Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a real estate investment manager at a state pension fund with a very large diversified portfolio. Your real estate allocation has fallen

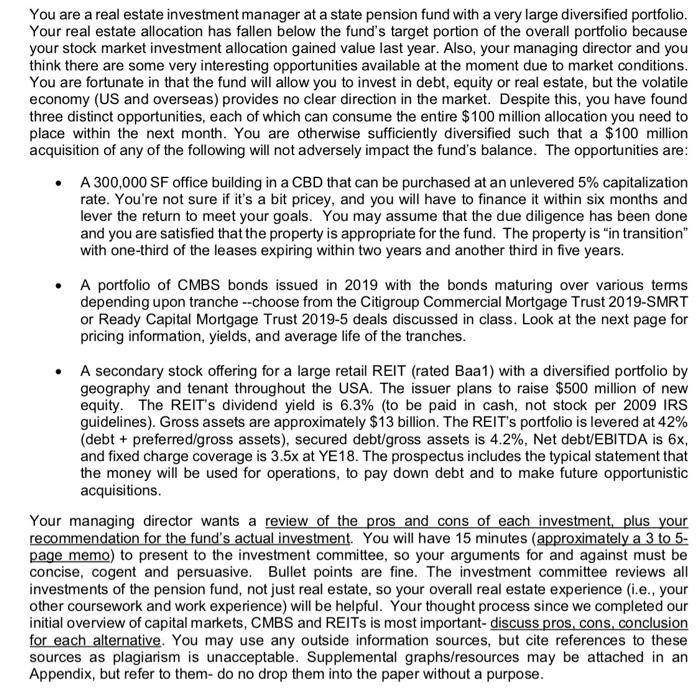

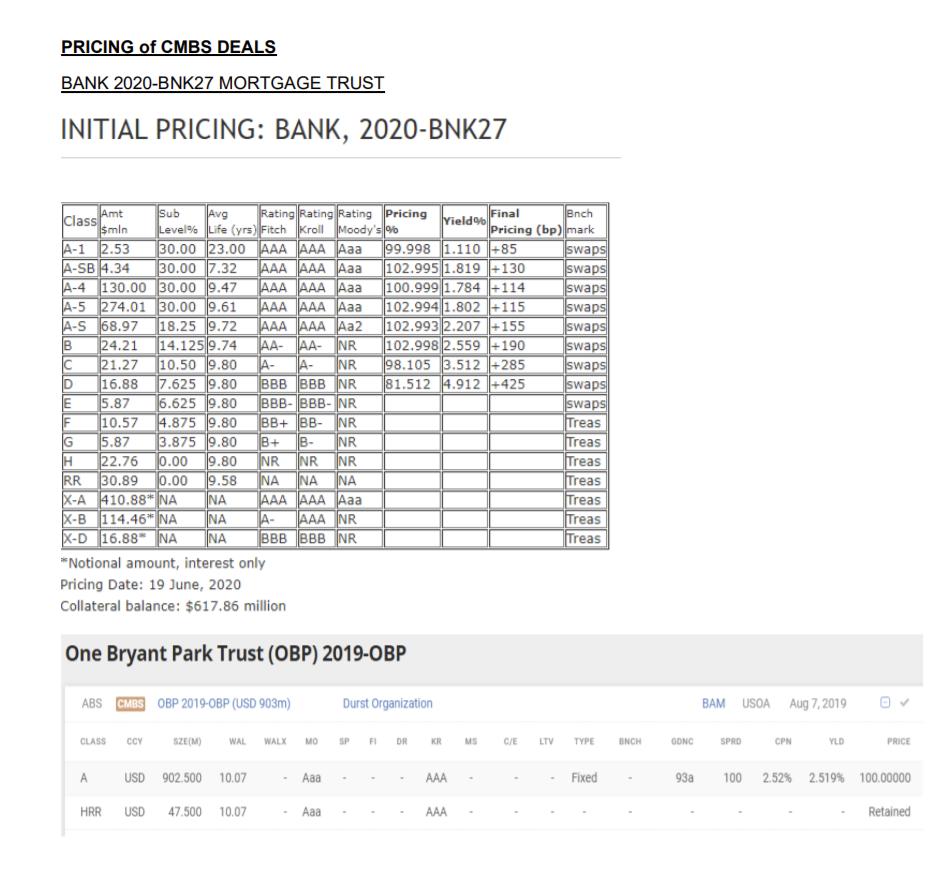

You are a real estate investment manager at a state pension fund with a very large diversified portfolio. Your real estate allocation has fallen below the fund's target portion of the overall portfolio because your stock market investment allocation gained value last year. Also, your managing director and you think there are some very interesting opportunities available at the moment due to market conditions. You are fortunate in that the fund will allow you to invest in debt, equity or real estate, but the volatile economy (US and overseas) provides no clear direction in the market. Despite this, you have found three distinct opportunities, each of which can consume the entire $100 million allocation you need to place within the next month. You are otherwise sufficiently diversified such that a $100 million acquisition of any of the following will not adversely impact the fund's balance. The opportunities are: A 300,000 SF office building in a CBD that can be purchased at an unlevered 5% capitalization rate. You're not sure if it's a bit pricey, and you will have to finance it within six months and lever the return to meet your goals. You may assume that the due diligence has been done and you are satisfied that the property is appropriate for the fund. The property is "in transition" with one-third of the leases expiring within two years and another third in five years. A portfolio of CMBS bonds issued in 2019 with the bonds maturing over various terms depending upon tranche--choose from the Citigroup Commercial Mortgage Trust 2019-SMRT or Ready Capital Mortgage Trust 2019-5 deals discussed in class. Look at the next page for pricing information, yields, and average life of the tranches. A secondary stock offering for a large retail REIT (rated Baa1) with a diversified portfolio by geography and tenant throughout the USA. The issuer plans to raise $500 million of new equity. The REIT's dividend yield is 6.3% (to be paid in cash, not stock per 2009 IRS guidelines). Gross assets are approximately $13 billion. The REIT's portfolio is levered at 42% (debt + preferred/gross assets), secured debt/gross assets is 4.2%, Net debt/EBITDA is 6x, and fixed charge coverage is 3.5x at YE18. The prospectus includes the