City National Bank signed a loan agreement with State Electric Supply Company on January 2, 2020. The loan had the following terms: Principal: Term:

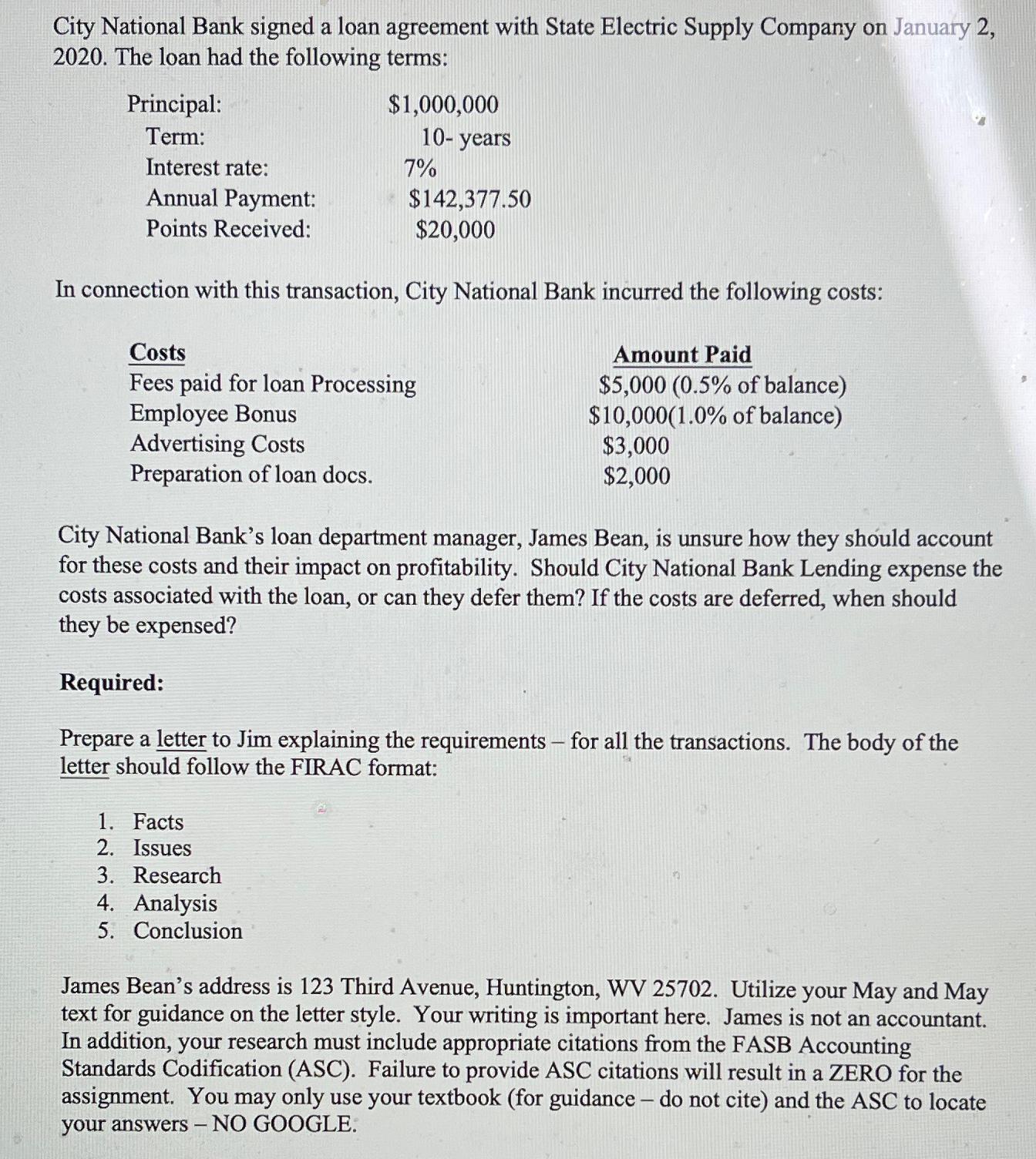

City National Bank signed a loan agreement with State Electric Supply Company on January 2, 2020. The loan had the following terms: Principal: Term: Interest rate: Annual Payment: $1,000,000 10- years 7% Points Received: $142,377.50 $20,000 In connection with this transaction, City National Bank incurred the following costs: Amount Paid Costs Fees paid for loan Processing Employee Bonus Advertising Costs Preparation of loan docs. $5,000 (0.5% of balance) $10,000(1.0% of balance) $3,000 $2,000 City National Bank's loan department manager, James Bean, is unsure how they should account for these costs and their impact on profitability. Should City National Bank Lending expense the costs associated with the loan, or can they defer them? If the costs are deferred, when should they be expensed? Required: Prepare a letter to Jim explaining the requirements - for all the transactions. The body of the letter should follow the FIRAC format: 1. Facts 2. Issues 3. Research 4. Analysis 5. Conclusion James Bean's address is 123 Third Avenue, Huntington, WV 25702. Utilize your May and May text for guidance on the letter style. Your writing is important here. James is not an accountant. In addition, your research must include appropriate citations from the FASB Accounting Standards Codification (ASC). Failure to provide ASC citations will result in a ZERO for the assignment. You may only use your textbook (for guidance - do not cite) and the ASC to locate your answers - NO GOOGLE.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started