of capital. Evaluate the methodology and assumptions used in the estimates of Petrobrs' WACC shown in the popup window,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started