Answered step by step

Verified Expert Solution

Question

1 Approved Answer

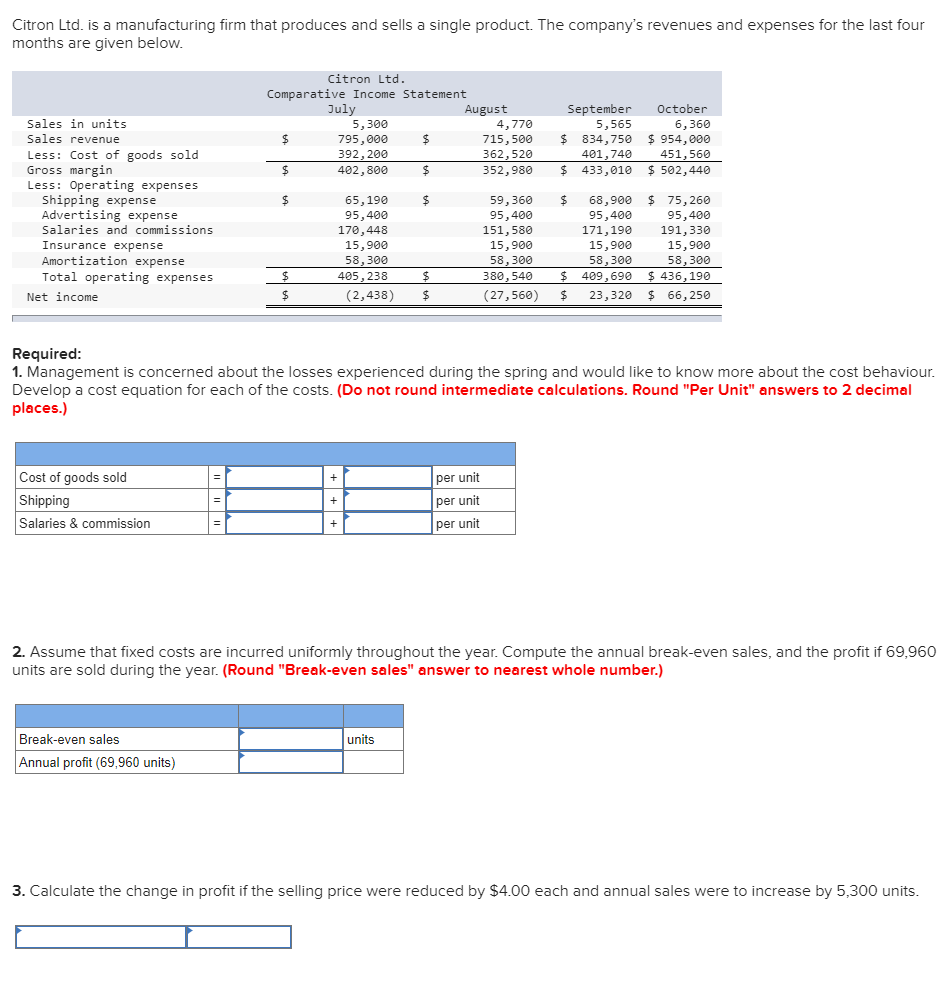

Citron Ltd. is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are

Citron Ltd. is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. Citron Ltd. Comparative Income Statement July August Sales in units 5,300 Sales revenue $ 795,000 $ 4,770 715,500 September 5,565 October $ 834,750 Less: Cost of goods sold 392,200 362,520 401,740 6,360 $954,000 451,560 Gross margin $ 402,800 $ 352,980 Less: Operating expenses Shipping expense Advertising expense 65,190 59,360 $ 433,010 $ 502,440 68,900 $ 75,260 95,400 95,400 95,400 95,400 Salaries and commissions 170,448 151,580 171,190 191,330 Insurance expense 15,900 15,900 15,900 15,900 Amortization expense 58,300 58,300 58,300 58,300 Total operating expenses $ Net income $ 405,238 (2,438) $ 380,540 $ 409,690 $ 436,190 $ (27,560) $ 23,320 $ 66,250 Required: 1. Management is concerned about the losses experienced during the spring and would like to know more about the cost behaviour. Develop a cost equation for each of the costs. (Do not round intermediate calculations. Round "Per Unit" answers to 2 decimal places.) Cost of goods sold Shipping per unit + per unit Salaries & commission per unit 2. Assume that fixed costs are incurred uniformly throughout the year. Compute the annual break-even sales, and the profit if 69,960 units are sold during the year. (Round "Break-even sales" answer to nearest whole number.) Break-even sales Annual profit (69,960 units) units 3. Calculate the change in profit if the selling price were reduced by $4.00 each and annual sales were to increase by 5,300 units.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started