typical statement that the money will be used for operations, to pay down debt and to make future opportunistic acquisitions. Your managing director wants a review of the pros and cons of each investment, plus your recommendation for the fund's actual investment. You will have 15 minutes (approximately a 3 to 5- page memo) to present to the investment committee, so your arguments for and against must be concise, cogent and persuasive. Bullet points are fine. The investment committee reviews all investments of the pension fund, not just real estate, so your overall real estate experience (i.e., your other coursework and work experience) will be helpful. Your thought process since we completed our initial overview of capital markets, CMBS and REITs is most important- discuss pros, cons, conclusion for each alternative. You may use any outside information sources, but cite references to these sources as plagiarism is unacceptable. Supplemental graphs/resources may be attached in an Appendix, but refer to them- do no drop them into the paper without a purpose. PRICING of CMBS DEALS BANK 2020-BNK27 MORTGAGE TRUST INITIAL PRICING: BANK, 2020-BNK27 Amt Sub Class $min A-1 2.53 Level % 30.00 23.00 AAA AAA Aaa A-SB 4.34 30.00 7.32 AAA AAA Aaa A-4 130.00 30.00 9.47 AAA AAA Aaa A-5 274.01 30.00 9.61 AAA AAA Aaa A-S 68.97 18.25 9.72 AAA AAA Aa2 24.21 14.125 9.74 AA-AA- NR 10.50 9.80 A- A- NR 7.625 9.80 BBB BBB NR 6.625 9.80 BBB-BBB- NR 10.57 4.875 9.80 BB+ BB- NR 5.87 3.875 9.80 B+ B- INR H 22.76 0.00 9.80 NR NR NR RR 30.89 0.00 9.58 NA X-A 410.88 NA NA AAA AAA Aaa X-B 114.46 NA X-D 16.88 NA C 21.27 D 16.88 E 5.87 A- AAA NR NA BBB BBB NR AABUD EFGH Avg Rating Rating Rating Pricing Life (yrs) Fitch Kroll Moody's *Notional amount, interest only Pricing Date: 19 June, 2020 Collateral balance: $617.86 million One Bryant Park Trust (OBP) 2019-OBP ABS CMBS OBP 2019-OBP (USD 903m) A B HRR CLASS CCY SZE(M) WAL WALX MO SP FI DR USD 902.500 10.07 USD 47.500 10.07 Aaa Yield% 99.998 1.110 +85 102.995 1.819 +130 100.999 1.784 +114 102.994 1.802 +115 102.993 2.207 +155 102.998 2.559 +190 98.105 3.512 +285 81.512 4.912 +425 Aaa Durst Organization KR AAA AAA Bnch Final Pricing (bp) mark MS C/E swaps swaps swaps swaps swaps swaps swaps swaps swaps Treas Treas Treas Treas Treas Treas Treas LTV TYPE Fixed BNCH GONC 938 BAM USOA Aug 7, 2019 SPRO CPN YLD PRICE 100 2.52% 2.519 % 100.00000 Retained

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Financial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started