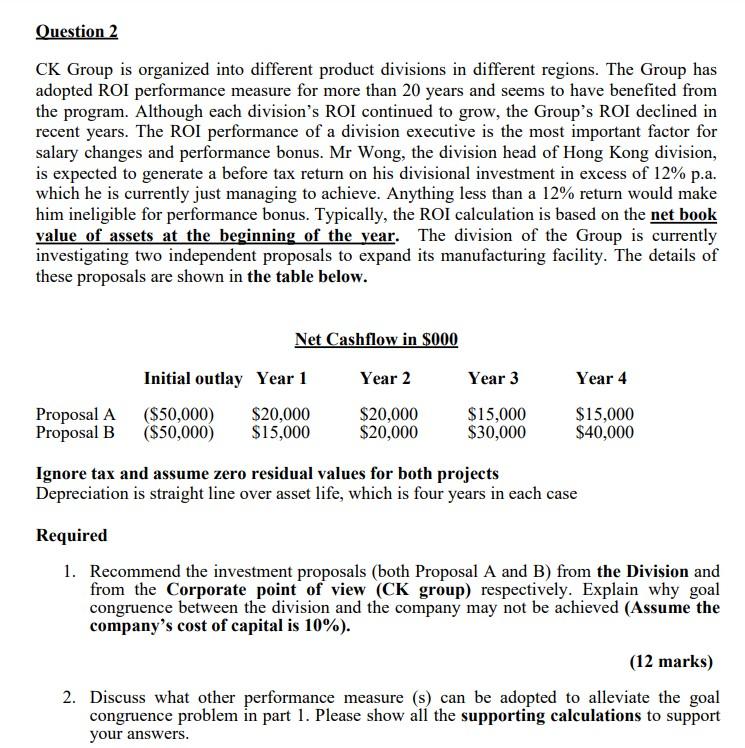

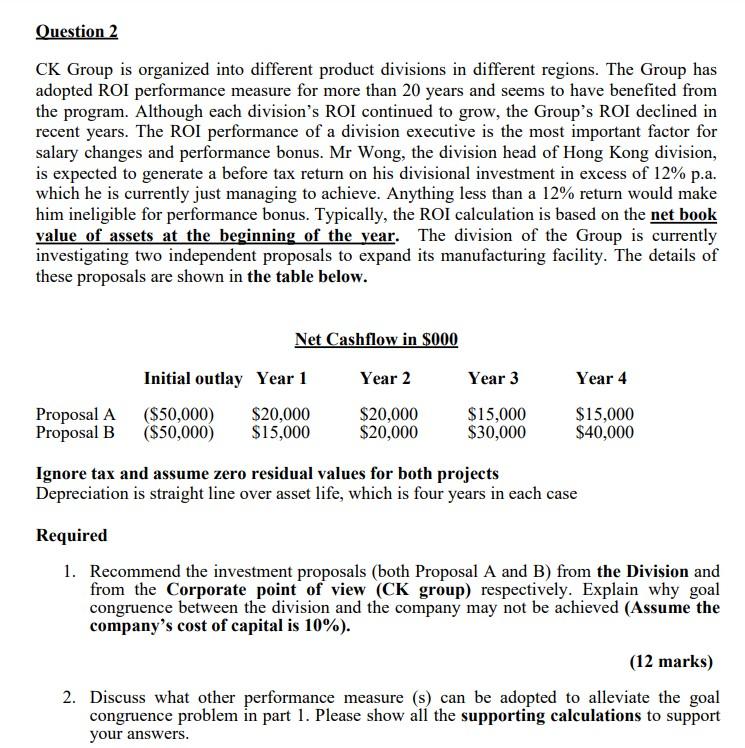

CK Group is organized into different product divisions in different regions. The Group has adopted ROI performance measure for more than 20 years and seems to have benefited from the program. Although each division's ROI continued to grow, the Group's ROI declined in recent years. The ROI performance of a division executive is the most important factor for salary changes and performance bonus. Mr Wong, the division head of Hong Kong division, is expected to generate a before tax return on his divisional investment in excess of 12% p.a. which he is currently just managing to achieve. Anything less than a 12% return would make him ineligible for performance bonus. Typically, the ROI calculation is based on the net book value of assets at the beginning of the year. The division of the Group is currently investigating two independent proposals to expand its manufacturing facility. The details of these proposals are shown in the table below. Ignore tax and assume zero residual values for both projects Depreciation is straight line over asset life, which is four years in each case Required 1. Recommend the investment proposals (both Proposal A and B ) from the Division and from the Corporate point of view (CK group) respectively. Explain why goal congruence between the division and the company may not be achieved (Assume the company's cost of capital is 10% ). (12 marks) 2. Discuss what other performance measure (s) can be adopted to alleviate the goal congruence problem in part 1 . Please show all the supporting calculations to support your answers. CK Group is organized into different product divisions in different regions. The Group has adopted ROI performance measure for more than 20 years and seems to have benefited from the program. Although each division's ROI continued to grow, the Group's ROI declined in recent years. The ROI performance of a division executive is the most important factor for salary changes and performance bonus. Mr Wong, the division head of Hong Kong division, is expected to generate a before tax return on his divisional investment in excess of 12% p.a. which he is currently just managing to achieve. Anything less than a 12% return would make him ineligible for performance bonus. Typically, the ROI calculation is based on the net book value of assets at the beginning of the year. The division of the Group is currently investigating two independent proposals to expand its manufacturing facility. The details of these proposals are shown in the table below. Ignore tax and assume zero residual values for both projects Depreciation is straight line over asset life, which is four years in each case Required 1. Recommend the investment proposals (both Proposal A and B ) from the Division and from the Corporate point of view (CK group) respectively. Explain why goal congruence between the division and the company may not be achieved (Assume the company's cost of capital is 10% ). (12 marks) 2. Discuss what other performance measure (s) can be adopted to alleviate the goal congruence problem in part 1 . Please show all the supporting calculations to support your answers