Answered step by step

Verified Expert Solution

Question

1 Approved Answer

City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $27,400. In addition, City paid sales

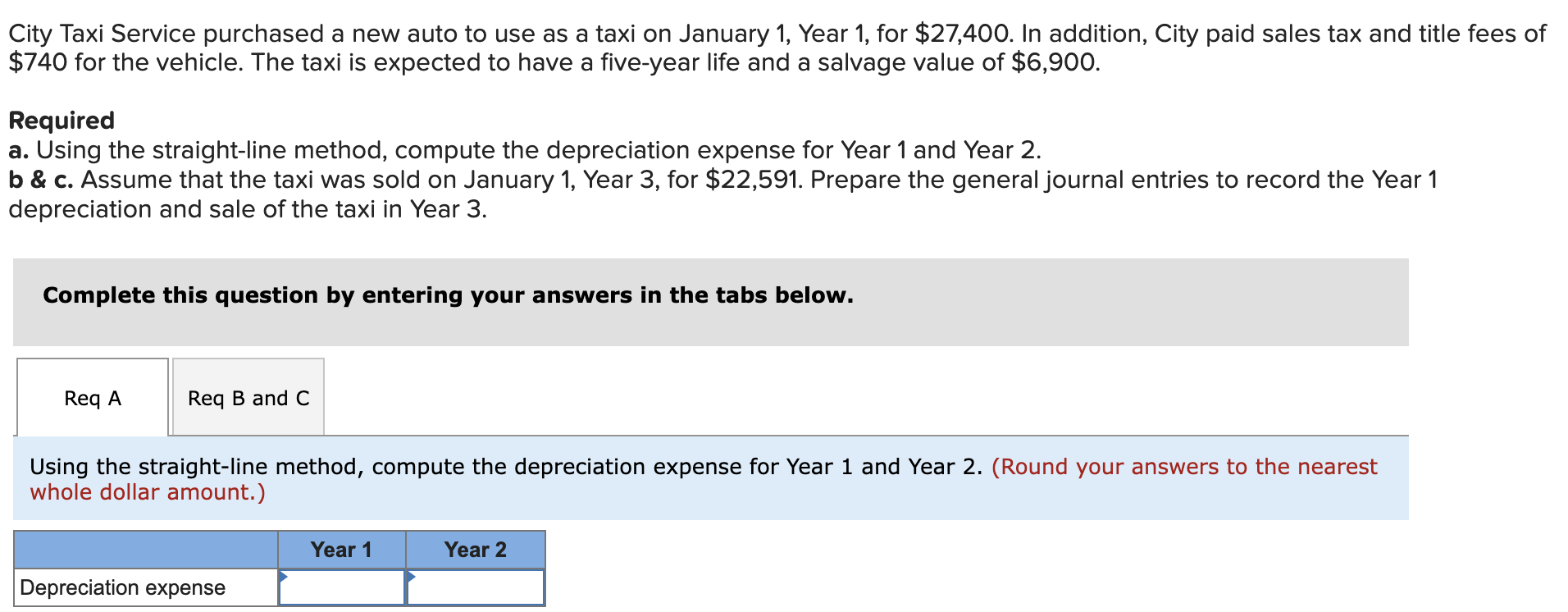

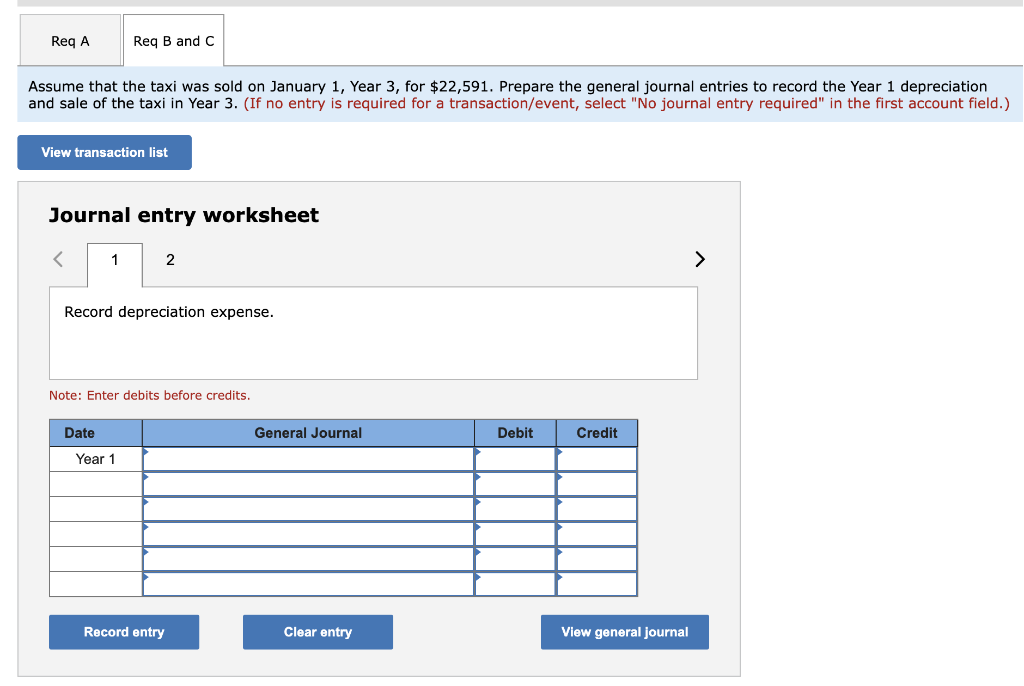

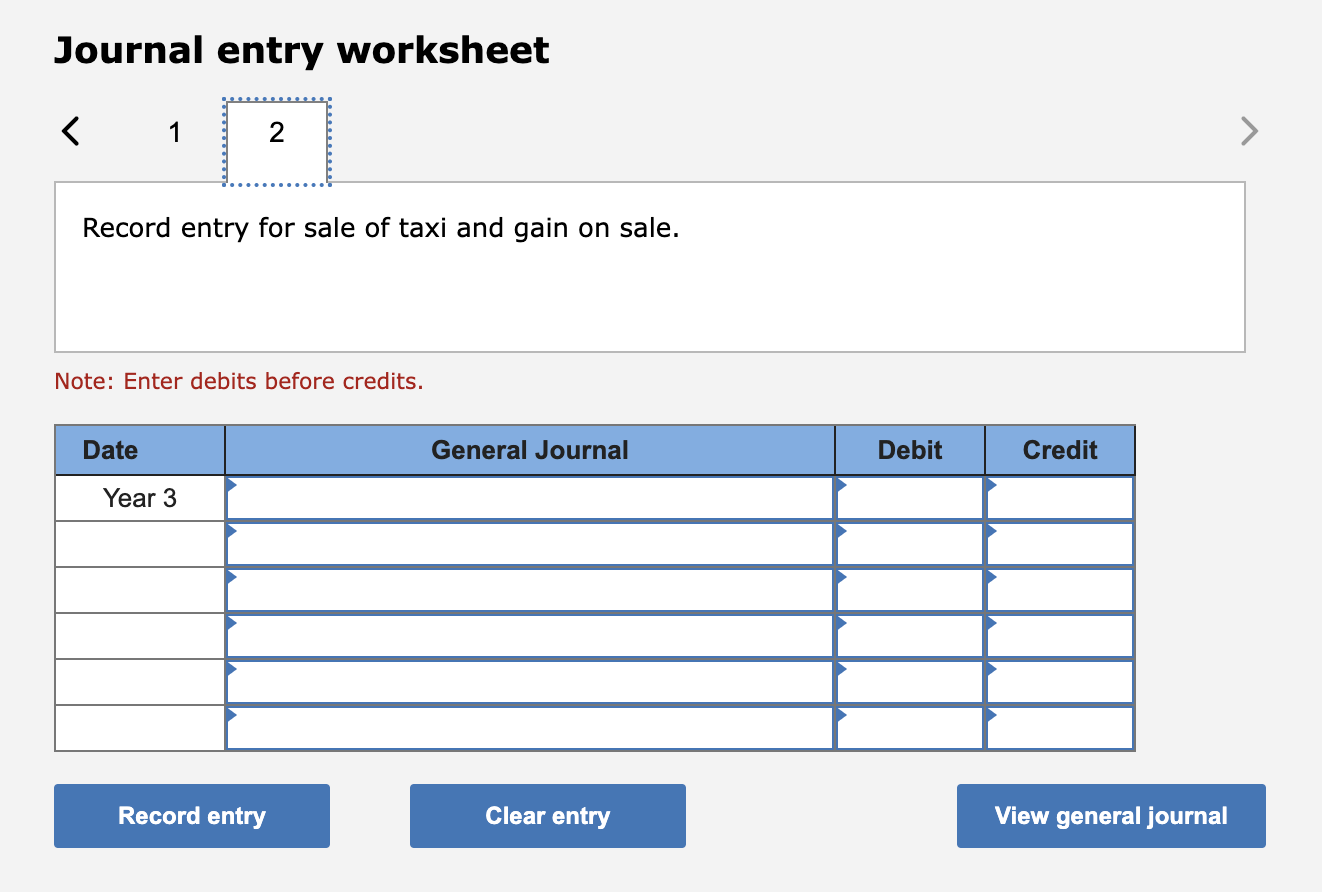

City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $27,400. In addition, City paid sales tax and title fees of $740 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $6,900. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. b & c. Assume that the taxi was sold on January 1, Year 3, for $22,591. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. Complete this question by entering your answers in the tabs below. Req A Reg B and C Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. (Round your answers to the nearest whole dollar amount.) Year 1 Year 2 Depreciation expense Reg A Reg B and C Assume that the taxi was sold on January 1, Year 3, for $22,591. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record depreciation expense. Note: Enter debits before credits. Date General Journal Debit Credit Year 1 Record entry Clear entry View general journal Journal entry worksheet 1 2 Record entry for sale of taxi and gain on sale. Note: Enter debits before credits. Date General Journal Debit Credit Year 3 Record entry Clear entry View general journal

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Straight line depreciation method Total cost of Taxi Purchase c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started